JD Industrials, Inc. (7618.HK) has launched its Hong Kong IPO. The subscription period runs from December 3 to December 8, with a global offering of 211,208,800 shares, including a 15% over-allotment option. The proposed offer price ranges from HK12.70toHK15.50 per share, with a board lot size of 200 shares, translating to a minimum investment of approximately HK$3,131.26. Trading is expected to commence on December 11 on the Main Board of the Hong Kong Stock Exchange. Joint sponsors for the listing are BofA Securities, UBS Group, Haitong International, and Goldman Sachs (Asia).

JD Industrials: China’s Leading Industrial Supply Chain Technology and Service Provider

Offering Structure: Approximately 10% (21,121,000 shares) for public offering in Hong Kong; approximately 90% (190,087,800 shares) for international placement.

Offer Price Range: HK12.70–HK15.50 per share

Board Lot Size: 200 shares

Minimum Investment: ~HK$3,131.26

Subscription Period: December 3–8 (expected pricing date: December 9)

Listing Date: December 11

IPO Sponsors: BofA Securities, UBS Group, Haitong International, Goldman Sachs (Asia)

Company Overview

JD Industrials is a leading industrial supply chain technology and service provider in China. Through its comprehensive digital solution "Tai Pu," the company offers extensive industrial product supplies and intelligent supply chain services, helping clients ensure supply stability, reduce costs, improve efficiency, and achieve compliance. The company primarily generates revenue by selling industrial products and related services, and has become the largest player in China's MRO procurement services market. In terms of transaction value in 2024, JD Industrials holds a 4.1% market share in the industrial supply chain technology and services sector. It serves approximately 11,100 key enterprise clients, covering about 60% of Chinese Fortune Global 500 companies and over 40% of global Fortune 500 enterprises operating in China.

Financial Highlights

According to the prospectus, JD Industrials reported continuing operations revenue of approximately RMB 14.135 billion, RMB 17.336 billion, and RMB 20.398 billion in 2022, 2023, and 2024 respectively, with net profits of approximately -RMB 1.384 billion, RMB 0.05 billion, and RMB 7.62 billion during the same periods. In the first half of 2025, the company achieved revenue of around RMB 10.25 billion and net profit of RMB 451 million. Based on the midpoint offer price of HK14.10andassumingnoexerciseofthegreenshoeoptionoroverallotment,thecompanyexpectstoraiseapproximatelyHK2.827 billion in net proceeds. These funds will be allocated as follows: ~35% to enhance industrial supply chain capabilities, ~25% for geographic expansion, ~30% for potential strategic investments or acquisitions, and ~10% for general corporate purposes and working capital.

uSMART launches “HK IPO Fee-Waiver Offer” – subscribe to new shares at zero cost

Margin subscription: 0 % interest, leverage up to 10×

Cash subscription: HK$0 handling fee

Grey-market trading supported

* 0 % interest applies to margin subscription amounts of HK$10 million or below.

^ All handling fees are waived for cash subscriptions.

This promotion is effective from 20 May 2025 until further notice. Certain high-profile IPOs may be excluded. The actual interest rates and fees charged are those shown in the uSMART App subscription interface; statutory government and exchange levies will still apply. The company reserves the right to amend, suspend or terminate the above offer or its terms and conditions at any time without prior notice, and its interpretation shall be final.

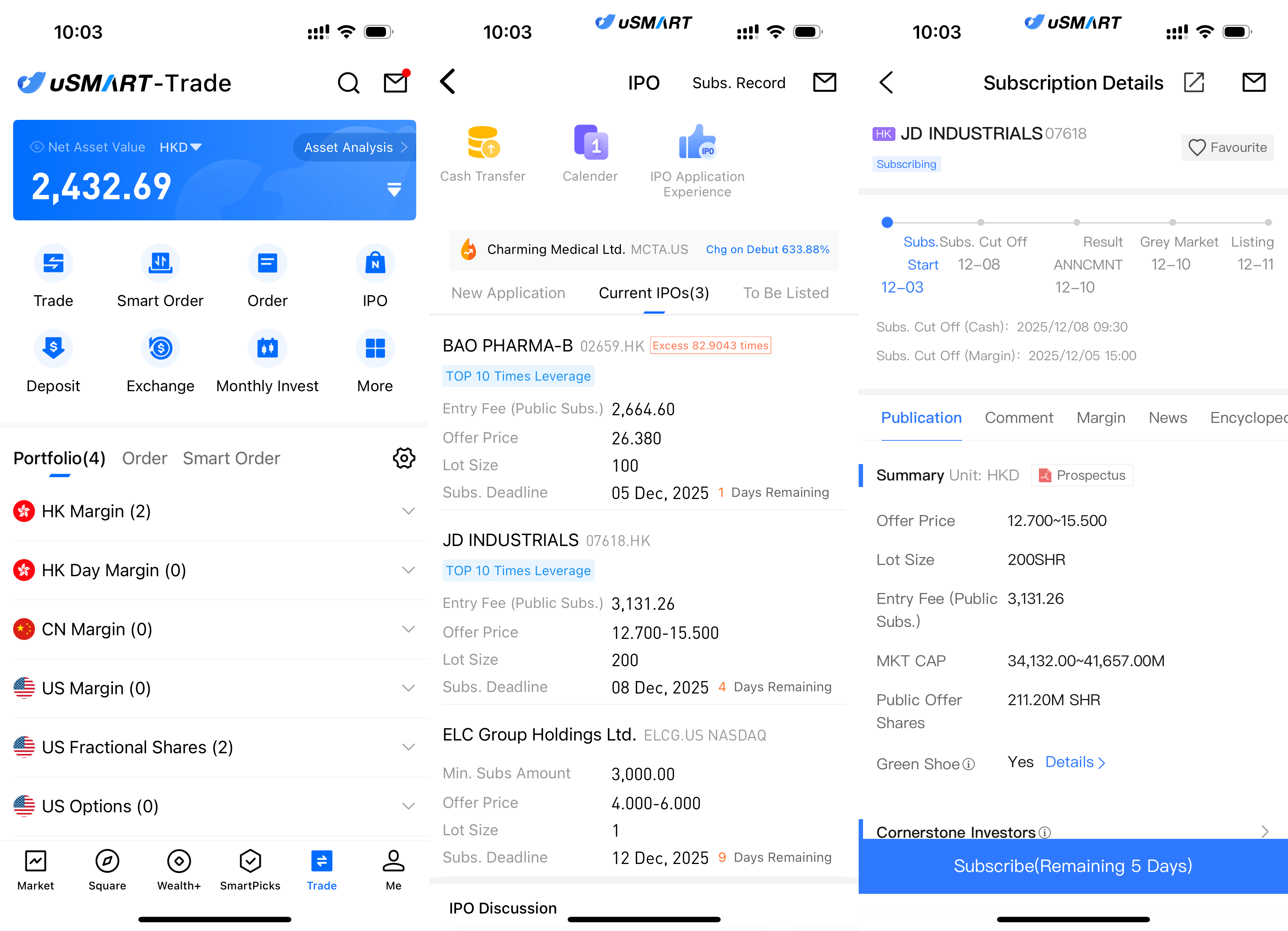

How to Subscribe for JD Industrials via uSMART HK

The uSMART HK App features an IPO Centre with exclusive perks, allowing clients to subscribe instantly to public offerings. After logging into the app, tap "Trade" at the bottom-right, go to "IPO Subscription," select JD Industrials, tap "Public Offer," enter your subscription quantity, and submit your order.

(Image source: uSMART HK App)