As we step into 2024, the AI industry, which consumes a vast amount of energy in data centers, is not only facing a shortage of chips but also an impending shortage of electricity. From 2023 to 2030, the power demand of data centers is expected to grow at a compound annual growth rate of 15%, and investors are turning their attention to power generation stocks.

With the summer peak electricity usage season approaching, coupled with the acceleration of power system reforms, the heat in the power sector remains high. In this wave of rising market trends, the "Hydropower King" Yangtze Power has shown a dazzling performance. As of June 3rd, Yangtze Power (600900) stock price has risen significantly, with an increase of 3.04%, trading at 27.42 yuan per share, hitting a historical high, with a transaction volume of 1.68 billion yuan, a turnover rate of 0.26%, and an amplitude of 2.52%.

(Source: uSMART, 2024.06.04)

Below is an analysis of this stock that can transcend cycles, allowing 260,000 shareholders to enjoy stable growth, with a market value of 650 billion yuan and a high moat - the hydropower leader, Yangtze Power.

In addition to the new high stock price, the market value has increased by more than 550 billion yuan in ten years.

As of June 4th, the total market value of Yangtze Power is about 672.3 billion Hong Kong dollars, with the current market value increasing by 550 billion yuan compared to 2014. Since 2014, Yangtze Power's stock price has steadily risen, with a cumulative increase of more than 5 times. There has hardly been a significant pullback during this period, and even during the stock market crash in 2015, there was only an adjustment of nearly 18%. Yangtze Power has shown strong resilience through cycles.

Behind the impressive stock price increase is the company's robust performance. Since 2016, Yangtze Power's annual net profit has exceeded 20 billion yuan, with a net profit of 27.239 billion yuan in 2023, setting a new annual record. In the first quarter of 2024, the company achieved a total operating income of 15.641 billion yuan, a year-on-year increase of 1.58%; the net profit was 3.967 billion yuan, a year-on-year increase of 9.80%, still maintaining a dual increase in revenue and net profit.

In addition, the tradition of a high proportion and continuously stable dividend is one of the important factors for capital preference for Yangtze Power. In 2023, the company paid out cash dividends of 20.064 billion yuan to shareholders. Since its listing, the company has paid out a total of 182.8 billion yuan in cash dividends, close to 67% of the company's cumulative net profit. (The above data source: Daily Economic News)

Company Basic Information

Yangtze Power is the world's largest hydropower listed company. Through many years of continuous unit construction and injection, it currently operates and manages the Three Gorges, Baihetan, Xiluodu, Wudongde, Xiangjiaba, and Gezhouba six cascade hydropower stations. These giant hydropower stations form the basic plate for the development of Yangtze Power, and the moat is wide enough, just like the "stock king" Kweichow Moutai.

Among the top ten hydropower stations in the world, five are under Yangtze Power. The hydropower installed capacity on the main stream of the Yangtze River reaches 71.695 million kilowatts, and the total installed capacity of hydropower both domestically and abroad is 71.795 million kilowatts, ranking first in the world. With obvious resource advantages, unprecedented policy support, and broad prospects for industry development, Yangtze Power has obtained an exclusive business of "making money while lying down."

Fundamental Analysis

● Steady Growth of Revenue and Net Profit

In 2023, the six cascade hydropower stations of Yangtze Power increased power generation by 14.015 billion kilowatt-hours year-on-year, achieving a total profit of 32.369 billion yuan, a year-on-year increase of 8.75%. Over the past decade, except for the impact of low water in 2015, 2019, 2021, and 2022, the company's net profit has been growing steadily.

Yangtze Power's net profit margin has been maintained at above 40% over the past decade, nearly 50% in some years. By selling 10 yuan of hydropower, the company can obtain a net profit of 4 yuan. In 2023, due to the acquisition of two hydropower stations, the increase in production capacity led to an increase in revenue to 78.1 billion yuan, and the financial expenses of debt financing increased by nearly 8 billion yuan; excluding the interest cost brought by financing, the net profit margin in 2023 was at the same level as previous years.

In addition, the company's revenue scale and total asset scale are in resonance. The growth of Yangtze Power's revenue is capped; as long as the company does not build a large number of new hydropower stations, there will be an upper limit to the power generation, and the fluctuation of revenue mainly depends on the abundance or scarcity of water resources.

● Continue High Proportion Dividend

The company has won the favor of long-term investors with stable dividends, accumulating more than 180 billion yuan in dividends over 22 years since its listing. In recent years, it has been maintained at more than 70%, and in 2022, almost all net profits were used for dividends. The company's articles of association clearly stipulate that the profit distribution for each year from 2021 to 2025 should be no less than 70% of the net profit realized in that year in the form of cash dividends. Such a high proportion of dividends is also rare in the entire A-share market.

From the perspective of the dividend yield, the company's dividend yield has shown a downward trend year by year, but this is only an appearance, mainly due to the rise in the company's stock price. In fact, the company's per-share dividend has been increasing year by year, and the dividend per 10 shares for 2021 to 2023 has exceeded 8 yuan.

● Asset-Liability Ratio Significantly Increased

At the end of 2023, the company's interest-bearing debt balance was 314.762 billion yuan, an increase of 31.946 billion yuan from the beginning of the period. The asset-liability ratio increased to 62.88%, mainly due to the financing increase caused by the acquisition of two hydropower stations of Yun Chuan Company. Although the debt ratio has increased, considering the stable income of the power company and the nature of state-owned capital, a moderate financial leverage can still enjoy the tax shield effect of interest deduction.

Net Asset Return on Equity has been maintained at around 15%. In 2023, Yangtze Power's net asset return on equity (deducted/weighted) was 14.13%, ranking first in the entire hydropower industry, with an average return on equity of 14.15% in the past five years. Yangtze Power's stability is extremely high. As long as the water of the Yangtze River continues to flow, the company's profits are guaranteed, and the net asset return on equity (ROE) is stable at around 15%, which is related to the company's business capacity.

● Secondary Market Aspect Concentrated

Over the past 10 years, the company's average valuation has been 17.7 times the price-to-earnings ratio, with a P/E ratio of around 20 times from 2021 to 2023, below 15 times in 2014 and 2016, and fluctuating between 15 and 20 times in other years.

The source of stock investment income comes from dividend income and capital gains. If you bought one share at the closing price of 10.67 yuan per share at the end of 2014 at a P/E ratio of 14.88 times, the stock price appreciation rate has reached 148%, the cumulative dividend yield is 50%, and the total yield of the two is over 200%.

Looking at the equity structure, as of the end of the first quarter, more than 75% of the shares are concentrated in the hands of the top ten shareholders, and the floating chips are less than 25%. Under this highly locked equity structure, the cost of the top ten shareholders is very low, and the dividend rate is actually very high. Yangtze Power relies on this less than 25% of the chips to rise steadily. When will it fall depends on when the top ten shareholders will explode and unload, or a large-level adjustment will be ushered in. Therefore, Yangtze Power in the SSE 50 can be said to be "steady happiness."

(The above data source: Hexun.com)

Yangtze Power Holding 10 Electricity Stocks

Yangtze Power's official website indicates that in recent years, the company has actively carried out foreign investments focusing on areas such as clean energy, smart integrated energy, industry chain upstream and downstream, and technological innovation.

Choice data shows that as of the first quarter of 2024, Yangtze Power appeared in the list of top ten shareholders of 11 listed companies. Among them, Gansu Energy, Hubei Energy, Shanghai Power, Zhejiang New Energy, Guangzhou Development, Three Gorges Water Conservancy, Guizhou Power, Shenneng Shares, Sichuan Investment Energy, and State Power Investment, all 10 are electricity stocks.

In addition to listed companies, the chess game that Yangtze Power has strung together through equity investment is also quite grand. By the end of 2023, the company held equity rights in a total of 65 companies, with significant equity investments amounting to 71.684 billion yuan, and investment income was 23.996 billion yuan. (Data source: Global Tiger Finance)

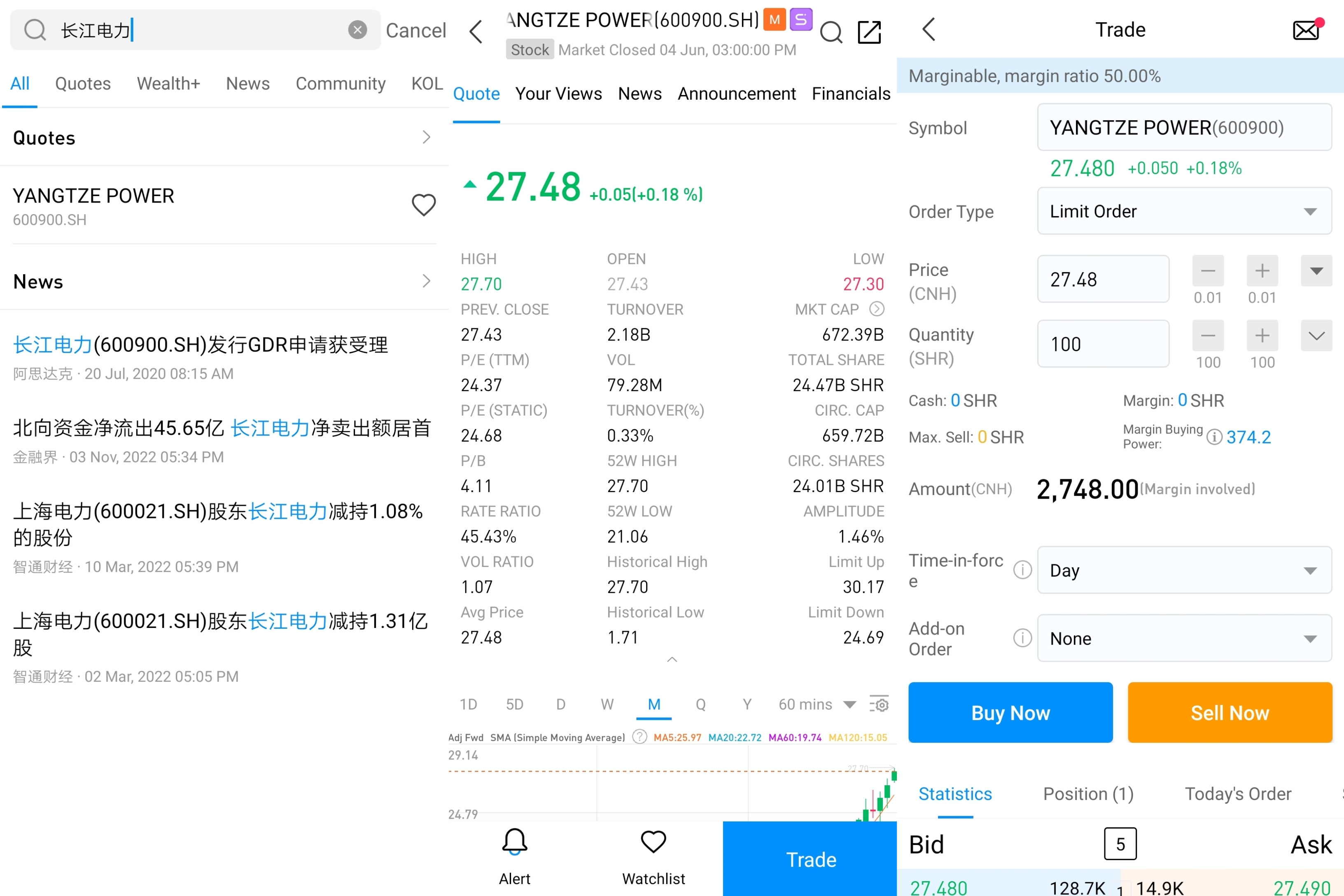

How to place a trade on uSMART mobile application

Log in to the uSMART HK APP, click on the "Search" icon at the top right corner of the screen, and enter the "Yangtze Power" to access the details page for trading information and historical trends. Click the "Trade" button at the bottom right corner, select the "Buy/Sell" function, fill in the trading conditions, and submit the order. The visual guide is as follows:

This diagram is provided for illustrative purposes exclusively

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.