On November 14th, Tencent continued its strong trend in the Hong Kong stock market, with its stock price stabilizing at a high level following the earnings report. The stock closed at HK$653.00, a slight decline of 0.46% from the previous trading day, with an intraday low of HK$641 and a high of HK$659.

From a daily chart perspective, Tencent has been on a steady rebound since hitting a low of around HK$489.6 in late May, showing a significant cumulative increase, and briefly reaching HK$683 in early November. After the earnings report exceeded expectations, the stock remained above both the 60-day and 120-day moving averages.

(Image Source: uSMART HK app)

Q3 Financial Report Shows Strong Performance, Key Business Segments Drive Growth

According to the publicly available information, Tencent released its Q3 earnings for the period ending September 30 on November 13th. Both revenue and profits exceeded market expectations, with growth driven by improvements in gaming, advertising, and AI-related applications. Despite chip resource constraints, the fintech and enterprise services segments continued to grow.

|

Item |

Q3 Data |

YoY Change |

|

Total Revenue |

~¥192.9 billion |

+15% |

|

Net Profit |

~¥63.1 billion |

+19% |

|

Value-added Services Revenue |

+16% |

Benefiting from gaming and social ecosystems |

|

Advertising Revenue |

+21% |

Driven by improved AI ad efficiency |

|

Fintech and Enterprise Services Revenue |

+10% |

Cloud business growth limited by AI chip shortages |

|

Capital Expenditures |

~¥13 billion |

Declined YoY |

(Data source: Tencent Q3 2025 Financial Report)

AI Technology Fully Integrated, Boosting Core Business Growth

Tencent's management stated that investments in large-scale models and AI applications are enhancing efficiency across various business units. AI has significantly improved product performance in areas like advertising precision, game content generation, and social content distribution, providing strong support for revenue growth.

In the gaming sector, both domestic and international markets showed growth, with the overseas gaming segment continuing to be a major driver. The social ecosystem remains vast, creating a stable foundation for advertising and content commercialization.

Advertising performance was particularly outstanding this quarter, growing over 20%, primarily driven by AI improving advertiser conversion rates, thus boosting overall commercialization efficiency.

Cloud Business Growth Slows, but Long-Term Potential Remains

Although both enterprise services and cloud businesses continued to show double-digit growth, their growth rate was relatively modest compared to other segments. Tencent noted that the shortage of AI chips led to an inability to fully meet cloud computing demand, with priority given to internal needs. Market expectations suggest that, if hardware supply improves in the future, this segment could see renewed acceleration, particularly as demand for AI inference and model services continues to grow.

Looking Ahead: Investors Focus on Three Key Areas

The market widely believes Tencent's future growth will depend on several key factors. First, the deep integration of AI technology and commercialization will continue to drive the company's development, especially in improving advertising efficiency and accelerating AI-driven game content generation. Second, continued expansion of international gaming businesses will remain a major growth driver. Lastly, as hardware supply gradually improves, the enterprise services segment could see significant growth potential, further accelerating the overall business expansion.

Overall, Tencent's Q3 earnings demonstrate steady growth in its traditional core businesses, while AI-driven improvements in various segments further strengthen its ecosystem value. Despite temporary constraints in the enterprise services sector due to hardware shortages, the company’s overall strong financial performance provides support for the stock price to maintain an upward trend in the medium term.

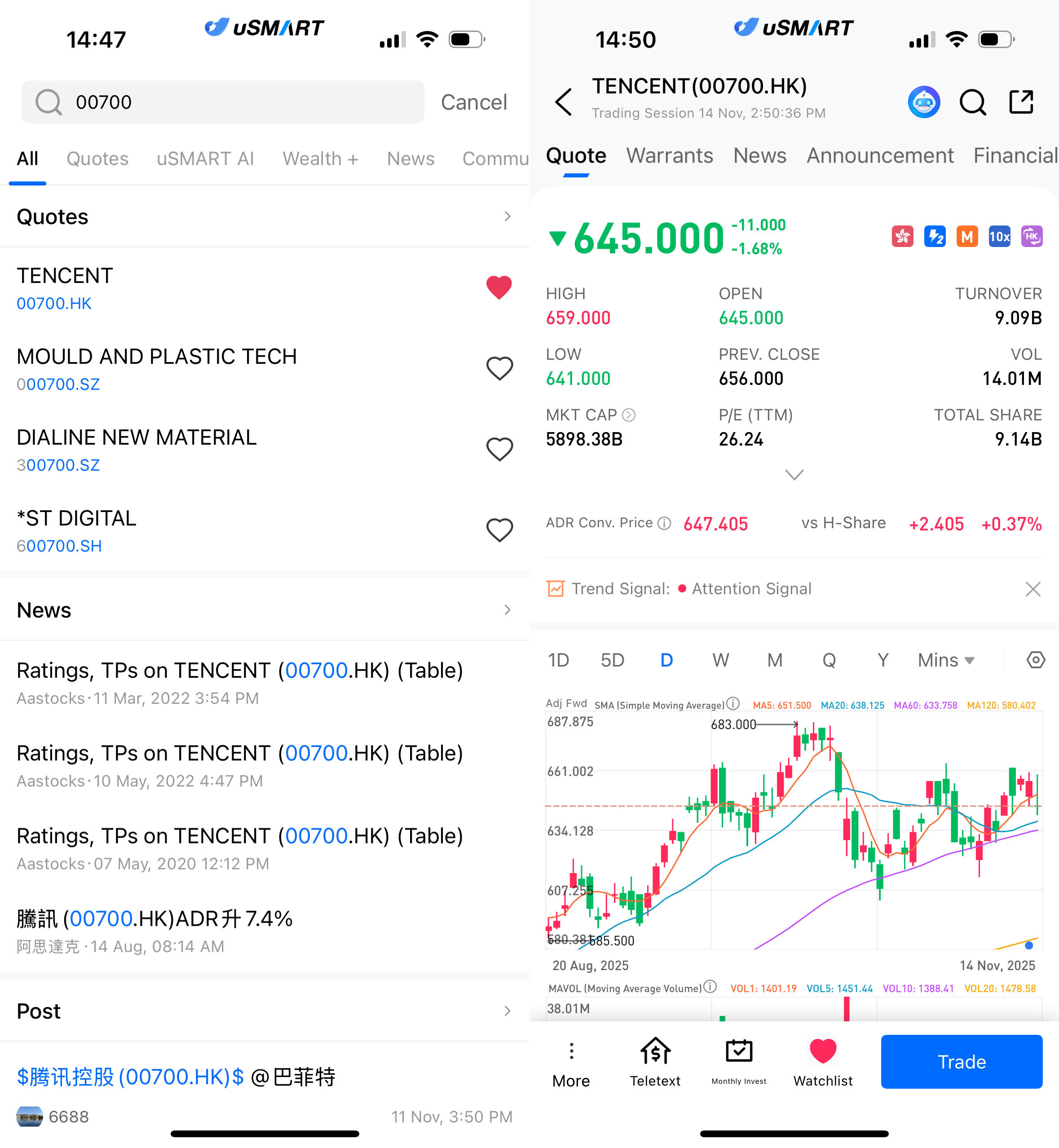

How to Buy Tencent via on uSMART

After logging into the uSMART HK app, click the “Search” button in the top-right corner of the page, enter the ticker code (00700.HK), and navigate to the details page to view transaction details and historical trends. Click the “Trade” button in the bottom-right corner, select the trade type, and submit your order after filling in the transaction conditions.

(Image Source: uSMART HK app)