CATL , the global leader in renewable energy battery manufacturing, is launching its IPO from May 12 to May 15, 2025. The company plans to issue 118 million shares, with a maximum offering price of HKD 263.00 per share. Each board lot consists of 100 shares, and the expected entry fee is approximately HKD 26,565.24. The shares are set to begin trading on the Hong Kong Stock Exchange on May 20, 2025.

CATL : A global leader in the renewable energy battery manufacturing sector, focusing on technological innovation and development for electric vehicles (EVs) and energy storage systems.

Offer Allocation: Hong Kong Public Offering: 8.84 million shares, accounting for 7.5% of the total offering. International Offering: Approximately 109 million shares, accounting for 92.5% of the total offering. An over-allotment option of 17.68 million shares is also available.

Offer Price:The maximum offer price is HKD 263.00 per share, with each board lot consisting of 100 shares. The entry fee is approximately HKD 26,565.24.

Offer Period: May 12, 2025, to May 15, 2025

Listing Date: May 20, 2025

IPO Sponsors:China International Capital Corporation Hong Kong Securities Limited, CITIC Securities (International) Financing Limited, J.P. Morgan Securities (Far East) Limited, and Merrill Lynch (Asia Pacific) Limited.

(Image Source: CATL Prospectus)

Company Overview

Contemporary Amperex Technology Co., Limited (CATL) was established in 2011 and is headquartered in Ningde, Fujian Province, China. It is a global leader in the production of power batteries and energy storage system solutions. The company focuses on the research, development, and manufacturing of lithium-ion batteries for electric vehicles (EVs) and energy storage systems, striving to drive the global transition towards sustainable energy. In recent years, CATL has gained a significant presence in the global market, becoming a key player in the renewable energy industry with its innovative technology and robust production capabilities.

In its latest fundraising project, CATL plans to allocate approximately 90% of the raised funds to the first and second phases of its Hungarian project. This strategic investment will further enhance the company's competitiveness in the global renewable energy market, especially consolidating its leadership position in the European market. Additionally, CATL is actively advancing the research and development of high-nickel batteries, energy storage systems, and other technologies to meet the growing global demand for high-performance battery products.

Financial Information

Despite the intense price competition in the electric vehicle (EV) industry and the continued decline in lithium battery prices, CATL has demonstrated strong financial performance. In 2024, the company achieved a full-year revenue of CNY 362.013 billion, with a net profit attributable to shareholders of CNY 50.745 billion, reflecting a 15% year-on-year increase. Even in a challenging market environment, CATL managed to maintain profitable growth. In 2025, the company continued its strong growth trajectory, with first-quarter revenue reaching CNY 84.705 billion and a net profit of CNY 13.963 billion, marking a year-on-year increase of 32.85%. The gross profit margin stood at 24.4%, continuing to climb sequentially, showcasing the company’s strong cost control and profitability.

Furthermore, since its listing, CATL has accumulated nearly CNY 60 billion in dividends, with a dividend payout ratio of 50% in both 2023 and 2024, demonstrating its strong profitability and commitment to returning value to shareholders.

First-Day Subscription Performance

CATL's Hong Kong public offering saw an exceptionally strong first-day subscription performance. The public offering portion was oversubscribed by 21 times, attracting approximately HKD 51.7 billion in subscription funds, showcasing the market's high confidence in the company’s future prospects. Due to the overwhelming demand, CATL applied for a waiver of the clawback mechanism from the Hong Kong Stock Exchange, a rare move in IPO history. The proportion of retail subscription was only 7.5%, significantly lower than the typical 50% for popular IPOs, making the chances of securing shares much more difficult.

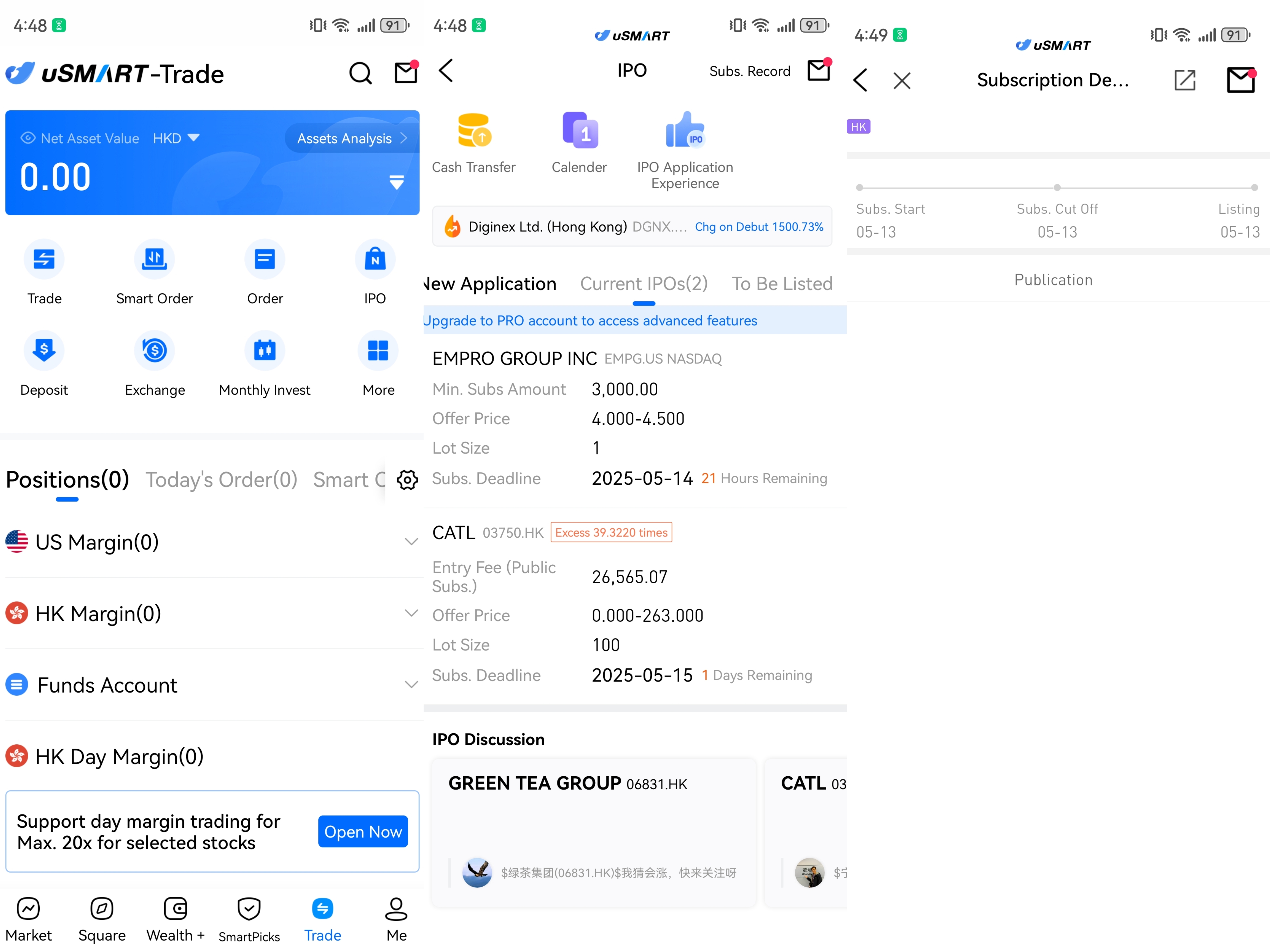

How to subscribe to Hong Kong IPOs via uSMART HK

The uSMART HK App offers an IPO Center, providing early access to IPO subscriptions and exclusive promotions. Customers can subscribe to newly issued shares directly through the app. After logging into the uSMART HK App, select "Trading" at the bottom right, click "IPO Subscription", choose the IPO you wish to subscribe to, click "Public Offering", enter the desired subscription quantity, and submit the order.

(Image Source: uSMART HK)