Uncertainty stemming from Trump’s tariff policies has heightened market concerns, while a weakening U.S. dollar is further supporting the rise in gold prices. During Wednesday’s Asian trading session, spot gold surged past the $3,260 and $3,270 levels, setting yet another all-time high. Since the beginning of 2025, gold prices have climbed over 23%, with its safe-haven appeal continuing to attract strong investor interest.

(Image source: uSMART HK)

Goldman Sachs and UBS have once again released bullish forecasts for gold, citing two primary drivers behind the precious metal's sustained rally: stronger-than-expected central bank demand for gold and its critical role as a hedge against economic recession and geopolitical risk. After gold prices surged 6.6% last week and broke above $3,245 per ounce this Monday to hit a new record high, several institutions now project continued gains, with gold potentially rising to $3,700 by the end of 2025 and reaching $4,000 by mid-2026. These projections reflect a strong market consensus favoring gold, especially against the backdrop of global uncertainty driven by Trump’s trade policy shifts.

Meanwhile, central banks around the world have been increasing their gold holdings at an average rate of 80 tonnes per month in 2025 — surpassing the previously estimated 70 tonnes. Analysts point out that rising recession risks and the underperformance of risk assets are likely to lead to further capital inflows into physical gold ETFs. As international trade tensions and geopolitical dynamics grow increasingly complex, the importance of allocating to safe-haven assets is becoming more pronounced. Demand for gold continues to strengthen across a wide range of market participants — from central banks and institutional investors to private wealth managers and retail traders.Despite gold's elevated price levels, analysts believe there is still room for further allocation, as current market positioning remains far from overcrowded on the long side.

Promotional Offers Fuel Gold ETF Investment Boom

Amid ongoing global economic and geopolitical volatility, gold’s status as a safe-haven asset continues to strengthen. Prices are repeatedly hitting record highs, with strong bullish sentiment in the market. Spotting this trend, uSMART has launched a special trading promotion on Hong Kong-listed ETFs. Investors can now trade over 100 selected Hong Kong ETFs — including SPDR Gold ETF, Value Gold ETF, and FL South Gold ETF — with unlimited commission-free trading and waived platform fees.

This promotional offer not only lowers the barrier to entry but also provides investors with a more efficient and convenient way to build exposure to high-potential gold ETFs.

For more details on the promotion, please refer to our information document

*Terms and conditions apply

How to Buy Gold ETF on uSMART

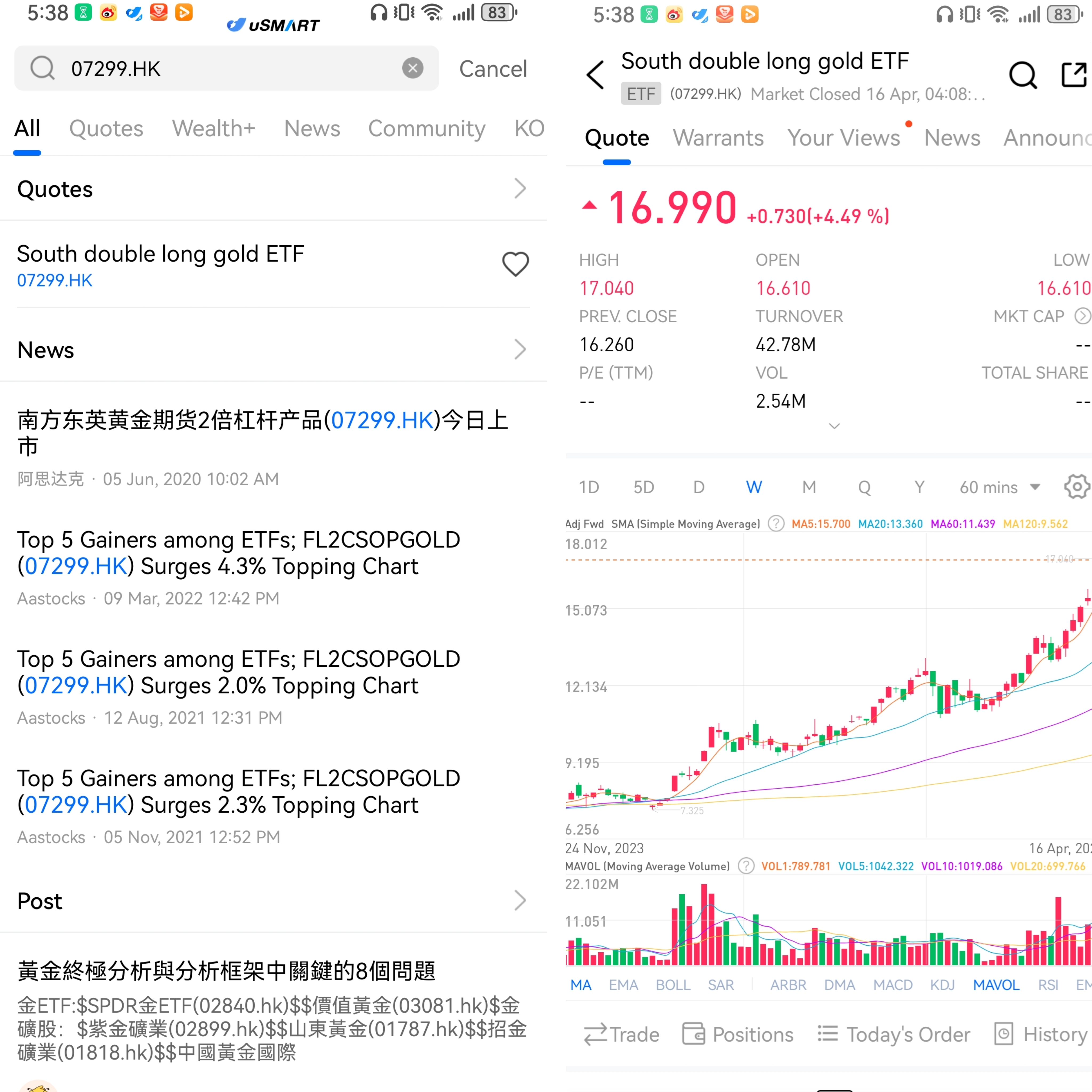

After logging into the uSMART HK app, click on "Search" at the top right of the page, input the stock code to access the details page and view transaction details and historical trends. Then click the "Trade" button at the bottom right, select the "Buy/Sell" option, fill in the transaction conditions, and submit your order.

(Image source: uSMART HK)