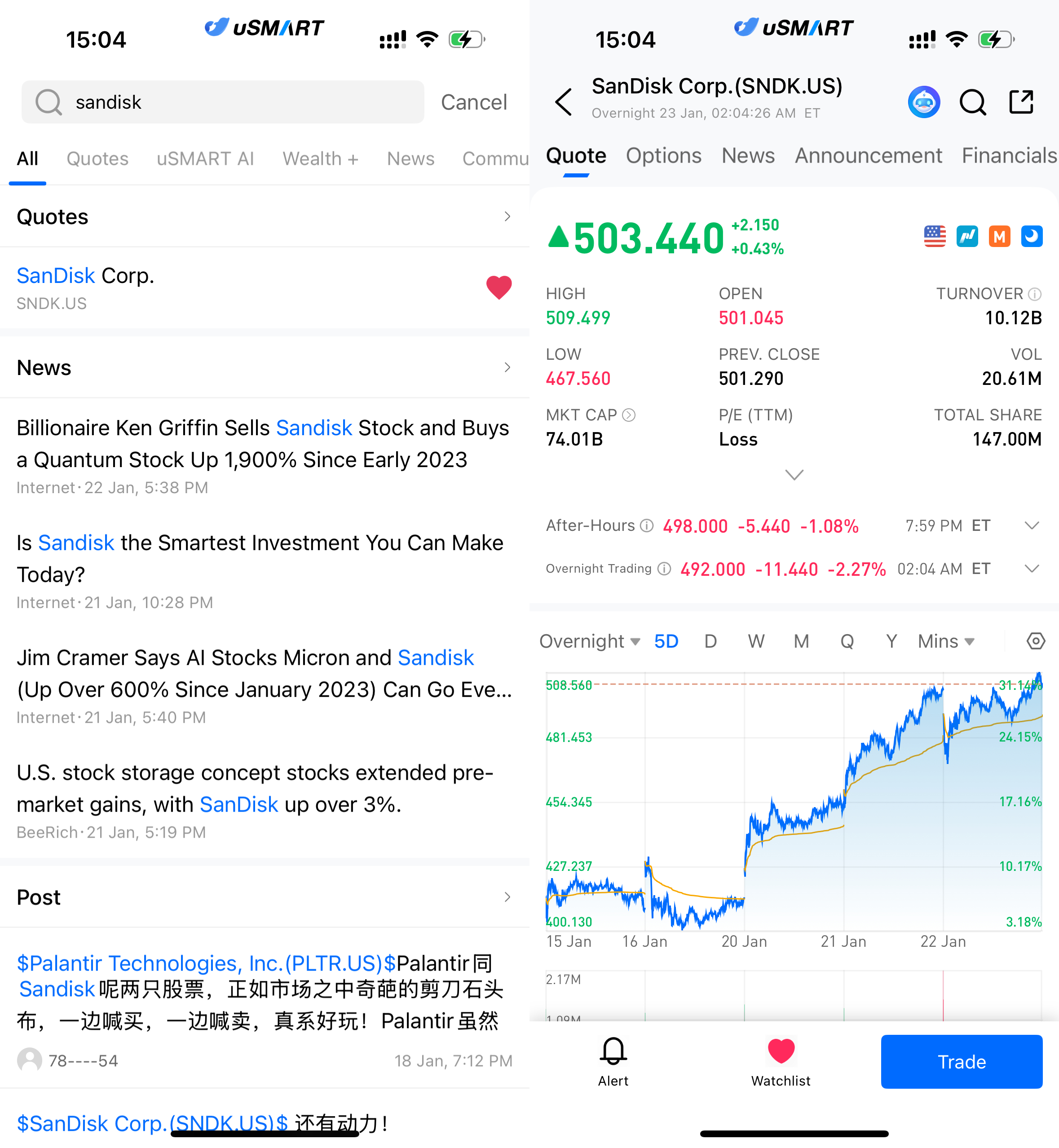

January 23, 2026 — The storage sector has continued its strong momentum recently, with SanDisk (SNDK.US) emerging as a standout performer. As of January 22, SanDisk shares closed at USD 503.44, hitting an intraday high of USD 509.50. Since rebounding from around the USD 400 level in mid-January, the stock has surged to near USD 500 in just a few trading sessions, delivering cumulative gains of over 25%. Both price and trading volume have expanded in tandem, signaling sustained capital inflows and positioning SanDisk as one of the most representative names in the current storage-sector rally.

(Image Source: uSMART HK app)

AI Inference Demand Shifts, Storage Becomes the New Bottleneck

As large-model inference scales up, bottlenecks in AI systems are shifting from “insufficient compute” to “context and state management.” At CES 2026, NVIDIA for the first time systematically outlined a new architecture that emphasizes coordination between inference workloads and storage, noting that as context sizes expand rapidly, relying solely on HBM is not sustainable.

In its latest data center solutions, NVIDIA introduced a dedicated inference storage layer, independent of compute nodes, designed to host context memory, KV cache, and related data. This marks a fundamental shift: storage is now explicitly defined as a core component of AI inference systems, rather than a peripheral data repository.

Model-Level Breakthroughs Bring NAND into a Tiered Memory Hierarchy

Beyond hardware architecture, advances at the model level are also reshaping the role of storage. Recent next-generation model designs indicate that certain parameters and long-term knowledge exhibit “deterministic access” characteristics, making them suitable for offloading to lower-cost storage media.

Research suggests that, with manageable performance trade-offs, a meaningful portion of large-model parameters no longer need to reside permanently in high-bandwidth memory. Instead, they can be fetched on demand from system memory or high-speed SSDs via prefetching mechanisms. This provides a realistic pathway for NAND to serve as “slow memory” within AI systems.

Rise of AI Agents Amplifies Demand for Persistent Storage

Changes at the application layer further reinforce this trend. As AI agents gain traction in programming, operations, and automation, AI systems are evolving from stateless, one-off tools into continuously running, stateful systems.

These applications require long-term preservation of conversation histories, working contexts, and intermediate results. Storage demand is no longer simply tied to individual inference calls, but instead scales with the duration of state persistence. Compared with consuming costly GPU resources, offloading state data to storage layers offers a far more cost-effective solution.

Why SanDisk Has Become a Market Focus

Against the backdrop of these converging forces, the market is reassessing the long-term value of NAND manufacturers. As a global leader in storage solutions, SanDisk has deep expertise in enterprise SSDs and data center markets, positioning it to directly benefit from shifts in AI infrastructure investment logic.

Current market pricing for SanDisk is no longer based solely on traditional storage cycles, but increasingly reflects the structural demand uplift driven by AI. With cyclical recovery overlapping with long-term growth drivers, the valuation framework for the storage sector is undergoing a subtle yet profound transformation.

How to Buy SanDisk via on uSMART

After logging into the uSMART HK app, click the “Search” button in the top-right corner of the page, enter the ticker code (SNDK.US), and navigate to the details page to view transaction details and historical trends. Click the “Trade” button in the bottom-right corner, select the trade type, and submit your order after filling in the transaction conditions.

(Image Source: uSMART HK app)

(Image Source: uSMART HK app)