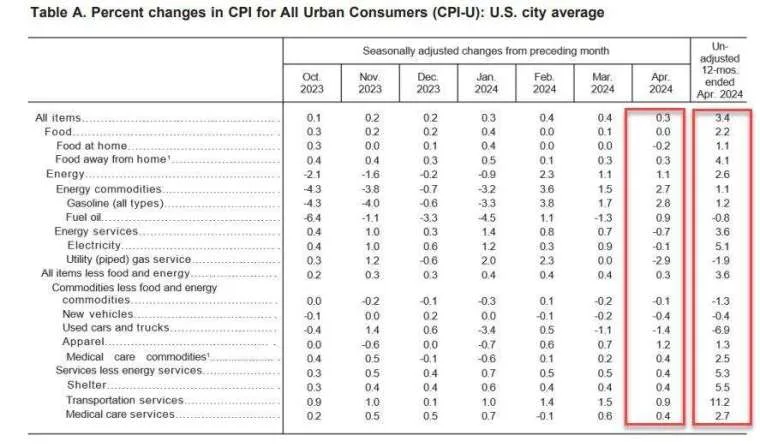

According to data released by the US Bureau of Labor Statistics (BLS) on May 15, the year-on-year increase in CPI for April was 3.4%, which is in line with market expectations and slightly lower than the previous value of 3.5%. On a monthly basis, it grew by 0.3%, which is lower than the market expectation and the previous value of 0.4%. The core CPI dropped to 3.6%, marking the smallest annual increase in three years, and it also recorded the first monthly decline in six months. This has renewed hopes for interest rate cuts in the market, leading to an upward momentum in the bond market. On May 15th, US Treasury yields slipped to the lowest level in over a month.

(Source:BLS,2024.05.15)

(Source:BLS,2024.05.15)

Market Reaction: US Stocks and Bonds May Experience Significant Volatility

US stock indices surged simultaneously, with the S&P 500 and Nasdaq hitting unprecedented highs; the US dollar weakened, and the Japanese yen surged by 1% at one point; the yield on US 10-year Treasury bonds plummeted by 10 basis points to 4.34%, marking the lowest level since April 10, while the yield on 2-year US Treasury bonds also dropped. Bond yields move inversely to prices, thus causing a jump in US bond prices.

MarketWatch data shows that at the closing bell on May 15 in the New York bond market, the yield on 2-year Treasury bonds, which is more sensitive to Fed interest rate policies, fell by 8.3 basis points to 4.734%, hitting a new low since April 5; the yield on 10-year Treasury bonds dropped by 9 basis points to 4.354%, reaching a new low since April 4; and the yield on 30-year Treasury bonds slipped by 7.8 basis points to 4.515%, marking a new low since April 9.

Energy and housing costs continue to rise, while prices for new and used cars decline.

The rise in energy and housing costs in April remains the biggest obstacle to cooling inflation, as prices for new and used cars decline, slowing down inflation rates. Specifically, housing and gasoline accounted for over 70% of last month's price increase. Housing, which comprises about one-third of the CPI, increased by 0.4% month-on-month in April, marking a three-month consecutive increase of that magnitude. Additionally, the new car index decreased by 0.4% in April, while the used car and truck index dropped by 1.4%, further expanding the decline compared to March.

(Source:BLS,2024.05.15)

(Source:BLS,2024.05.15)

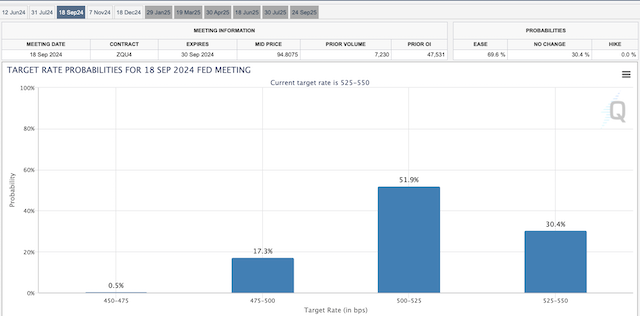

Probability of Fed Cutting Interest Rates in September Reaches Nearly 70%

According to the CME Group's FedWatch tool, the probability of a 1-point interest rate cut by the Federal Reserve in September is 51.9%, the probability of a 2-point (50 basis points) cut is 17.3%, and the probability of a 3-point (75 basis points) cut is 0.5%. The probability of the Fed keeping rates unchanged is 30.4%. Furthermore, the probability of a rate cut in November stands at a high of 82.3%.

(Source:CME Group,2024.05.15)

Federal Reserve Chair Jerome Powell admitted during a recent event that his confidence in cooling inflation is not as strong as before. However, he reiterated that the next course of action is unlikely to be a rate hike and it is more likely that rates will be maintained at the current level, waiting for further evidence of a slowdown in inflation.