Amid fluctuating inflation expectations, rising geopolitical tensions, and increasing gold purchases by central banks around the world, gold has once again become a focal point in global capital markets. Recently, international gold prices have reached new record highs, sparking widespread discussion among investors.

Compared to traditional physical gold investments, Gold ETFs (Exchange-Traded Funds) offer advantages such as trading convenience, high liquidity, and transparent fees, making them an increasingly popular “safe haven” choice in many investors' portfolios.

What Is a Gold ETF?

A Gold ETF (Exchange-Traded Fund) is a financial product that tracks the price of gold, allowing investors to gain exposure to the gold market without the need to physically hold the metal. Compared to traditional gold investments, Gold ETFs have a lower entry barrier and are easy to trade. Investors only need a brokerage account to buy and sell Gold ETFs just like stocks.

Key Advantages

High Convenience: No need to worry about storage, insurance, or transportation of physical gold.

High Liquidity: Can be traded during market hours with ease, similar to equities.

Diverse Options: A wide range of Gold ETFs are available on the market, including those that track gold prices, leverage-based products, and even ETFs that invest in gold mining companies—catering to different strategies and risk preferences.

Common Types of Gold ETFs

Based on the underlying asset and investment strategy, Gold ETFs can generally be categorized into four types:

1、Gold Price ETFs: These track the spot or futures price of gold and are ideal for investors who want direct exposure to gold price fluctuations.

2、Leveraged Gold ETFs: These use financial derivatives to amplify the movements of gold prices, usually offering 2x or 3x returns. Suitable for short-term traders due to higher risk.

3、Inverse Gold ETFs: These move in the opposite direction of gold prices. When gold prices fall, the ETF's value rises. Useful for bearish investors or hedging strategies.

4、Gold Mining Company ETFs: These invest in global companies involved in gold exploration, mining, and production. Their performance is closely tied to company fundamentals and gold price expectations.

Gold ETFs in the Hong Kong Market

Currently, there are four Gold ETFs listed on the Hong Kong Stock Exchange:

1、SPDR Gold ETF (2840)

Tracks the spot price of London gold. It offers low costs and high liquidity—suitable for investors who prefer trading in HKD.

2、Value Gold ETF (3081)

Backed by physical gold, with high transparency. Suitable for long-term investors. It supports trading in HKD, RMB, and USD.

3、Hang Seng RMB Gold ETF (83168)

Tracks the LBMA AM Gold Price and is denominated in RMB.

4、CSOP Gold Futures Daily (2x) Leveraged ETF (7299)

Tracks gold futures with 2x leverage, magnifying both gains and losses—ideal for experienced traders seeking amplified returns.

Gold ETFs in the U.S. Market

1、SPDR Gold Shares (GLD)

The largest and most actively traded Gold ETF in the world. It tracks the spot price of gold, with tight bid-ask spreads and low trading costs—popular among short-term and active traders.

2、iShares Gold Trust (IAU)

Also tracks the spot price of gold. It has a lower management fee than GLD, though its liquidity is slightly lower.

3、VanEck Vectors Gold Miners ETF (GDX)

Does not directly track gold prices but invests in gold mining companies, offering exposure to the broader gold mining industry.

4、VanEck Vectors Junior Gold Miners ETF (GDXJ)

Similar to GDX but focuses on small- and mid-cap gold mining firms globally, offering higher growth potential with increased risk.

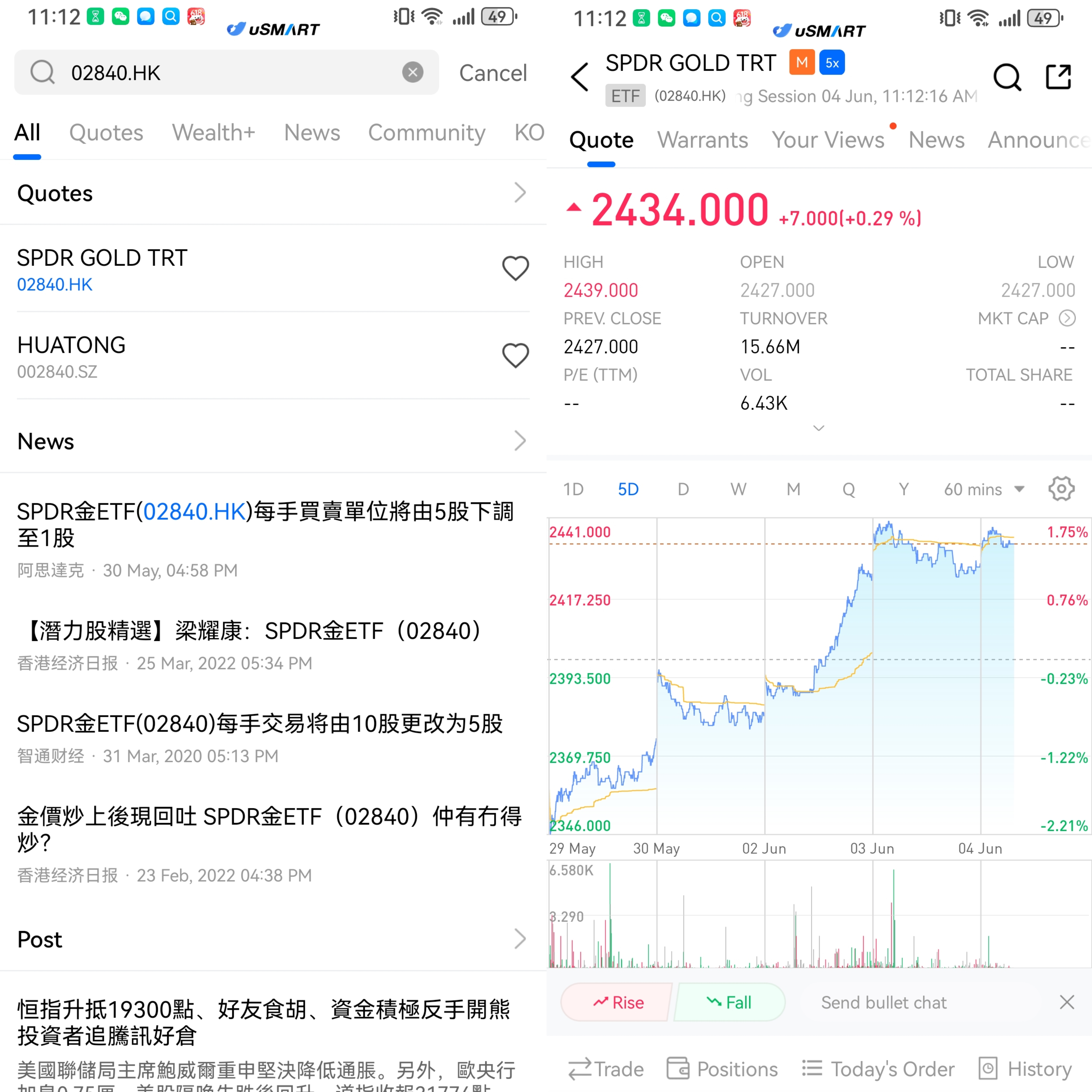

How to Buy Gold ETFs on uSMART

After logging into the uSMART HK app, click on "Search" at the top right of the page, input the stock code to access the details page and view transaction details and historical trends. Then click the "Trade" button at the bottom right, select the "Buy/Sell" option, fill in the transaction conditions, and submit your order.

(Image source: uSMART HK)