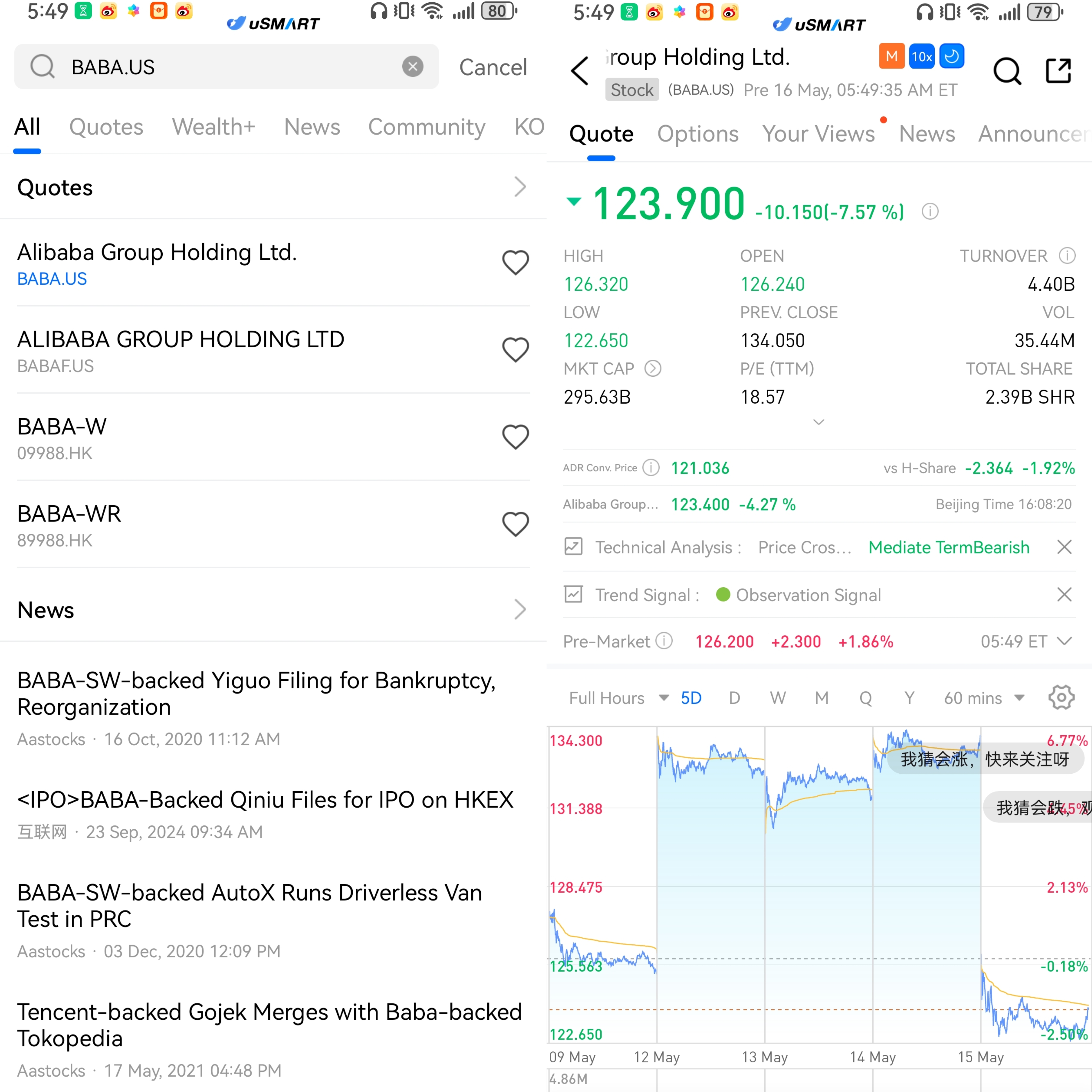

On Thursday evening, Alibaba reported its financial results, showing a 7% year-over-year increase in revenue for the fourth fiscal quarter, falling short of market expectations. However, net profit saw significant year-over-year growth. Following the earnings release, Alibaba's stock dropped about 8%, notably underperforming the broader market.

(Image source: uSMART HK)

Revenue Performance

On Thursday, Alibaba Group Holding Limited released its financial results for the fourth quarter and full fiscal year 2025. According to the data, the company posted Q4 revenue of RMB 236.45 billion, representing a 7% year-over-year increase, slightly below market expectations of RMB 237.91 billion. Full-year revenue reached RMB 996.35 billion, up 6% year-over-year. Net profit for the full year surged 77% to RMB 125.98 billion.

Alibaba Cloud stood out in this quarter, with revenue increasing 18% year-over-year to RMB 30.13 billion—marking its fastest growth in three years. Notably, revenue from AI-related products has achieved triple-digit year-over-year growth for seven consecutive quarters. Driven by generative AI technologies such as large language models, demand for cloud computing continues to rise, making Alibaba Cloud a key growth driver for the company.

Stock Price Reaction

Following the earnings release, Alibaba’s stock declined by approximately 8%. According to analysts, the drop was primarily due to overly high market expectations for Alibaba Cloud’s growth. Although the segment delivered an 18% year-over-year increase in revenue, it fell short of the 20% growth expected by the market. Seasonal factors such as the Chinese New Year and supply chain fluctuations also impacted the quarter’s performance, partially masking Alibaba Cloud’s true growth potential.

However, the long-term outlook for Alibaba Cloud remains solid. Industry demand continues to outpace supply, and Alibaba—being the only major player solely focused on external cloud services—enjoys a unique competitive edge. The open-source Qwen 3 model enhances customer stickiness through edge-cloud collaboration. Although heavy investment in AI infrastructure may pressure short-term margins, it lays a strong foundation for future growth. Management remains optimistic, forecasting a 22% year-over-year revenue increase for Alibaba Cloud in Q1 of fiscal year 2026, which could serve as a key catalyst for stock price recovery.

How to Buy Alibaba on uSMART

After logging into the uSMART HK app, click on "Search" at the top right of the page, input the stock code to access the details page and view transaction details and historical trends. Then click the "Trade" button at the bottom right, select the "Buy/Sell" option, fill in the transaction conditions, and submit your order.

(Image source: uSMART HK)