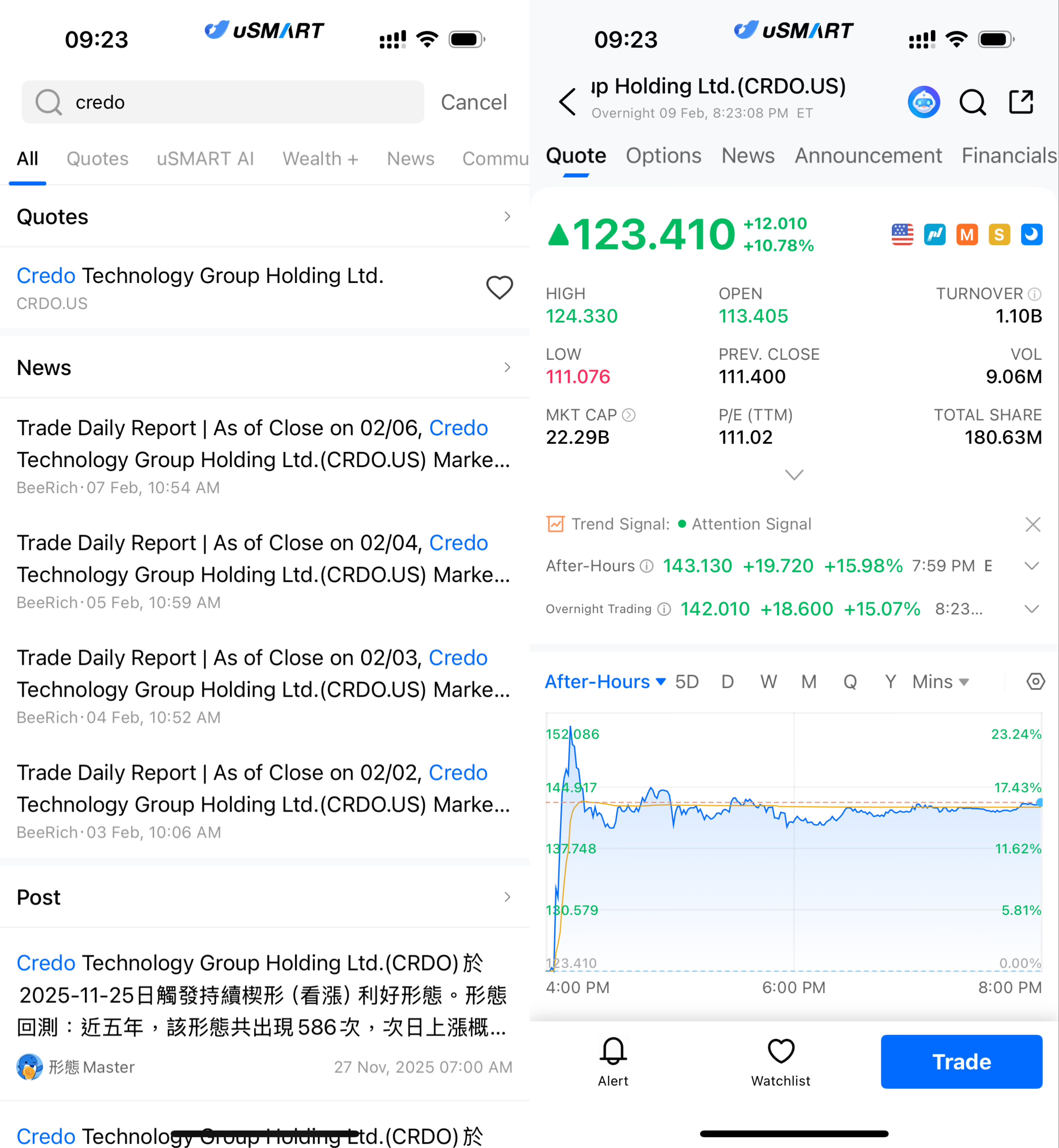

On February 9th, after the market closed, Credo (CRDO.US) saw a significant surge in its stock price. Boosted by the company's updated earnings guidance, its stock price rose to $124.33 in after-hours trading, an increase of more than 20%. However, the gain was later moderated, and the stock closed at $123.41, up 10.78% from the previous day's close of $111.40.

(Image Source: uSMART HK app)

Third-Quarter Revenue Guidance Significantly Raised

Credo released its preliminary revenue guidance for the third quarter of the 2026 fiscal year and also updated its outlook for the following quarters. The company expects revenue for Q3 2026 to be between $404 million and $408 million, a substantial increase over the previously projected range of $335 million to $345 million. With the midpoint of the new range, the expected revenue is 19% higher than the previous upper guidance, indicating stronger-than-expected business performance, product shipments, and customer demand for the quarter.

This significant upward revision in revenue guidance indicates that the company’s core product lines have outperformed market expectations, greatly enhancing investor confidence in its future financial performance.

Medium- and Long-Term Growth Path Becomes Clearer

Looking ahead, Credo maintains an optimistic outlook for its growth trajectory. The company projects that during the latter part of the 2026 fiscal year and into the 2027 fiscal year, it will see a mid-single-digit sequential growth rate, which will contribute to a year-over-year growth rate of over 200% for the full 2026 fiscal year. This projection suggests that the company's rapid growth is not a one-time occurrence, but rather a sustainable trend.

As the demand for high-speed interconnects, data centers, and AI-related infrastructure continues to expand, Credo expects to benefit from these long-term market trends, further solidifying its revenue potential. The market's increasing recognition of the company's income elasticity and growth potential is also evident.

Complete Earnings Report Coming Soon, Focus on Future Verification

According to the company’s announcement, Credo will release its full financial results for the third quarter of the 2026 fiscal year after the U.S. market closes on March 2, 2026. A subsequent earnings conference call will be held to disclose more detailed financial data for the quarter ending January 31, 2026, and to provide further insights into the company’s future outlook.

The pre-announcement of the revised revenue guidance, ahead of the formal earnings report, is generally seen as a strong signal from management that it has a high degree of certainty about current quarter performance. Following the stock's rapid response in after-hours trading, market attention is likely to focus on the quality of the company’s growth and whether its high growth trajectory can continue. Investors will closely monitor details such as gross margins, expense control, and the sustainability of revenue growth in the upcoming earnings report.

How to Buy Credo via on uSMART

After logging into the uSMART HK app, click the “Search” button in the top-right corner of the page, enter the ticker code (CRDO.US), and navigate to the details page to view transaction details and historical trends. Click the “Trade” button in the bottom-right corner, select the trade type, and submit your order after filling in the transaction conditions.

(Image Source: uSMART HK app)