新股解讀 | 洪九果品:年入百億的水果大王,營收、利潤年均增速翻倍

港股新股市場有一點回暖跡象了,在傳統新股淡季的8月份,已經有4只新股上市了,動物模式龍頭百奧賽圖前腳剛截止招股,洪九果品和樂華娛樂就緊跟上了。首日翻倍的中國石墨和最高漲近90%的雙財莊,也極大的刺激着打新人的神經。

招股信息

洪九果品於8月24日至29日招股,預計上市日期9月5日,保薦人爲中金。發售價爲40-52港元,每手100股,入場費5252.41港元。發行1401.25萬股H股,僅佔發行後總股份的3%,集資規模5.6-7.3億港元,市值186.83-242.88億港元。引入廣發證券和南方基金兩名基石,共認購27.99-36.38%發售股份。

歷經30餘年發展,成爲中國鮮果分銷龍頭

洪九果品是一家中國自有品牌鮮果分銷商,專注於高端進口水果和高質量國產水果的全產業鏈運營,形成了以榴蓮、山竹、龍眼、火龍果、櫻桃、葡萄爲核心共49種品類的豐富水果產品組合。洪九果品自全球100多個優質水果原產地爲消費者挑選及採購質量鮮果,通過直採、標準化加工及數字化供應鏈管控,在水果領域打造了出色的產品力。

按2021年的銷售收入計算,洪九果品是中國領先的榴蓮分銷商,市場份額佔比8.3%,火龍果、山竹和龍眼2021年市場份額分別爲2.2%、6.1%及2.8%,均爲前五大分銷商。

無懼疫情,過去3年收入、利潤年均複合增長率均超100%

2019-21年總營收分別爲20.78億元、57.71億元及102.8億元,CAGR高達122.42%,收入翻倍式增長源於客戶對產品需求不斷增加、對公司強大供應鏈管理能力的認可以及廣泛的銷售網絡。2022年1-5月營收爲57.25億元、同比增長25.1%。

2019-21年經調整淨利潤分別爲2.28億元、6.62億元及10.9億元,CAGR高達118.65%。2022年1-5月經調整利潤爲7.45億元、同比增長39.6%,繼續保持高增長。

品牌認可度高,“端到端”供應鏈能力強大

疫情反覆的這三年,消費品牌哀鴻遍野,洪九果品爲什麼還能保持驚人的翻倍增速?

首先是打造了一系列核心自有品牌,比如“洪九泰好吃榴蓮”、“洪九越來美火龍果”、“洪九奉上好黃桃”等,水果行業同質化競爭情況嚴重利潤率較低,洪九果品從2013年開始打造自己的品牌,做差異化營銷,目前品牌水果貢獻了70%以上的收入。

其次是強大的供應鏈能力,從直採、加工、分揀再到分銷,洪九果品都進行標準化操作,有效的控制損耗提高品質,在疫情期間也能做到不缺貨。

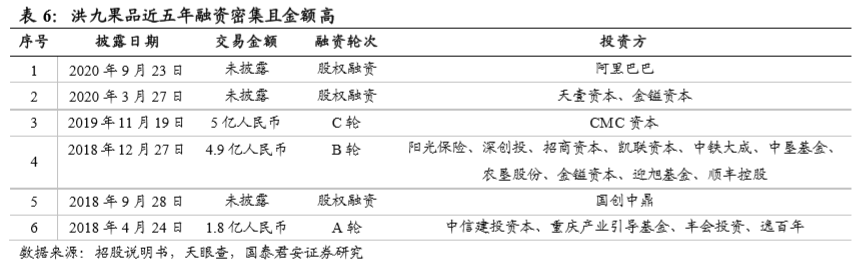

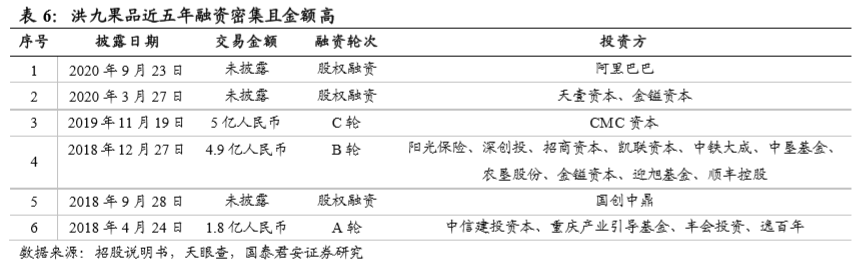

IPO前融資金額高,阿裏爲最大外部股東

2018年至今洪九果品累計已完成6輪融資,金額超11億元。歷輪融資的投資方主要包括阿裏巴巴、天壹資本、金鎰資本等知名機構。截止2021年8月的最新投後估值約爲75.92億元人民幣,約87億港元。

估值

洪九果品招股市值爲186.83-242.88億港元,以2021年經調整淨利潤10.9億元人民幣計算,市盈率爲15-19.4倍,2022年前5個月淨利潤增速約40%,若全年保持這個增速則2022年市盈率爲10.7-13.9倍,如果考慮到過往3年翻倍的增速,則市盈率降到10倍以下。目前港股沒有上市的水果股,洪九果品有一定的稀缺性。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.