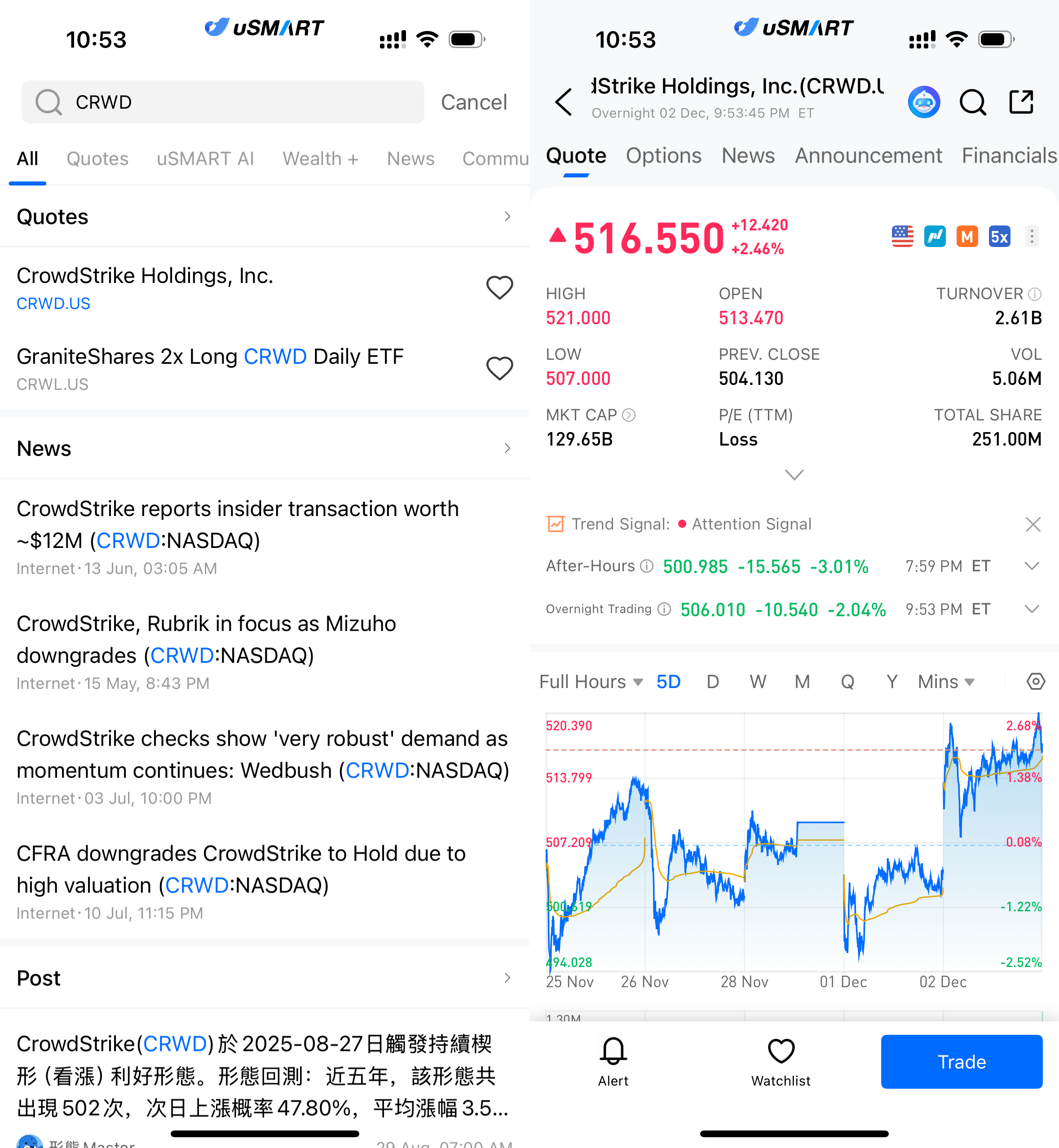

On December 3, 2025, CrowdStrike Holdings, Inc. (CRWD.US), a global leader in cloud-native cybersecurity platforms, saw strong market reaction following the release of its third-quarter financial results for fiscal year 2026. The company’s stock surged 2.46% in pre-market trading, reaching a high of $516.550. This positive momentum reflects investor confidence in the robust financial performance and signals that market sentiment has fully recovered from the short-term concerns surrounding the earlier “global system outage” incident, refocusing instead on the company’s core competitiveness and long-term growth potential.

(Image source: uSMART HK app)

Q3 Revenue Reaches $1.23 Billion, Up 22% Year-on-Year, Beating Expectations for Another Quarter

According to the earnings report, CrowdStrike achieved total revenue of 1.23billioninQ3FY2026(endedOctober31,2025),representinga221.21 billion. This marks the company’s 18th consecutive quarter of double-digit revenue growth, demonstrating exceptional consistency and momentum.

Subscription revenue reached $1.17 billion, up 21% year-on-year and accounting for 95.1% of total revenue—highlighting CrowdStrike’s successful transition to a highly predictable, SaaS-based business model. Strong customer reliance on the Falcon platform has kept renewal rates industry-leading, with net revenue retention rate remaining above 120% this quarter, indicating that existing customers are generating over 20% additional revenue growth on average each year.

International revenue outside the U.S. also accelerated, growing more than 30% year-on-year and now accounting for approximately 28% of total revenue, reflecting rapid progress in its global expansion strategy.

Profitability Strengthens as ARR Surpasses $4.9 Billion

Key metric Annual Recurring Revenue (ARR) rose to 4.92billionthisquarter,up23265.3 million, underscoring the effectiveness of its customer acquisition and cross-selling strategies.

Additionally, non-GAAP earnings per share (EPS) came in at 0.96,exceedinganalystexpectationsof0.94 and showing significant improvement compared to $0.78 in the same period last year—evidence that operational efficiency continues to improve even amid rapid growth.

Full-Year Guidance Raised, Sending Positive Signals

Backed by strong Q3 performance and confidence in future demand, CrowdStrike significantly raised its full-year guidance for FY2026:

Full-year revenue is now expected to reach 4.797billionto4.807 billion, up from the previous ~$4.74 billion;

Non-GAAP EPS is projected at 3.70to3.72, also above prior forecasts.

The company also forecast Q4 revenue between 1.29billionand1.30 billion, with non-GAAP EPS of 1.09to1.11, maintaining its upward trajectory.

AI-Powered Security Upgrade Reinforces Market Leadership

The core driver behind CrowdStrike’s growth lies in the deep integration of artificial intelligence into cybersecurity. As AI-generated threats—such as deepfakes and automated phishing—become increasingly common, enterprise demand for AI-enabled detection and response platforms is surging. Leveraging its cloud-native Falcon platform, CrowdStrike continues to lead in threat detection speed, accuracy, and automated response capabilities.

Although the company previously faced scrutiny due to a third-party software-related “global blue screen” incident, this latest earnings report powerfully demonstrates that product resilience and customer trust remain intact—and may have even been strengthened, further validating the market’s recognition of its technological strength.

How to Buy CrowdStrike via on uSMART

After logging into the uSMART HK app, click the “Search” button in the top-right corner of the page, enter the ticker code (CRWD.US), and navigate to the details page to view transaction details and historical trends. Click the “Trade” button in the bottom-right corner, select the trade type, and submit your order after filling in the transaction conditions.

(Image Source: uSMART HK app)