In after-hours U.S. trading on January 27, shares of Corning Inc. (GLW.US) surged sharply, hitting an intraday high of $113.99 and last trading at $109.74, marking a 15.58% single-day gain. Trading volume and turnover expanded significantly, pushing the stock to a new all-time high.

Market participants widely attributed the rally to Corning’s recently announced long-term fiber supply agreement worth up to $6 billion with global technology giant Meta, covering deliveries through around 2030 for next-generation AI data center construction. The deal is viewed as a clear signal that AI competition is extending beyond chips into the underlying data transmission infrastructure.

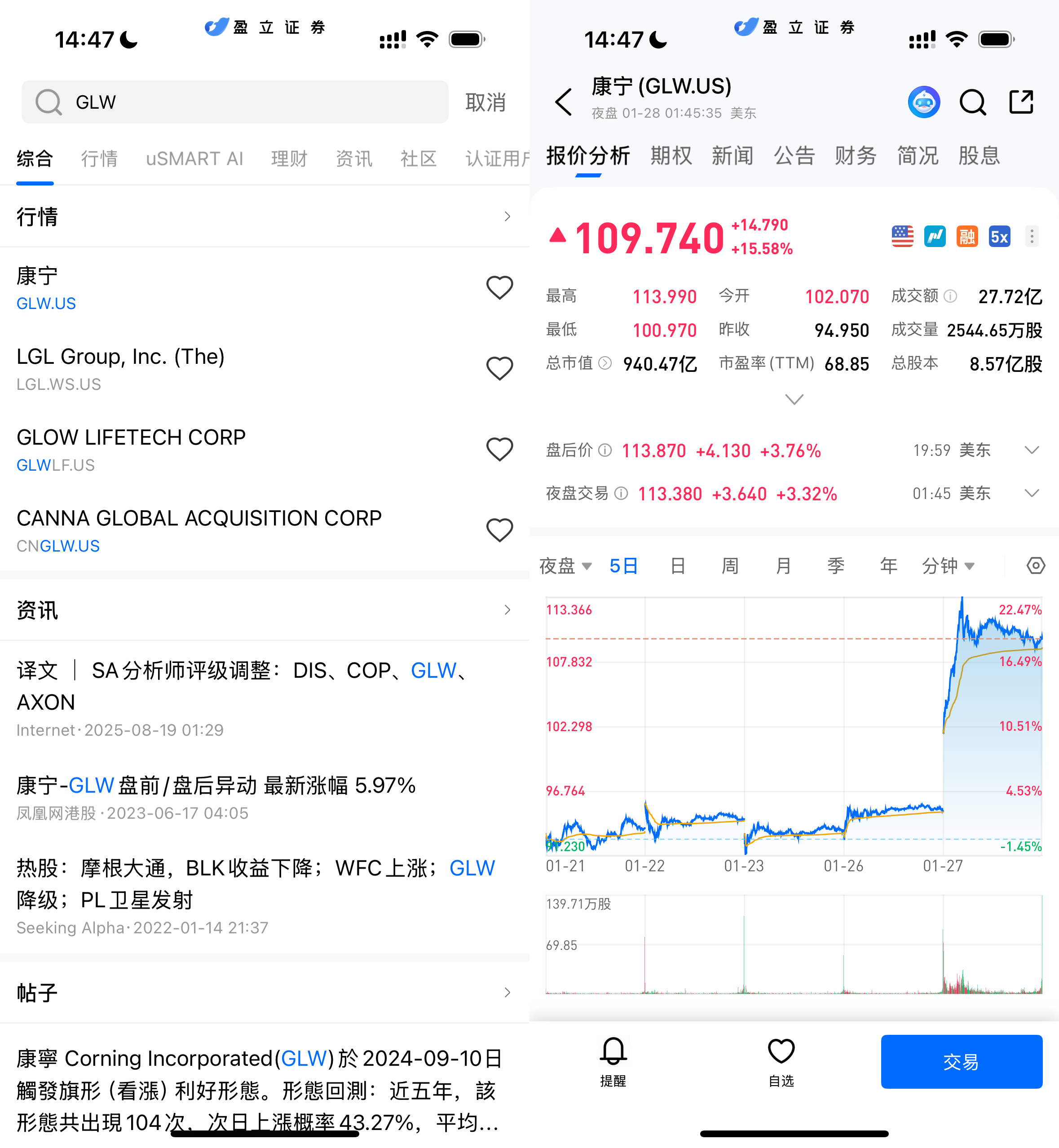

(Image source: uSMART HK app)

Large-Scale Orders Materialize as Optical Fiber Becomes a “Must-Have” for AI Computing

Unlike traditional cloud computing, AI training and inference place far higher demands on bandwidth, latency, and energy efficiency. Massive GPU clusters must exchange data at extremely high frequencies, elevating the role of optical fiber within and between data centers, where it is increasingly replacing copper-based connections.

According to disclosures, Meta is advancing multiple hyperscale AI data center projects across the United States, including a next-generation facility in Ohio and an ultra-high-power campus in Louisiana, with individual sites reaching gigawatt-scale capacity. These projects are expected to deploy Corning’s optical fiber products extensively to support high-speed interconnect requirements.

Industry observers note that long-term orders of this magnitude remain rare in the data center optical communications space. Their significance lies less in short-term revenue contribution and more in locking in multi-year demand visibility, providing suppliers with greater confidence to expand capacity and accelerate technological upgrades.

Corning Accelerates Strategic Shift as Optical Communications Becomes Core Growth Engine

With a history spanning more than a century, Corning has traditionally been known for consumer electronics glass, display panels, and industrial materials. However, amid the AI-driven investment cycle, its optical communications segment is rapidly emerging as a new primary growth engine.

Recent financial results show that revenue from optical communications has maintained double-digit growth, with its share of total company revenue continuing to rise. Management has repeatedly emphasized that orders from hyperscale data center customers are accelerating, with demand shifting from cyclical inventory restocking toward long-term structural expansion.

To support this growth, Corning is actively expanding production capacity for optical fiber and related components, while rolling out higher-density, higher-efficiency fiber solutions tailored to AI data centers’ tightening constraints on space and power consumption.

AI Capital Spending Spillover Revalues Infrastructure Supply Chain

From an industry perspective, Corning’s share price surge is not an isolated event. As global technology companies continue to ramp up AI-related capital expenditures, investor focus is increasingly shifting beyond compute chips toward so-called “hidden essentials” such as power infrastructure, cooling systems, and optical communications.

Meta has steadily increased its capital spending in recent years, positioning AI infrastructure as a long-term strategic asset. By locking in critical transmission materials in advance, the company aims to reduce construction uncertainty while reinforcing competitive barriers.

This trend suggests a broader shift in AI industry valuation logic—from performance at the chip level alone toward system-wide efficiency and scalability. Within this framework, foundational components such as optical fiber are being structurally re-rated.

Market Outlook: Strong Momentum Tempered by Cyclical Awareness

Despite elevated near-term market enthusiasm, some institutions continue to caution about the cyclical nature of the optical communications industry. Historically, the sector has experienced periods of rapid expansion followed by sharp pullbacks. However, compared with earlier internet infrastructure cycles, AI-driven demand today benefits from greater technological certainty and broader application scenarios.

Corning, for its part, remains cautiously optimistic about long-term demand. Management has indicated that even if investment pacing from individual customers fluctuates, overall data transmission requirements are expected to maintain a solid medium- to long-term growth trajectory.

As Corning and Meta prepare to release their upcoming quarterly earnings, markets will closely monitor capital expenditure plans, order sustainability, and the extent to which AI data center investment translates into earnings growth.

How to Buy Corning via on uSMART

After logging into the uSMART HK app, click the “Search” button in the top-right corner of the page, enter the ticker code (GLW.US), and navigate to the details page to view transaction details and historical trends. Click the “Trade” button in the bottom-right corner, select the trade type, and submit your order after filling in the transaction conditions.

(Image Source: uSMART HK app)