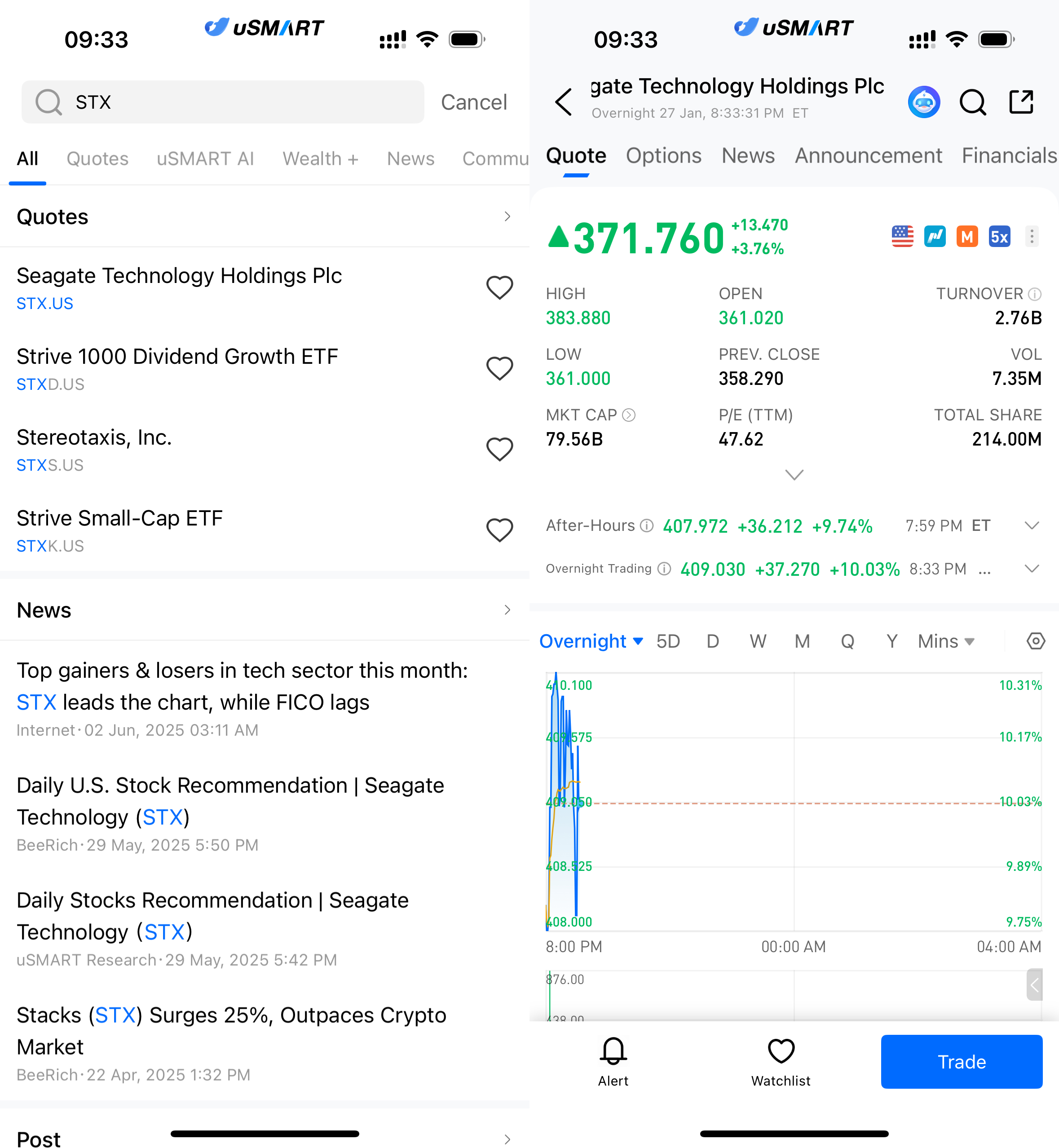

Against the backdrop of continued expansion in AI computing power and data center construction, momentum across the storage supply chain has once again been validated. Seagate Technology (STX.US) reported quarterly results that significantly exceeded market expectations, driving its shares higher in after-hours and overnight trading. On January 27 (U.S. Eastern Time), Seagate’s stock last traded at $371.76 in overnight trading, up 3.76% from the previous close of $358.29, after briefly climbing to an intraday high of $383.88, marking a new near-term peak.

(Image source: uSMART HK app)

Earnings Beat Across the Board as Profitability Reaches New Highs

According to the earnings report, Seagate generated revenue of $2.825 billion in the second quarter of fiscal year 2026, representing a 21.5% year-on-year increase. While revenue growth was solid, the more notable highlight for investors was the company’s sharp improvement in profitability.

On a non-GAAP basis, Seagate’s gross margin rose to 42.2%, while operating margin climbed to 31.9%, with both figures reaching record highs. Non-GAAP earnings per share came in at $3.11, a substantial increase from the prior-year period and well above market expectations.

From a cash flow perspective, operating performance also strengthened during the quarter. Seagate generated robust operating and free cash flow, providing a solid foundation for future capital allocation and shareholder returns.

|

Item |

FY2026 Q2 |

YoY Change / Comparison |

|

Revenue |

$2.825 billion |

+21.5% YoY |

|

Non-GAAP Gross Margin |

42.2% |

35.5% a year earlier; record high |

|

Non-GAAP Operating Margin |

31.9% |

23.1% a year earlier; record high |

|

Non-GAAP EPS |

$3.11 |

$2.03 a year earlier |

|

Operating Cash Flow |

$723 million |

Significant improvement |

|

Free Cash Flow |

$607 million |

Maintained at a high level |

|

Q3 Revenue Guidance |

~$2.9 billion (±$100 million) |

Above market expectations |

|

Q3 Non-GAAP EPS Guidance |

~$3.40 (±$0.20) |

Above market expectations |

(Source: Seagate Technology FY2026 Q2 earnings release)

Q3 Guidance Exceeds Expectations, Highlighting Demand Resilience

Beyond the reported results, Seagate’s outlook for the next quarter also played a key role in supporting the stock’s strength. The company expects third-quarter revenue of approximately $2.9 billion and adjusted earnings per share of around $3.40, both exceeding consensus analyst forecasts.

Management noted during the earnings call that demand from data center customers for high-capacity storage remains resilient. The rapid expansion of AI applications is significantly amplifying data creation, further elevating the strategic importance of storage within AI infrastructure. This trend has improved visibility into order flows and shipment volumes.

Technology Roadmap and Product Mix Support Long-Term Growth

Market observers believe Seagate’s latest performance reflects more than a cyclical recovery, pointing instead to structural improvements driven by product mix optimization. As high-areal-density storage products continue to ramp, the company’s advantages in unit cost control and overall margin structure have become increasingly evident.

In AI training, inference, and enterprise data retention scenarios, storage solutions that balance capacity, cost efficiency, and reliability are becoming critical components of modern data centers. As data volumes scale toward the exabyte level, the “non-discretionary” nature of storage demand is being increasingly re-evaluated by the market.

Broader Sector Strength as Investor Focus Returns to Storage

Following Seagate’s earnings beat and upbeat guidance, the broader U.S. storage sector also saw positive momentum. In after-hours trading, shares of several storage and related semiconductor companies moved higher, as investor attention within the AI infrastructure value chain continues to expand beyond computing chips to include storage.

Despite substantial gains earlier, Seagate’s ability to hold elevated levels after earnings reflects investor confidence in the durability of its earnings trajectory and industry positioning. As AI adoption accelerates, the long-term growth narrative for data storage continues to gain further validation.

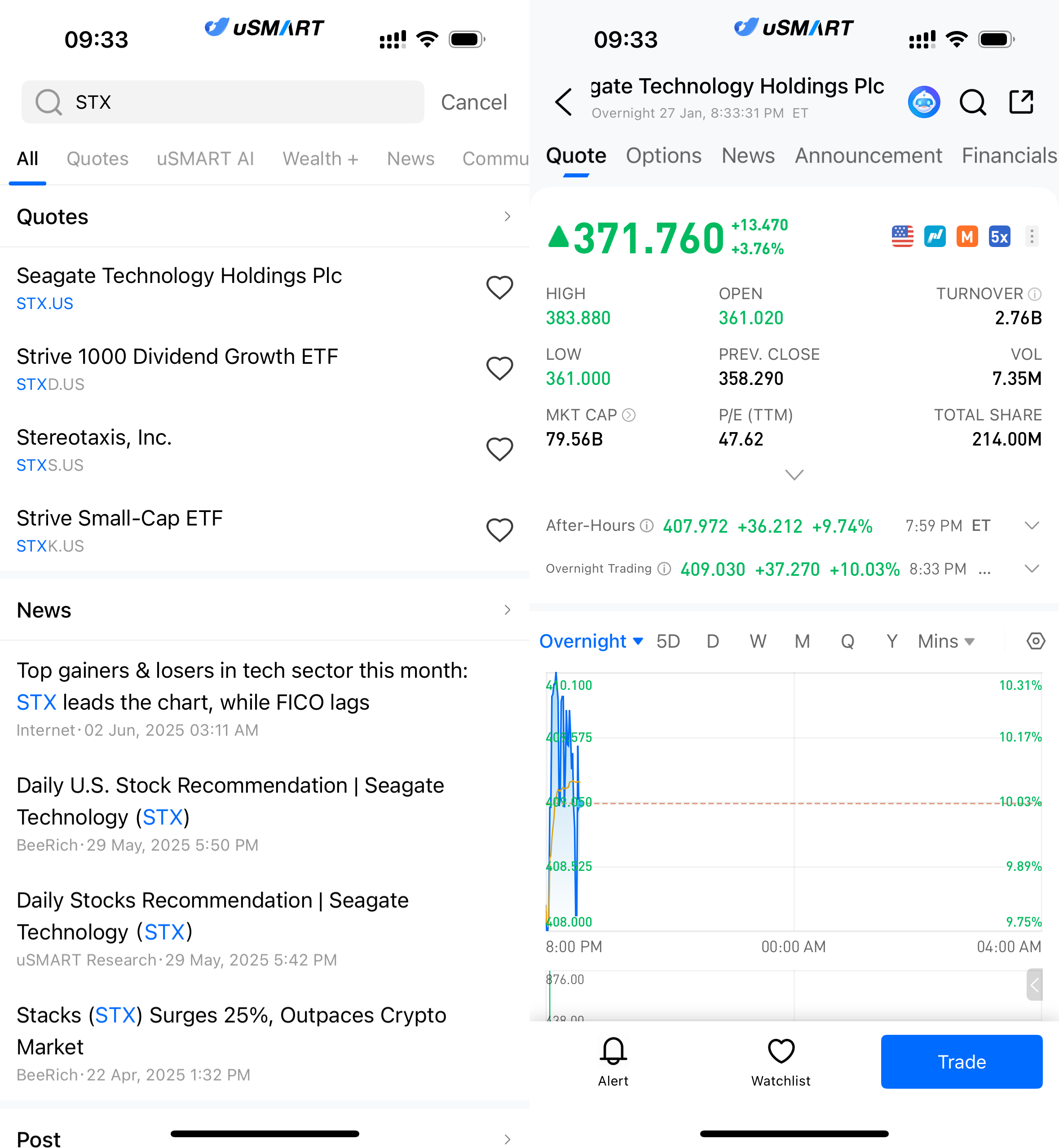

How to Buy Seagate via on uSMART

After logging into the uSMART HK app, click the “Search” button in the top-right corner of the page, enter the ticker code (STX.US), and navigate to the details page to view transaction details and historical trends. Click the “Trade” button in the bottom-right corner, select the trade type, and submit your order after filling in the transaction conditions.

(Image Source: uSMART HK app)