The Hong Kong stock market has shown strong momentum recently. As of May 13, 2024, it has risen for three consecutive weeks, rebounding nearly 3,000 points within a month, and has quickly recovered to the 189 level, the high point of the September wave last year. At present, the Hong Kong stock market is still on an upward trajectory, and it is not advisable to be bearish in the short term. The outlook for the future is still optimistic.

The issue of undervaluation in the Hong Kong stock market

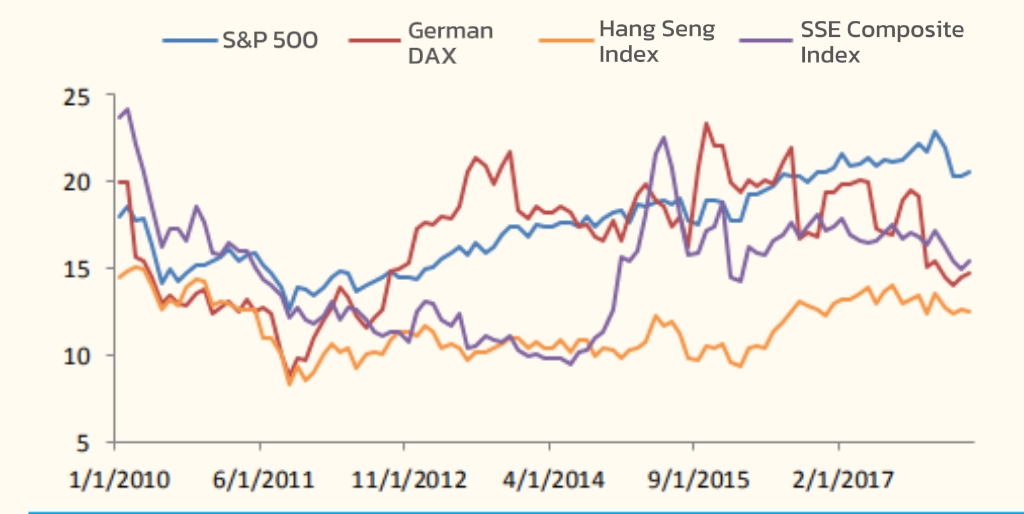

Compared with the historical price-to-earnings ratios of major global stock indices, the valuation of the Hong Kong stock market has always been at a low level. Since 2010, the Hang Seng Index PE ratio has consistently been below 15, with an average of 11.6. In the same period, the S&P 500 had an average PE ratio of 17.5, the Shanghai Stock Exchange A-shares had an average of 14.9, and the German DAX had an average of 16.7.

(Source:The Wall Street Journal,2018.04)

(Source:The Wall Street Journal,2018.04)

There are four main reasons that contribute to the low valuation of the Hong Kong stock market:

1. Mismatch between investor sources and listed companies

As a highly mature and open capital market, the Hong Kong stock market attracts investors from around the world. According to data from the Hong Kong Exchanges and Clearing Limited in 2018, more than half of the trades were conducted by investors from European and American markets, while mainland Chinese investors accounted for only 21.5%. However, due to the favorable market environment and listing rules in Hong Kong, the main listed companies on the Hong Kong stock market are primarily focused on the mainland Chinese market.

Due to investors generally having a preference for their local markets, they prioritize investing in the markets they are familiar with. This mismatch between the sources of Hong Kong stock market investors and the listed companies means that the valuation does not fully reflect the recognition, brand effects, and attention given to local companies.

2. Dominance of foreign institutional investors in the stock market

High valuations are often associated with individual investors; however, the Hong Kong stock market is primarily dominated by professional institutional investors. Compared to individual investors, professional institutional investors have the dual advantages of capital and information, and they are more flexible in their investment choices and methods. They also have a more professional and mature approach to stock valuation. Furthermore, most institutional investors in the Hong Kong stock market are overseas investors, and their pursuit of globally diversified capital allocation with a focus on safety leads to a more cautious approach to stock valuation.

3. Imbalanced supply and demand structure in the Hong Kong stock market

From the perspective of demand structure, the structural imbalance in the Hong Kong stock market leads to insufficient liquidity. Specifically, the demand for capital is much lower than the supply of stocks. Therefore, when compared horizontally with global markets, key indicators such as transaction volume, turnover rate, and the ratio of transaction volume to total market capitalization in the Hong Kong stock market are all relatively low.

From the supply perspective, Hong Kong is one of the most lenient regions for initial public offerings (IPOs) globally. According to data from Dealogic, the Hong Kong Stock Exchange was the highest fundraising IPO market in both 2015 and 2016, but it slipped to fourth place in 2017, behind the New York Stock Exchange, Shanghai Stock Exchange, and Nasdaq. However, it still significantly surpassed other exchanges in terms of IPO fundraising scale. In a situation where there are many new stocks but a noticeable lack of incremental funds, the scarcity of stocks hinders the overall valuation improvement of the Hong Kong stock market.

4. Mainly low-valuation industries such as finance and real estate among listed companies

Listed companies in the Hong Kong stock market are primarily focused on low-valuation industries such as finance and real estate, which further lowers the overall valuation of the Hong Kong stock market.

Hong Kong Stock Market Rebound Trend

As of May 13th,the Hang Seng Index rose for the third consecutive day, gaining a total of 801 points or 4.4%, surpassing the 19,000 mark, while the Hang Seng Tech Index also crossed the 4,000 mark, rising 3.8% over the past three days. The Hang Seng Index opened lower by 59 points at 18,904 points, with the morning session seeing a decline of up to 136 points, hitting a low of 18,827 points before receiving buying support. The market turned around and rose again, surpassing the 19,000 mark and reaching as high as 19,123 points in the afternoon session, marking a new high in over nine months and closing near the intraday high. The Hang Seng Index closed up 151 points or 0.8% at 19,115 points for the day, while the Hang Seng China Enterprises Index rose 0.6% to 6,761 points, and the Hang Seng Tech Index increased by 1.4% to close at 4,018 points, with a total market turnover of HK$147.2 billion.

Blue chips such as AIA (1299) rose by 0.3%; Tencent (700) gained 1.9%; Alibaba (9988) announced its earnings and rose by 4.1% for the day; Meituan (3690) increased by 3.1%, contributing 91 points to the Hang Seng Index along with Alibaba; JD.com (9618) rose by 2.1%; the Mainland Freight Index (Ou Line) main contract hit a new high, with COSCO Shipping Holdings (316) surging by 5.9%, ranking as the best-performing blue chip; Ping An Insurance (2318) reduced its stake in HSBC Holdings (0005) for the first time in 10 years, with HSBC still rising by 0.1%; while Ping An Insurance fell by 0.4%. Railway and infrastructure stocks were in demand, with CRRC (1766) soaring by 7.3%; State Grid Corporation of China (3898) surged by 6%; and China Railway Group (390) bounced back by 4.5%.

Currently, investors are concerned about whether the upward trend in the Hong Kong stock market can continue. This question can be understood within the framework of the current bull market, which can be categorized into four scenarios:

1. Valuation recovery of large-cap blue-chip stocks, represented by Hong Kong Exchanges and Clearing Limited and Tencent.

2. Valuation recovery of the real estate sector under policy stimulus.

3. Violent surges of stocks lacking earnings support in the context of loose liquidity.

4. Further enhancement of high-dividend stock sectors due to recent rumors of dividend tax abolition.

In summary, the underlying logic of the current bull market in the Hong Kong stock market is solid, which is why the market has been almost continuously rising since late April. However, it is worth noting that late May marks the period when companies will disclose their first-quarter earnings, leading to market differentiation. Stocks with earnings support will continue to see their valuations rise, achieving a 'Davis Double'; whereas stocks without earnings support may revert to their original levels.

What investment opportunities are there in the Hong Kong stock market in 2024?

· Public utilities sector, especially the electricity industry

In the case of low or negative growth in the Consumer Price Index (CPI), public utilities, especially the electricity industry, may perform better. This is because during periods of low inflation, prices of utilities products (such as electricity) have room to rise, and electricity prices have not significantly increased over the past 40 years. Slower growth in electricity demand (from 4-5% to 2-3%) may lead to a reduction in coal consumption, which could help improve the pricing system for electricity, as slower demand growth may alleviate pressure on energy prices. The development of new energy sources brings new opportunities for electricity operators, especially those companies that operate both traditional and new energy sources. The introduction of new energy sources helps improve the cost structure of these companies, as new energy sources generally have lower operating costs and are more environmentally friendly.

· Investment opportunities in consumer stocks

Although the overall Hong Kong stock market has declined over the past two years, stocks of consumer goods companies (such as beer, dairy products, food, and dining) have remained relatively stable. This may be because foreign investors have a deeper understanding and preference for the consumer goods industry. However, since foreign investors account for a larger proportion of the Hong Kong stock market, their movements significantly affect the market, so investors cannot ignore this factor when considering investment.