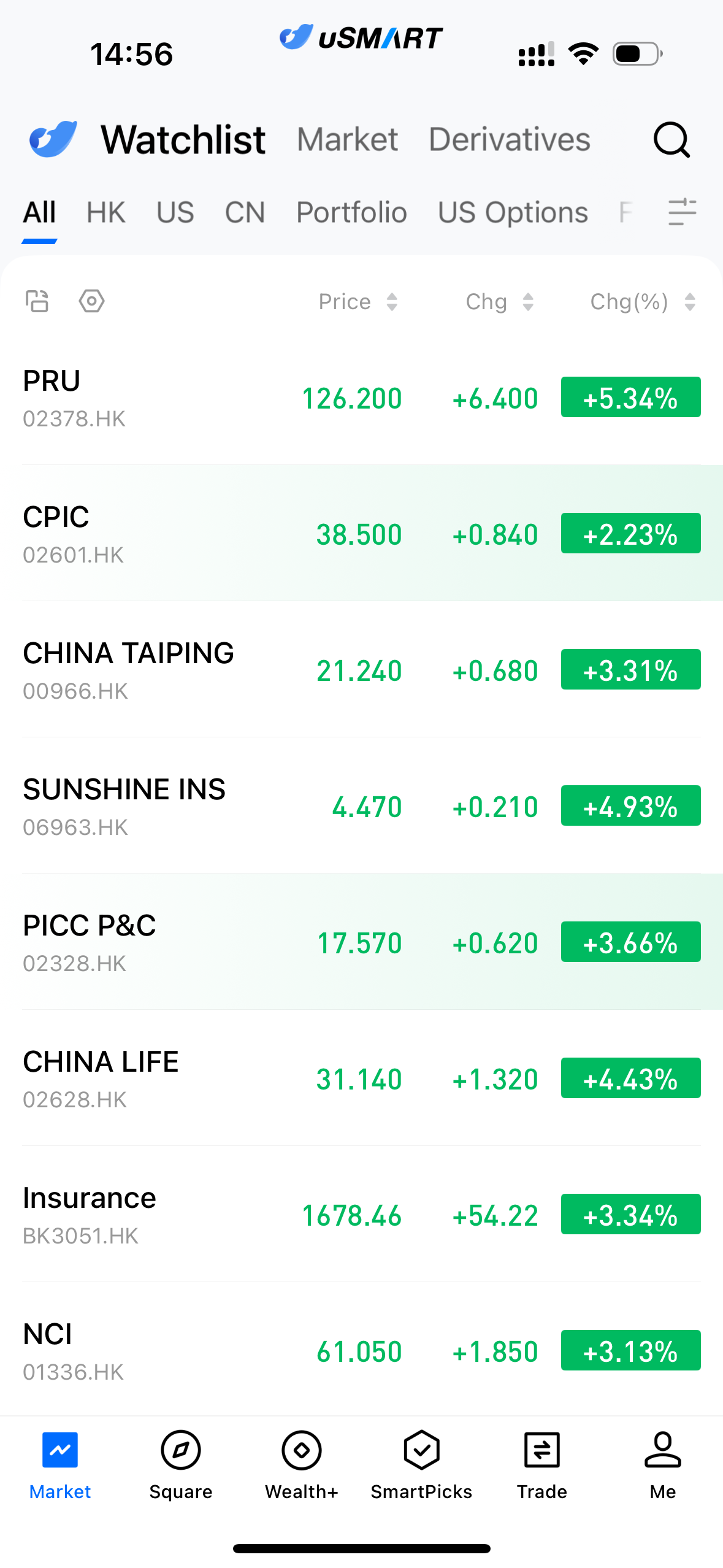

January 6, 2026 — Hong Kong’s financial sector posted solid gains today, with insurance stocks leading the non-bank financial segment and extending their recent upward momentum. Market data showed the insurance sector index closed at 1,678.42 points, rising 3.34% on the day and significantly outperforming the broader market. The sector emerged as a key pillar supporting the overall index, reflecting sustained investor interest.

(Image Source: uSMART HK app)

Solid Industry Data Underpins Fundamentals, Premium Growth Supports Outlook

From an industry perspective, the latest publicly available data indicate that China’s insurance sector recorded cumulative premium income of approximately RMB 5.76 trillion in the first 11 months of 2025, representing a year-on-year increase of around 7.6%. Among them, life insurance premiums maintained relatively strong growth momentum, highlighting the resilience of long-term protection demand and providing fundamental support for the performance of insurance stocks.

Meanwhile, recent media reports suggest that the insurance industry has seen an active pace of business development at the beginning of the year. New policy sales at several leading insurers have shown solid performance, contributing to improved market expectations regarding earnings sustainability.

Continued Fund Inflows Highlight Allocation Appeal

From a fund flow perspective, demand from southbound investors via Stock Connect for insurance stocks has strengthened. Non-bank financial themed products with significant exposure to insurance heavyweights also posted notable gains, indicating a clear rebound in market attention toward the sector.

Against the current market backdrop, insurance stocks—characterized by relatively stable cash flows and dividend attributes—have demonstrated defensive qualities amid market volatility, attracting continued participation from medium- to long-term capital.

Potential Volatility Remains, Sector Performance to Be Monitored

Despite the sector’s strong overall performance, insurance stocks have historically experienced short-term volatility due to company-specific events or changes in the external environment. Going forward, factors such as movements in the macro interest rate environment, liquidity conditions, and the investment performance of insurance funds will remain key variables influencing sector trends.

Overall, since the start of 2026, Hong Kong-listed insurance stocks have maintained strong momentum. Supported by improving industry data and sustained capital inflows, the sector has delivered a clear “strong start” and stands out as one of the better-performing segments in the Hong Kong equity market.