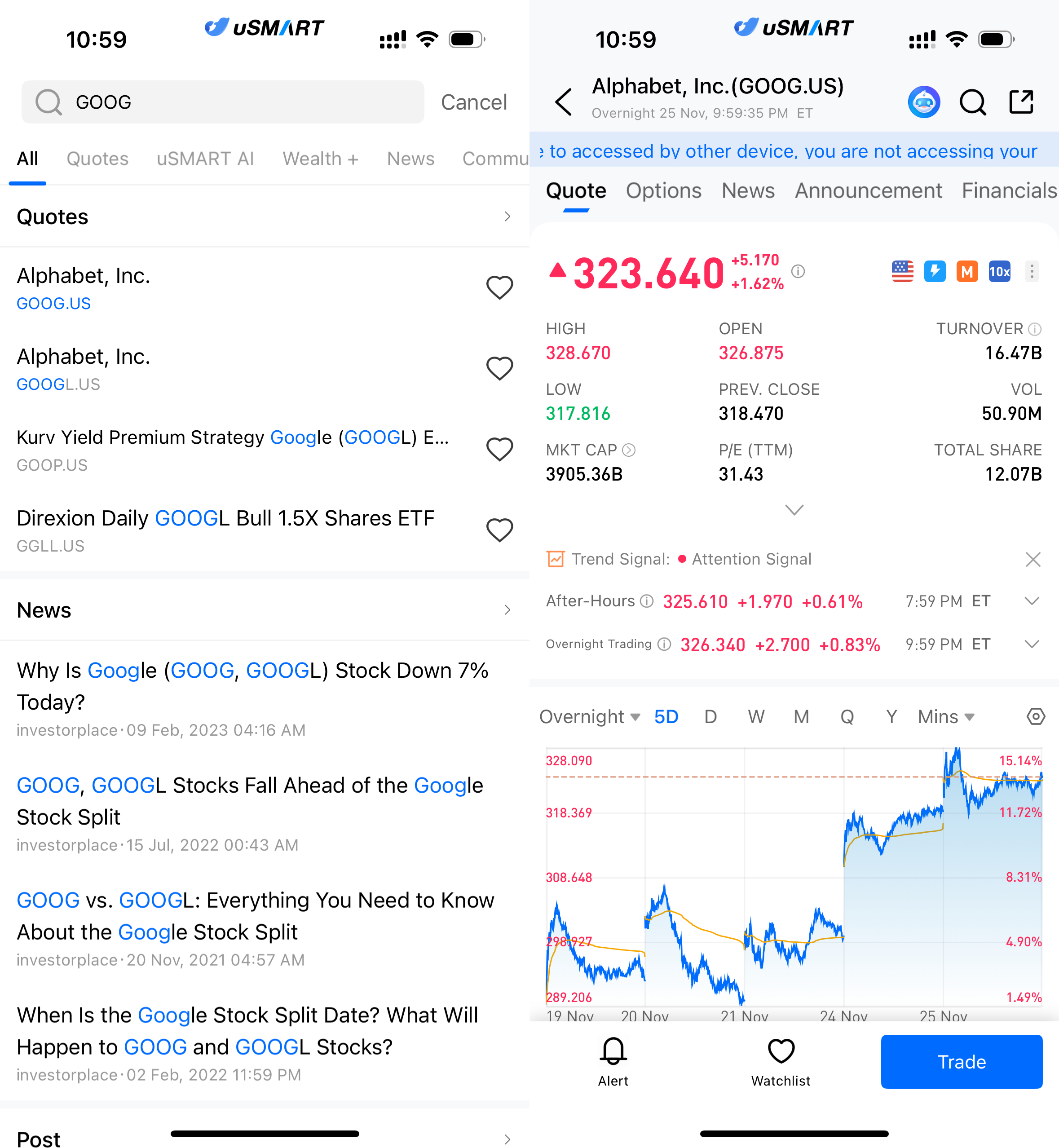

Alphabet Inc. (GOOG.US), Google's parent company, has seen its stock price surge in recent days, making it one of the most closely watched leading tech stocks on Wall Street this week. According to recent market data, Google's stock price has steadily risen from around $290 last week to surpass $328 during intraday trading on November 25, closing above $320, marking a new high. With this price increase, Alphabet's market capitalization has also surpassed the $2 trillion mark, securing its position as one of the largest public companies globally, trailing only Apple and Microsoft.

(Image Source: uSMART HK app)

Next-Generation Large Language Model Gemini 3 Boosts Google’s AI Leadership

Google is preparing to launch its next-generation large language model, Gemini 3, which has shown impressive performance in various tests. The model will be used to enhance Google’s search, advertising, cloud services, and Workspace product ecosystem, marking an important milestone in Google’s effort to reclaim leadership in AI technology.

At the same time, Google’s proprietary TPU AI chips are generating significant buzz in the tech industry. Multiple media outlets report that Google is in talks with enterprise clients for training and inference solutions based on TPU, aiming to build a differentiated competitive edge through a “model + chip + cloud” vertical integration strategy. Market expectations are that Google’s push into the high-performance computing space will create more direct competition with Nvidia, further enhancing its future growth potential.

Google Cloud Continues to Drive Growth, Core Advertising Business Maintains Stable Cash Flow

Google Cloud has become a crucial source of profit elasticity for the company. The growing demand for AI training, data analytics, and digital operations among enterprise users is making cloud services a key structural pillar supporting Google’s stock price. Additionally, a recovery in global advertising budgets is helping to stabilize growth in Google’s core advertising business, with improvements seen in both search traffic and advertiser spending, which are providing a steady cash flow to support Google's investments in AI technology.

Continued Capital Inflows into Tech Stocks, Google Becomes a Key Target for Institutional Investors

As the AI sector heats up again, institutional investors, including tech-focused ETFs and actively managed funds, have been increasing their positions in Google. Several investment banks have also updated their long-term valuation models for Google, suggesting the company is entering a phase of “AI technology implementation + steady growth in traditional businesses,” which could drive further stock price elasticity.

In addition to Google itself, related companies in the AI ecosystem, such as data center construction firms, server suppliers, and high-performance chip manufacturers, have also seen growth, creating a noticeable “Google-driven” effect in the market.

Regulatory and Competitive Risks Remain Key Concerns, Stock Price Likely to Experience Volatility

Despite Google’s strong performance, potential risks remain, including intensifying competition among major tech companies in the AI model space, slower-than-expected commercialization of large models, and uncertainties stemming from privacy and data regulation policies. Google’s advertising and search businesses still account for a significant portion of its revenue, and the company may face stricter antitrust scrutiny in the future.

Overall, Google is currently at a key stage of capitalizing on the AI transformation, with its cloud business and the upcoming release of new models serving as major drivers for the recent stock price surge. If technological advancements proceed smoothly, the market valuation for Google may increase further, but short-term stock movements will likely remain volatile, influenced by overall market conditions and regulatory expectations.

How to Buy Google via on uSMART

After logging into the uSMART HK app, click the “Search” button in the top-right corner of the page, enter the ticker code (GOOG.US), and navigate to the details page to view transaction details and historical trends. Click the “Trade” button in the bottom-right corner, select the trade type, and submit your order after filling in the transaction conditions.

(Image Source: uSMART HK app)