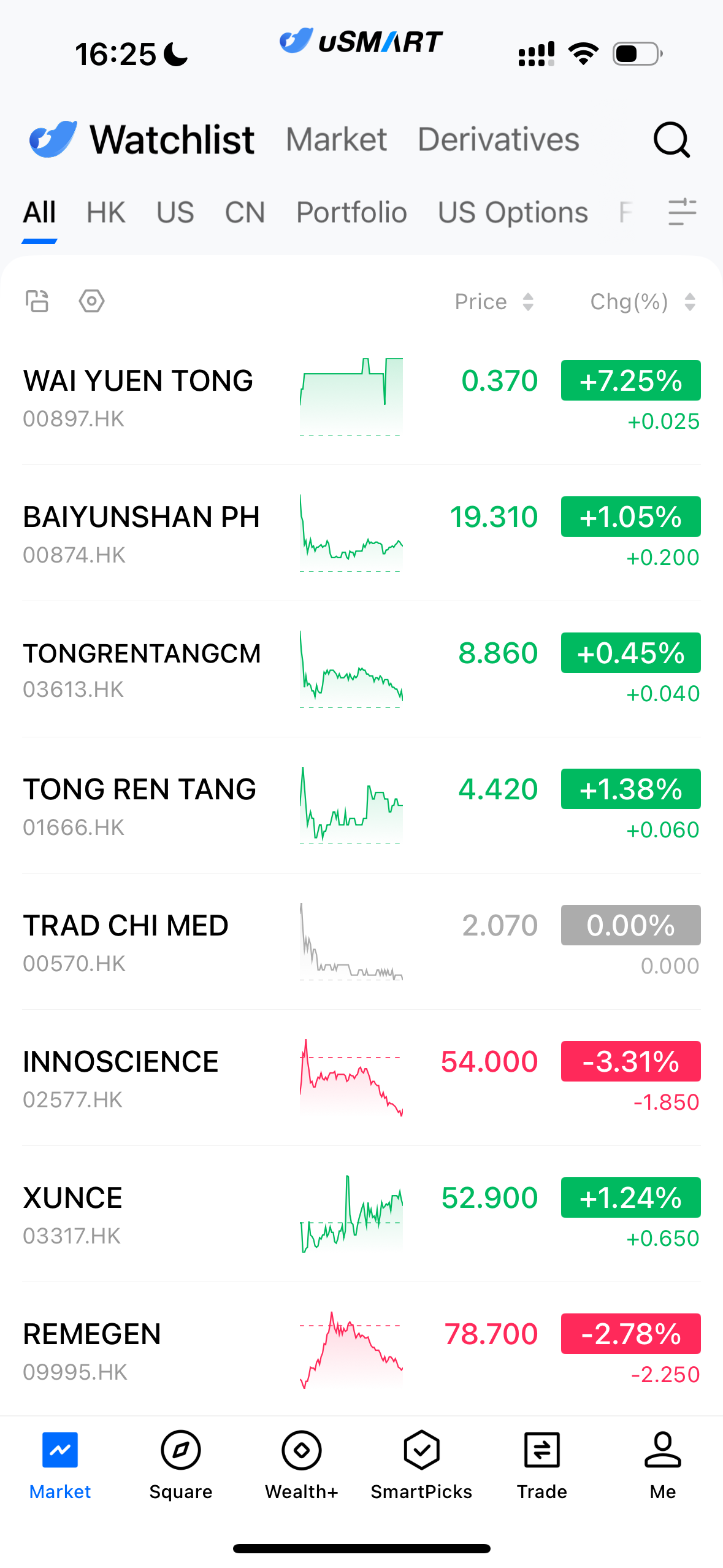

On February 6th, the Hong Kong TCM sector performed strongly despite market volatility, with many stocks recording gains. As of the time of publication, Yuen Wo Tong (00897.HK) was at HKD 0.370, up by 7.25%; Tong Ren Tang Chinese Medicine (03613.HK) was at HKD 8.86, up by 0.45%; Tong Ren Tang Technologies (01666.HK) was at HKD 4.42, up by 1.38%; and Baiyunshan (00874.HK) was at HKD 19.31, up by 1.05%. The sector's overall performance significantly outpaced the broader market, attracting heightened attention.

(Image Source: uSMART HK app)

Policy Major Move, Development Path of the Chinese Medicine Industry Further Clarified

On February 5th, the Ministry of Industry and Information Technology (MIIT) and several other departments jointly issued the "Implementation Plan for the High-Quality Development of the Chinese Medicine Industry (2026–2030)." The plan aims to cultivate a group of leading enterprises in the Chinese medicine industry by 2030, as well as establish 60 high-standard production bases for Chinese medicinal materials to strengthen the upstream foundation of the industry.

On the product side, the policy outlines the goal of promoting the approval and listing of a number of innovative Chinese medicine products, cultivating 10 major Chinese medicine varieties, and accelerating the conversion of hospital Chinese medicine formulations into innovative drugs. This reflects the regulatory authorities' multi-dimensional efforts to promote the quality upgrade of the Chinese medicine industry, focusing on supply-side reforms, innovation, and industry chain collaboration.

Investment Logic Shift, Industry Moves from "Recovery" to "Growth"

The pharmaceutical sector is entering a new valuation and performance resonance cycle. In 2026, the investment logic of the Chinese medicine industry will gradually shift from "cost recovery" to "value growth." With continuous policy support, improvements in operational efficiency and economies of scale are expected to steadily enhance industry profitability.

At the same time, with the acceleration of TCM's internationalization, the registration of Chinese medicine products overseas and market expansion are advancing at a faster pace. Chinese medicine enterprises that possess core product advantages, industrial chain integration capabilities, and internationalization strategies are likely to unlock new growth opportunities in the global pharmaceutical market.

Sector Sentiment Warming Up, Capital Focuses on Policy Implementation

The strength of the Chinese medicine sector is not solely driven by sentiment, but by the gradual clarification of policy expectations, prompting capital to reprice the long-term value of the industry. As Chinese medicine is formally included in the high-quality development framework, clearer constraints and guidelines on standardized production, large-scale manufacturing, and quality control will improve market expectations regarding the profitability and sustainability of the Chinese medicine industry.

Additionally, the construction of raw material bases, the advancement of Chinese medicine innovation drug approvals, and the opening of hospital formulation conversion channels all signify that the industry competition landscape is shifting from fragmented, homogenous competition to a focus on R&D capabilities, supply chain integration, and brand strength. In this process, leading Chinese medicine companies with core product advantages, channel dominance, and industrial capabilities are expected to benefit first from the industry's rising concentration.