January 15, 2026 — Taiwan Semiconductor Manufacturing Company (TSMC.US) released its fourth-quarter 2025 earnings report, delivering a strong financial performance. The company’s shares rose sharply during the trading session, closing at NT$615, up 4.63% from the previous trading day and marking a near one-month high.

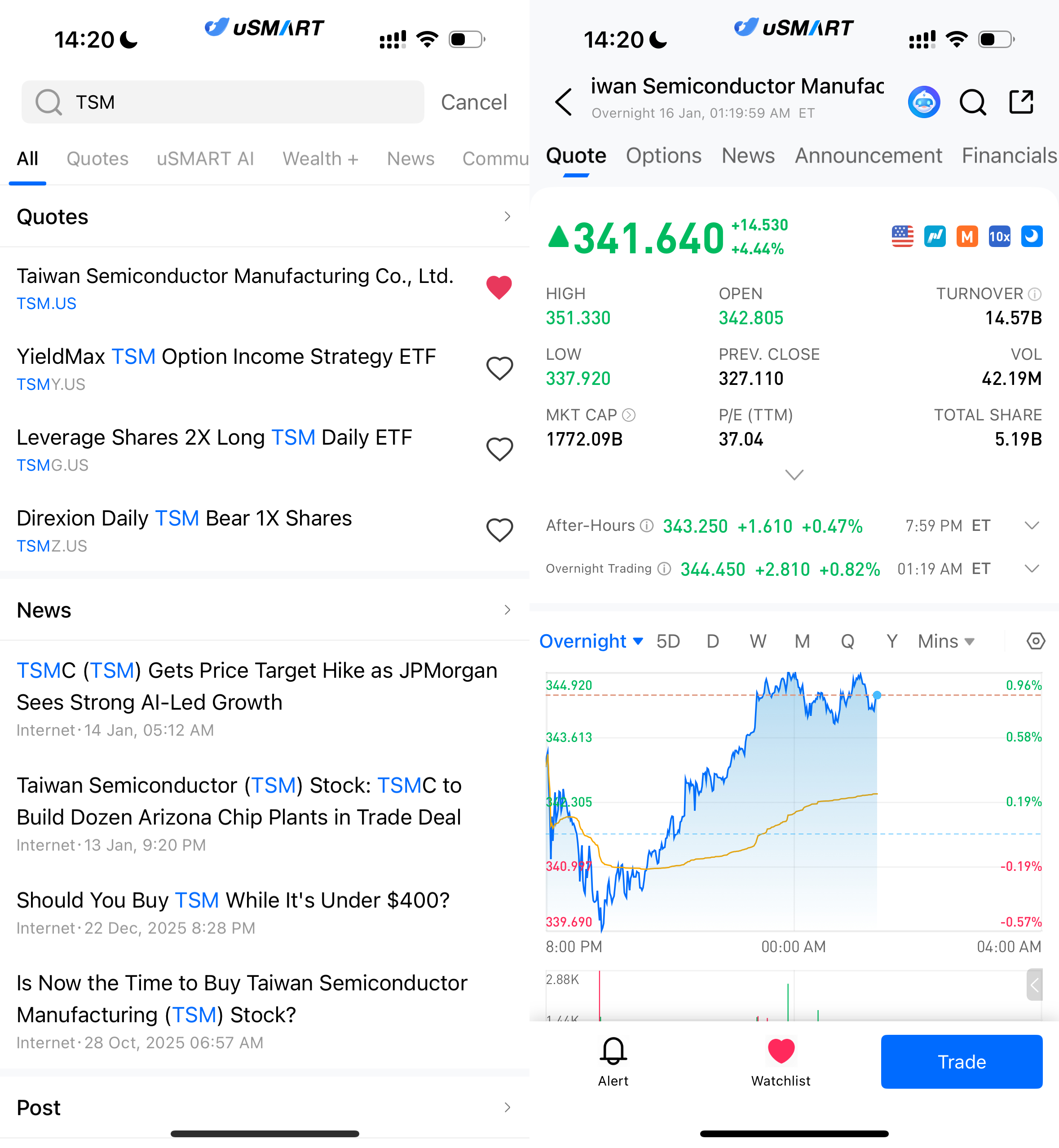

(Image source: uSMART HK app)

Strong Earnings: Revenue and Profit Rise in Tandem

In the fourth quarter of 2025, TSMC reported revenue of NT$120 billion, representing a 15% year-on-year increase. Gross margin reached 50.2%, up 2.5 percentage points quarter-on-quarter, reflecting improved manufacturing efficiency and enhanced product mix. Net profit climbed to NT$45 billion, up 12% year-on-year, underscoring the company’s solid profitability.

|

Financial Metrics |

2025 Q4 |

YoY Change |

|

Revenue |

NT$120 billion |

+15% |

|

Gross Margin |

50.2% |

+2.5 ppt |

|

Net Profit |

NT$45 billion |

+12% |

(Source: TSMC 2025 Q4 Earnings Report)

AI and Industry Momentum Continue to Build

During the earnings briefing, TSMC’s management highlighted that demand related to artificial intelligence (AI) and high-performance computing (HPC) remained a key driver of revenue growth. As demand for computing power continues to rise across servers, AI accelerators, and smart devices, TSMC’s technological leadership in advanced process nodes such as 3nm and 5nm is helping the company maintain its strategic position in the global semiconductor supply chain.

With major cloud service providers and chip designers stepping up investments in AI accelerators, orders for advanced process technologies remain robust, prompting TSMC to further expand capital expenditure and capacity planning.

Growth Outlook: AI and 5G to Power Future Expansion

TSMC’s continued investment in advanced manufacturing technologies has drawn strong global attention. In 2025, the company significantly increased R&D spending on 3nm and 2nm process technologies, strengthening its competitive edge in AI and high-performance computing chip production.

As global technology companies continue to ramp up demand for AI chips, TSMC’s medium- to long-term growth outlook is widely viewed as favorable. The company’s Q4 2025 earnings once again reinforce its leadership position in the global semiconductor industry. Supported by cutting-edge technologies and expanding market demand, TSMC’s growth momentum is expected to continue, with investor confidence remaining strong as the company moves into 2026.

How to Buy TSMC via on uSMART

After logging into the uSMART HK app, click the “Search” button in the top-right corner of the page, enter the ticker code (TSM.US), and navigate to the details page to view transaction details and historical trends. Click the “Trade” button in the bottom-right corner, select the trade type, and submit your order after filling in the transaction conditions.

(Image Source: uSMART HK app)