Recently, JD.com’s food delivery service has frequently made headlines. On April 16, due to the success of its large-scale subsidy event, traffic surged to four times its normal volume, causing a temporary system glitch. In response, JD.com issued 100,000 coupons to compensate users. On April 21, JD.com’s founder, Liu Qiangdong, was spotted delivering orders himself in a delivery rider uniform, attracting widespread attention. These moves highlight JD.com’s aggressive positioning in the instant retail market, signaling a shift in the competition with Meituan from a battle for market share to a comprehensive contest of services, user experience, and operational efficiency.

Development History

Since 2022, both Meituan and JD.com have declared instant retail as a key development area, and the industry has widely expected fierce competition between the two. In 2022, the pandemic served as a wake-up call for many internet companies, prompting them to scale back spending and focus resources on growth areas. In its Q2 earnings report, JD.com expressed strong interest in instant retail, noting the rapid growth of demand for on-demand delivery. Meanwhile, Meituan also emphasized the importance of its instant retail business.

Though both companies placed bets on instant retail, the real competition only began to intensify in 2025. In February of this year, JD.com’s food delivery service launched the "Quality Dine-in Restaurant Merchant" recruitment program, offering merchants a commission-free year if they joined before May 1, 2025. This move directly targeted Meituan’s pain points, attracting many merchants long burdened by high commission fees. A month later, JD.com announced that it would pay for five social insurances and one housing fund for its riders, while also signing formal labor contracts with over 10,000 full-time riders. Additionally, JD.com launched a massive subsidy program, offering large-scale discounts and waiving delivery fees for orders over 20 minutes late, further improving its market performance. Finally, JD.com made a commitment to never force "either/or" choices on part-time riders, ensuring that they could freely accept orders to maximize their income, while keeping the delivery business's net profit margin below 5%.

Stock Market Impact

As the battle in China’s food delivery sector continues to heat up, JD.com and Meituan’s stock prices saw significant drops on April 22 in the Hong Kong market. Meituan's stock plunged by 7.1%, while JD.com's stock dropped by 8.1%, reaching its lowest level in about seven months and becoming one of the worst performers in the Hang Seng Tech Index. This fluctuation in stock prices reflects investor concerns about the future profitability of both companies. As JD.com’s food delivery service enters the fray with its differentiated strategies, doubts have emerged about whether Meituan can maintain its dominant position. Furthermore, factors such as the ongoing price war, user growth, and cost control will have a significant impact on the financial performance of both companies. Investors should closely monitor how Meituan and JD.com balance expansion with profitability, whether they can find sustainable growth paths amid fierce market competition, and how China’s policy environment will affect these two giants.

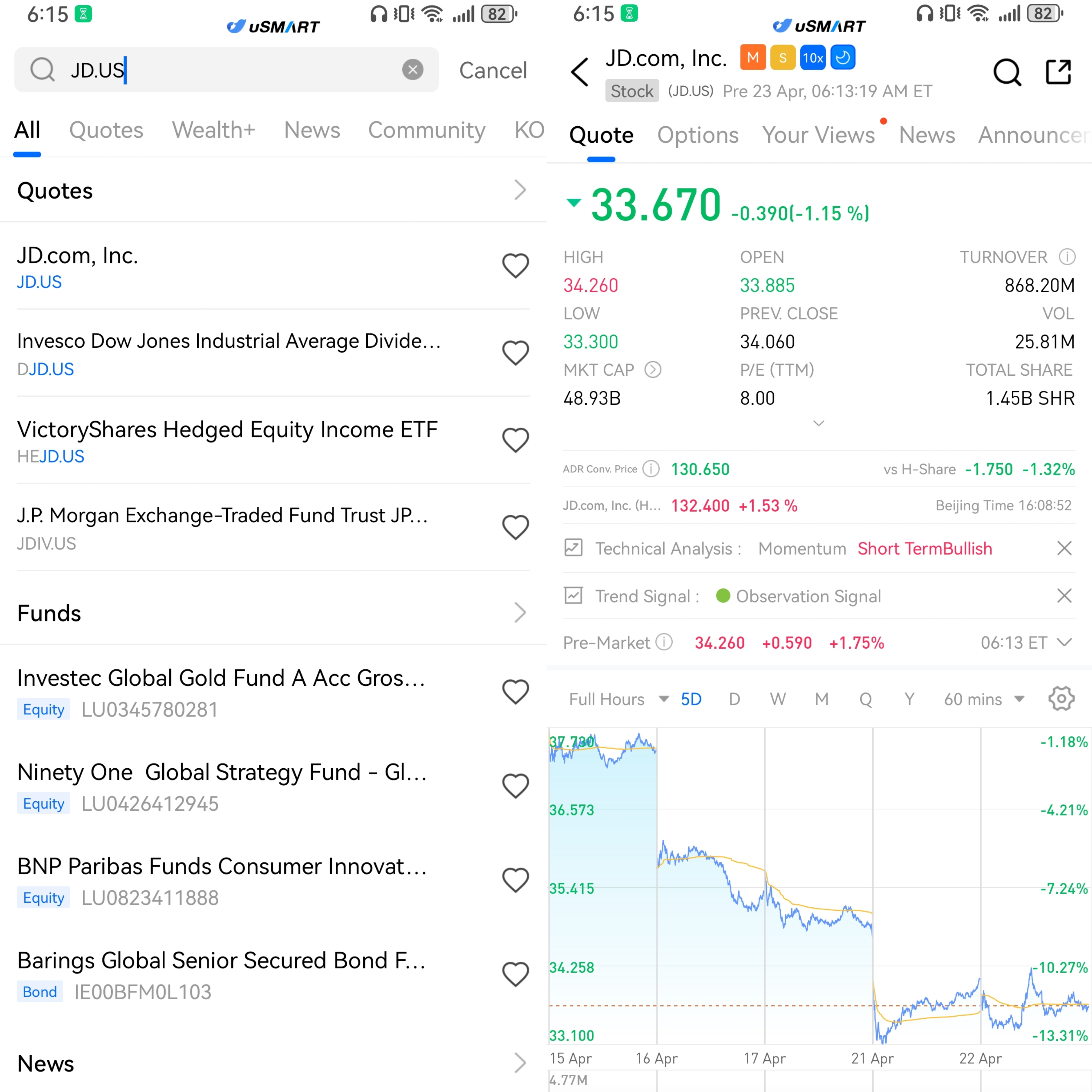

How to Buy JD on uSMART

After logging into the uSMART HK app, click on "Search" at the top right of the page, input the stock code to access the details page and view transaction details and historical trends. Then click the "Trade" button at the bottom right, select the "Buy/Sell" option, fill in the transaction conditions, and submit your order.

(Image source: uSMART HK)