December 5, 2025, California, USA — META Platforms, Inc. (META.US) saw its stock surge today, breaking the $660 mark and closing at $661.53, up 3.43%. This increase is primarily attributed to the company’s strong quarterly earnings report and the optimistic outlook for future growth, particularly driven by robust growth in artificial intelligence (AI) and advertising revenues, boosting investor confidence in META's future performance.

(Image source: uSMART HK app)

META’s Q3 Earnings Strong, AI and Advertising Business at the Core of Growth

META recently released its Q3 2025 earnings report, showing total revenue of $38 billion, a 20% year-on-year increase. This growth was largely driven by the strong performance of its advertising business and AI-powered products. Advertising revenue continued to grow strongly, up 24% to $31 billion, accounting for 82% of total revenue. The application of AI technology in advertising recommendation systems played a key role in driving significant improvements in ad effectiveness.

At the same time, META’s AI-driven business revenue also showed a strong growth trend, increasing by 40% to $7 billion. This growth reflects META’s ongoing investments and innovations in AI, especially in areas like intelligent recommendations, content creation, and personalized experiences.

|

Financial Metric |

Q3 2025 |

Q3 2024 |

同比增长 |

|

Total Revenue |

$38B |

$31.5B |

20% |

|

Advertising Revenue |

$31B元 |

$25B |

24% |

|

AI-driven Business Revenue |

$7B |

$5B |

40% |

|

EPS (Earnings per Share) |

$5.34 |

$4.10 |

30% |

|

Gross Margin |

80% |

78% |

2% |

(Data Source: META Q3 2025 Earnings Report)

In the conference call, META CEO Mark Zuckerberg stated, "Our advertising business remains the core driver, and the application of AI has significantly improved return on investment for advertisers. We are working hard to continue enhancing the user experience through innovative technologies and accelerate the personalization and intelligence of our platform."

META’s Virtual Reality and Augmented Reality Business Heading Toward Commercialization, Global Strategy Accelerates

In addition to its advertising and AI businesses, META’s virtual reality (VR) and augmented reality (AR) business is also making significant breakthroughs. With the launch of Meta Quest 4, the company’s influence in the VR hardware market continues to grow. The latest data shows that sales of Meta Quest VR devices have increased by 40% year-on-year. This growth reflects a surge in demand for META’s VR devices, particularly in educational, entertainment, and workplace applications.

META expects that the VR and AR sectors will generate significant revenue for the company in the coming years. The company plans to continue investing heavily in these areas while innovating in both hardware and content ecosystems. Zuckerberg also mentioned, "Our metaverse vision is gradually becoming a reality, and VR and AR will be the core components of this vision."

Furthermore, META's globalization strategy is accelerating, particularly in the Asia-Pacific region and Latin America. Through localized platforms and advertising services, META has successfully attracted advertisers from these regions. META’s Asia-Pacific revenue grew by 30% year-on-year, indicating substantial growth potential for its advertising revenue globally.

Conclusion: META’s Innovation and Global Expansion Provide Strong Momentum for Future Growth

With steady development in AI technology and virtual reality, META is showing strong growth momentum. Investors are confident in META’s future prospects, and it is expected to continue leading the technology industry in the coming quarters. The company’s innovative capabilities and global expansion strategy provide strong momentum for its future growth, and the continued rise in its stock price reflects market expectations for META’s profitability.

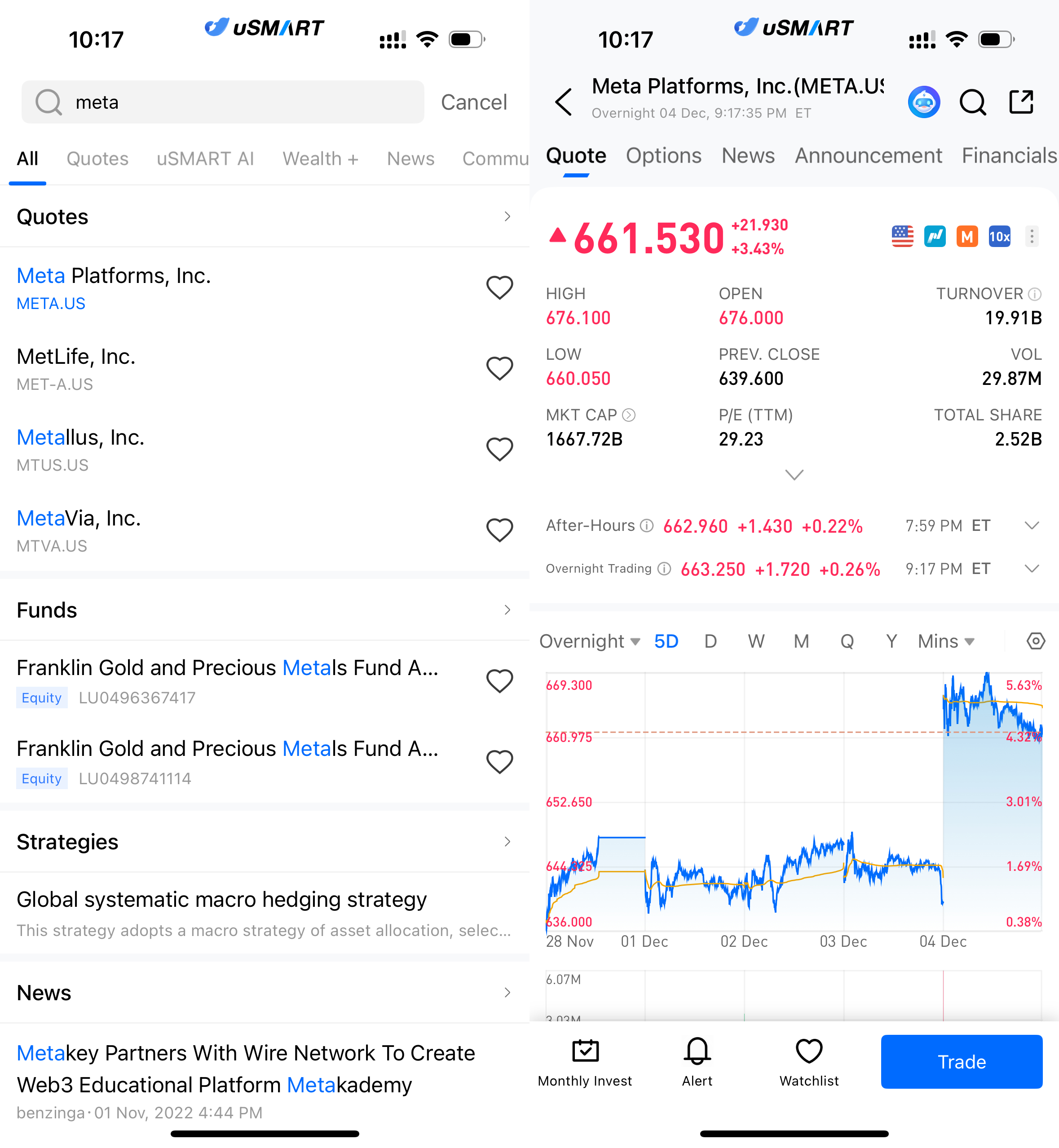

How to Buy Meta Platforms via on uSMART

After logging into the uSMART HK app, click the “Search” button in the top-right corner of the page, enter the ticker code (META.US), and navigate to the details page to view transaction details and historical trends. Click the “Trade” button in the bottom-right corner, select the trade type, and submit your order after filling in the transaction conditions.

(Image Source: uSMART HK app)