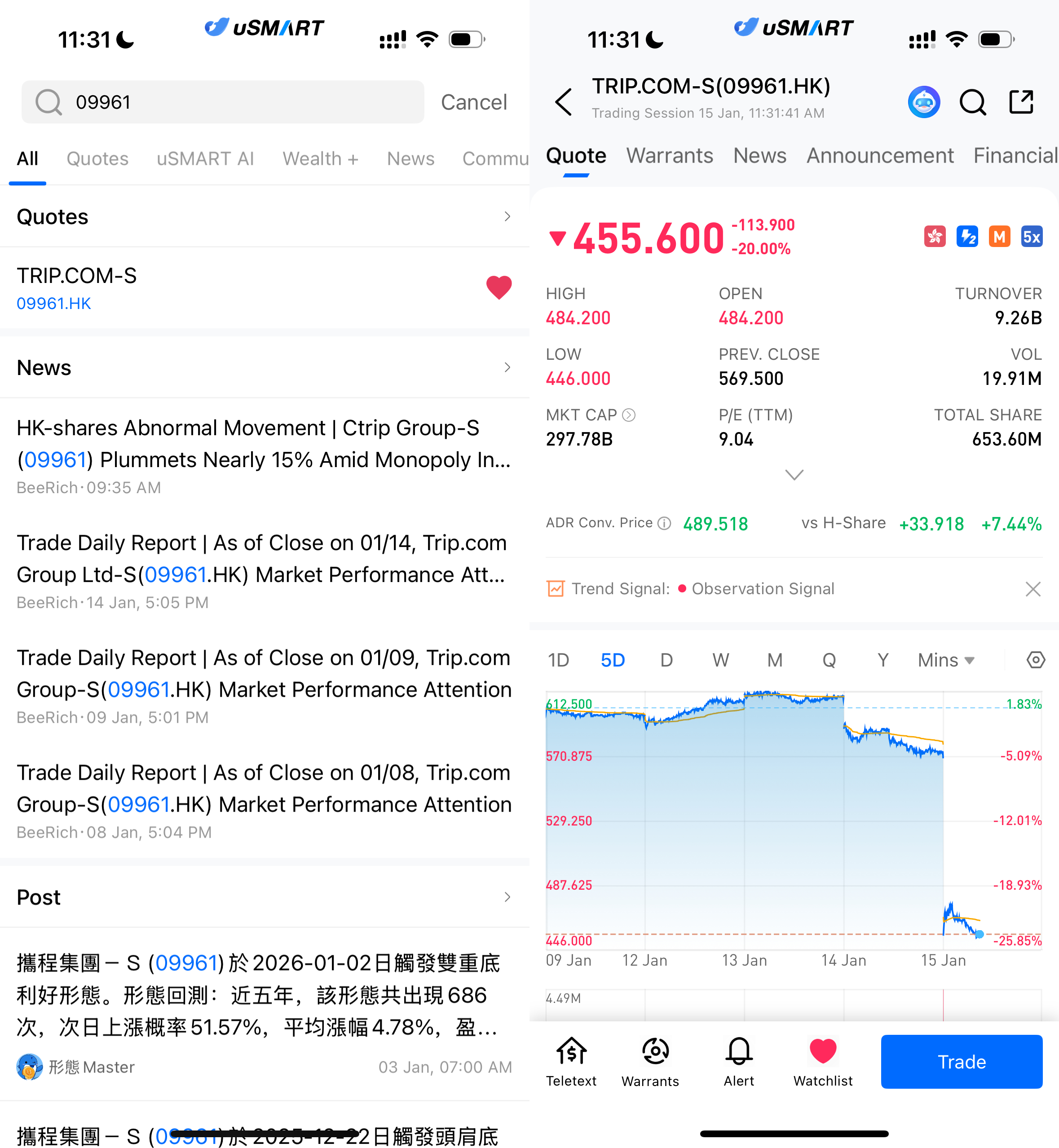

January 15, 2026 — Shares of Trip.com Group-S (09961.HK) suffered a sharp intraday sell-off on Thursday. During the trading session, the stock plunged more than 20%, last trading at around HK$454, after hitting an intraday low of HK$446. Turnover surged markedly, signaling heavy selling pressure. Amid the steep volatility, market attention quickly shifted to Trip.com’s recent antitrust investigation launched by China’s State Administration for Market Regulation (SAMR), with discussions intensifying over competition practices in the online travel sector and tightening regulatory oversight.

(Image source: uSMART HK app)

National-Level Antitrust Investigation Formally Launched

On January 14, SAMR announced that it had formally opened an investigation into Trip.com Group in accordance with China’s Anti-Monopoly Law, citing suspected abuse of market dominance. According to the official statement, the probe follows preliminary reviews and will focus on Trip.com’s business conduct in the OTA (online travel agency) market, particularly issues related to competition.

Trip.com responded that it has received the investigation notice and will actively cooperate with regulators in accordance with the law, adding that its operations remain normal. Despite the company’s response, the investigation has introduced significant near-term uncertainty, weighing heavily on market sentiment.

Accumulated Local Scrutiny and Industry Complaints Form the Backdrop

The antitrust case did not come without warning. As early as the second half of 2025, market regulators in regions including Guizhou and Zhengzhou had summoned Trip.com over issues such as alleged “choose-one-of-two” practices and interference with merchant pricing, underscoring regulators’ sustained focus on competition order in the online travel industry.

In addition, the Yunnan Tourism Homestay Industry Association previously issued a rights-protection notice publicly naming OTA platforms for alleged unfair competition. Market participants widely believe that prolonged feedback and complaints from local regulators and industry bodies laid important groundwork for the current national-level investigation.

Public Controversies Add to Market Sensitivity

Beyond regulatory scrutiny, Trip.com has recently been at the center of several public controversies. In mid-January, reports emerged that some employees had received text messages resembling company-issued termination notices, drawing widespread attention. Trip.com later clarified that the incident was caused by an internal system error, apologized to affected staff, and pledged to improve internal processes.

While the company characterized the incident as a technical and managerial mishap, the market has viewed the episode—against the backdrop of the antitrust probe—as highlighting areas where internal management and communication could be further strengthened.

Meanwhile, discussions around data security and overseas cooperation have yet to fully subside. A previous collaboration between Trip.com and the Cambodia Ministry of Tourism had sparked user concerns over personal data protection. The company subsequently issued clarifications and adjusted related promotional arrangements.

Tighter Regulation Raises Questions Over Industry Outlook

Industry observers note that as regulatory frameworks for the platform economy become increasingly refined, the OTA sector is entering a phase of more standardized development. How regulators define and enforce rules around market dominance is expected to have far-reaching implications for leading platforms’ business strategies, pricing mechanisms, and merchant partnerships.

Against this backdrop, Trip.com’s ability to balance regulatory compliance with business growth will remain a key focus for investors. With the 2026 Spring Festival travel peak approaching and demand for travel set to rise, developments in the antitrust investigation and the company’s subsequent responses are likely to remain critical factors influencing near-term share performance and broader industry expectations.

How to Buy Trip.com via on uSMART

After logging into the uSMART HK app, click the “Search” button in the top-right corner of the page, enter the ticker code (09961.HK), and navigate to the details page to view transaction details and historical trends. Click the “Trade” button in the bottom-right corner, select the trade type, and submit your order after filling in the transaction conditions.

(Image Source: uSMART HK app)