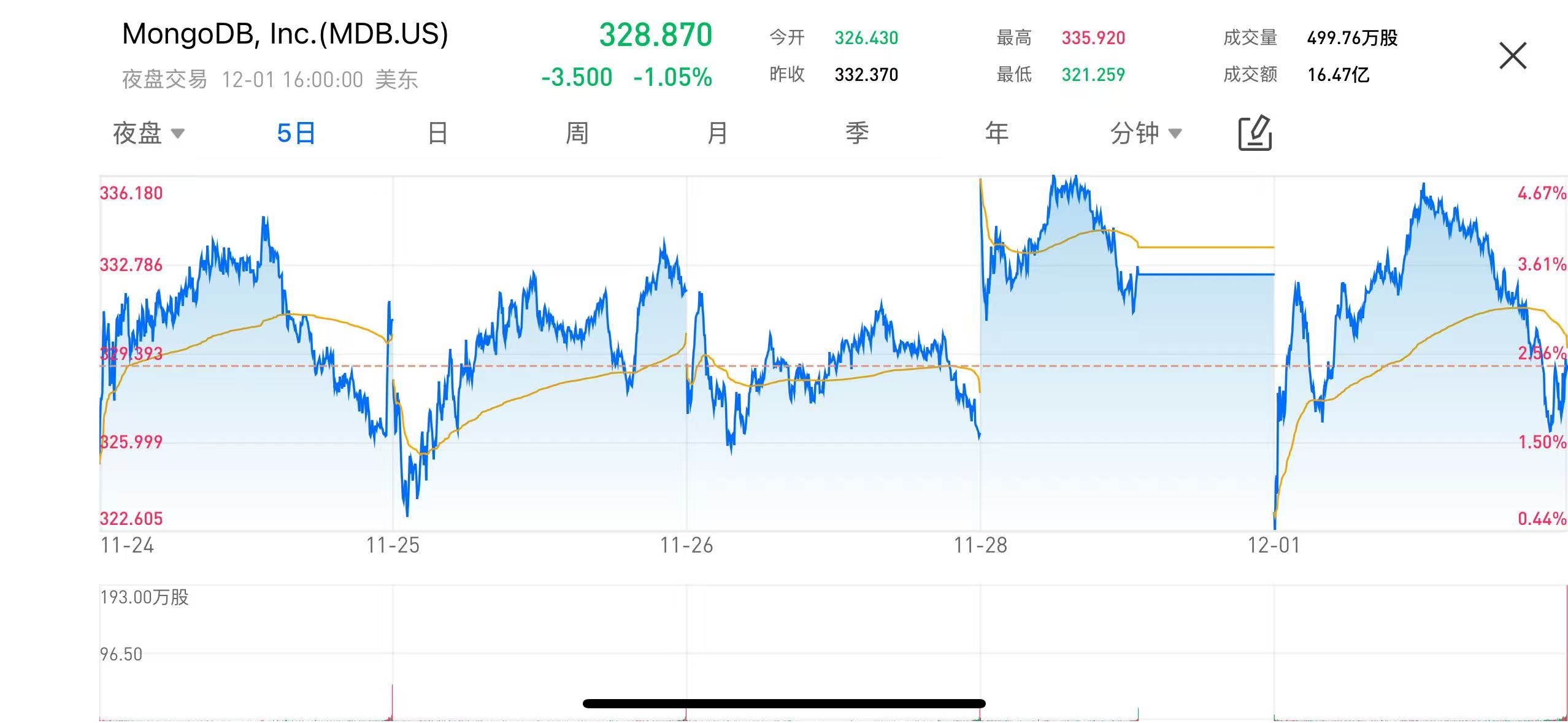

MongoDB (MDB.US) saw its stock price strengthen following the release of its Q3 FY2025 earnings report. Recent stock performance shows a significant rise after the earnings announcement, with market confidence in its business growth and cloud database demand further boosting. As the earnings details came through, investors have refocused on the long-term value of MongoDB in the cloud database sector.

(Image source: uSMART HK app)

Strong Revenue Growth Continues, Atlas Contribution Continues to Increase

According to the latest earnings report, MongoDB achieved revenue of approximately USD 628 million in the quarter, a year-on-year increase of nearly 20%, significantly exceeding market expectations. Of this, the core cloud database platform, MongoDB Atlas, accounted for about three-quarters of the company’s quarterly revenue, continuing to outperform the overall business and demonstrating the ongoing expansion of cloud database demand.

Customer numbers also saw steady growth, with around 2,600 new customers added this quarter, bringing the total number of customers to over 60,000. The growth in enterprise customers supports the company’s revenue structure and provides a stable cash flow source for long-term subscription-based business.

The earnings report also showed that the company’s gross margin and operating efficiency further improved, with operating profits exceeding management’s previous expectations, reflecting the marginal benefits of its subscription model at scale.

Full-Year Guidance Upgraded, Management Raises Growth Expectations

Building on a strong quarter, MongoDB announced an upgrade to its full-year FY2025 guidance. Management stated that, driven by the rapid expansion of Atlas, increased usage by enterprise customers, and optimization of its overall cost structure, the company is more confident about business growth in the second half of the year. The updated guidance indicates that revenue growth and profitability improvements in the upcoming quarters will be more positive than previously forecasted.

The market is particularly focused on this adjustment, as MongoDB is known for its cautious guidance, and raising the full-year outlook generally signals strong business momentum and improved visibility. Some institutions have also raised their target prices, optimistic about MongoDB’s continued expansion in the modern database space.

Positive Market Response, Stock Price Likely to Continue Rebounding

Thanks to the earnings report significantly exceeding expectations and the boost from the raised full-year guidance, MongoDB’s stock price has been on the rise, with trading activity significantly increasing post-announcement. Recent market trends show increased buying strength, with a positive funding outlook.

MongoDB’s growth model benefits greatly from the long-term trend of global enterprises migrating to cloud-native architectures. Its document-based database is highly applicable in areas such as AI, real-time data processing, and internet services, and will continue to drive its medium- to long-term growth.

Outlook: Strong Demand for Cloud Databases Continues, but Competitive Pressures Remain

As cloud computing, AI applications, and enterprise digital upgrades accelerate, the database market is in a structural growth cycle. MongoDB continues to lead the document and cloud database sectors, and with management raising the full-year guidance, the company shows strong confidence in future expansion.

However, investors should still be mindful of potential risks, including heavy reliance on cloud infrastructure providers, intensifying competition in the database market, and the impact of macroeconomic conditions on IT spending.

Overall, MongoDB’s performance this quarter has significantly exceeded expectations: strong revenue growth, impressive Atlas performance, improved profitability, and an upgraded full-year guidance. Given the structural expansion in the database industry, the company is well-positioned to benefit from the long-term trends in cloud and AI, with the rebound in its stock price supported by strong fundamentals.

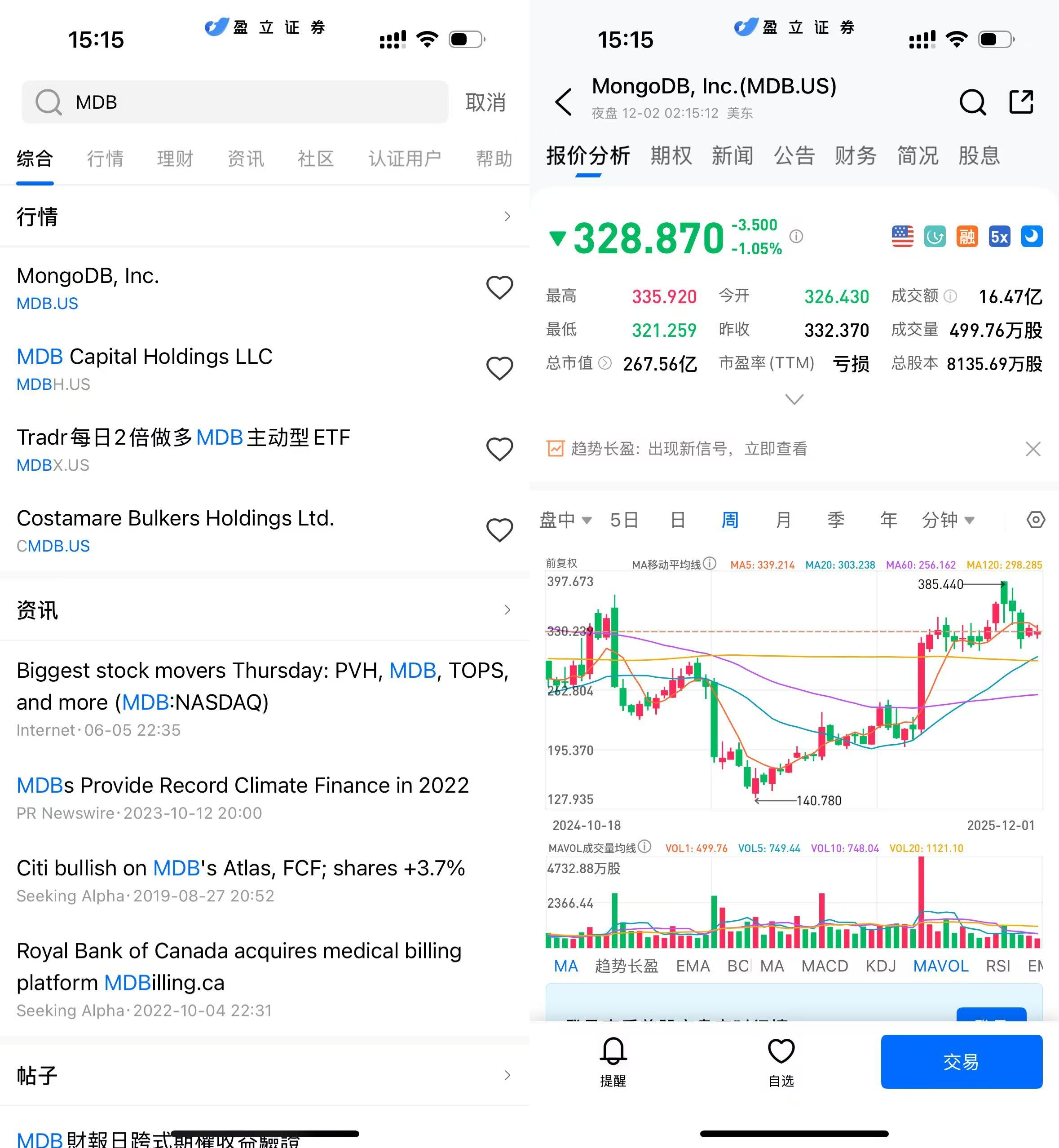

How to Buy MongoDB via on uSMART

After logging into the uSMART HK app, click the “Search” button in the top-right corner of the page, enter the ticker code (MDB.US), and navigate to the details page to view transaction details and historical trends. Click the “Trade” button in the bottom-right corner, select the trade type, and submit your order after filling in the transaction conditions.

(Image Source: uSMART HK app)