Beijing Haizhi Technology Group Co., Ltd. (2706.HK) has launched its Hong Kong IPO. The offering period runs from February 5 to February 10, 2026, with a planned global offering of 28,030,200 H shares. The offer price range is HK$25.60–28.00 per share. Each board lot consists of 200 shares, with an entry cost of approximately HK$5,656.48. The company is expected to be listed on the Main Board of the Hong Kong Stock Exchange on February 13, 2026. The joint sponsors are CMB International Capital Corporation Limited, BOCI Asia Limited, and Shenwan Hongyuan Capital (H.K.) Limited.

Haizhi Technology: China’s Leading Graph-Centric AI Agent Provider

Offer Structure:Hong Kong public offering of approximately 10% (2,803,200 shares, subject to reallocation);International placing of approximately 90% (25,227,000 shares, subject to reallocation).

Offer Price: HK$25.60–28.00 per share

Board Lot: 200 shares

Entry Cost: Approximately HK$5,656.48

Offer Period: February 5–10, 2026 (expected pricing date: February 11, 2026)

Listing Date: February 13, 2026

Sponsors: CMB International Capital Corporation Limited, BOCI Asia Limited, Shenwan Hongyuan Capital (H.K.) Limited

Company Overview

Haizhi Technology focuses on developing Atlas graph-based solutions and industrial-grade intelligent agents through its graph–model fusion technology, providing industry-level artificial intelligence solutions. According to Frost & Sullivan, based on 2024 revenue, the company ranked fifth among China’s industrial AI agent providers with a 2.8% market share, and first among China’s graph-centric AI agent providers with a market share of approximately 50%. As of September 30, 2025, the company had served over 360 customers, with business spanning more than 100 application scenarios.

Financial Information

According to the prospectus, Haizhi Technology recorded revenues of approximately RMB 313 million, RMB 376 million, and RMB 503 million in 2022, 2023, and 2024, respectively, with corresponding net losses of approximately RMB 176 million, RMB 266 million, and RMB 94 million. For the nine months ended September 30, 2025, the company achieved revenue of approximately RMB 249 million while recording a net loss of approximately RMB 211 million. Based on the mid-point offer price of HK$26.80, Haizhi Technology expects to raise net proceeds of approximately HK$648 million, which are planned to be allocated mainly to enhancing research and development of graph–model fusion technology (approximately 45%), optimizing the Atlas intelligent agent platform (approximately 20%), deepening customer cooperation and expanding overseas markets (approximately 15%), pursuing strategic investments and acquisitions (approximately 10%), and for working capital and general corporate purposes (approximately 10%).

uSMART launches “HK IPO Fee-Waiver Offer” – subscribe to new shares at zero cost

Margin subscription: 0 % interest, leverage up to 10×

Cash subscription: HK$0 handling fee

Grey-market trading supported

* 0 % interest applies to margin subscription amounts of HK$20 million or below.

^ All handling fees are waived for cash subscriptions.

This promotion is effective from 5 December 2025 until further notice. Certain high-profile IPOs may be excluded. The actual interest rates and fees charged are those shown in the uSMART App subscription interface; statutory government and exchange levies will still apply. The company reserves the right to amend, suspend or terminate the above offer or its terms and conditions at any time without prior notice, and its interpretation shall be final.

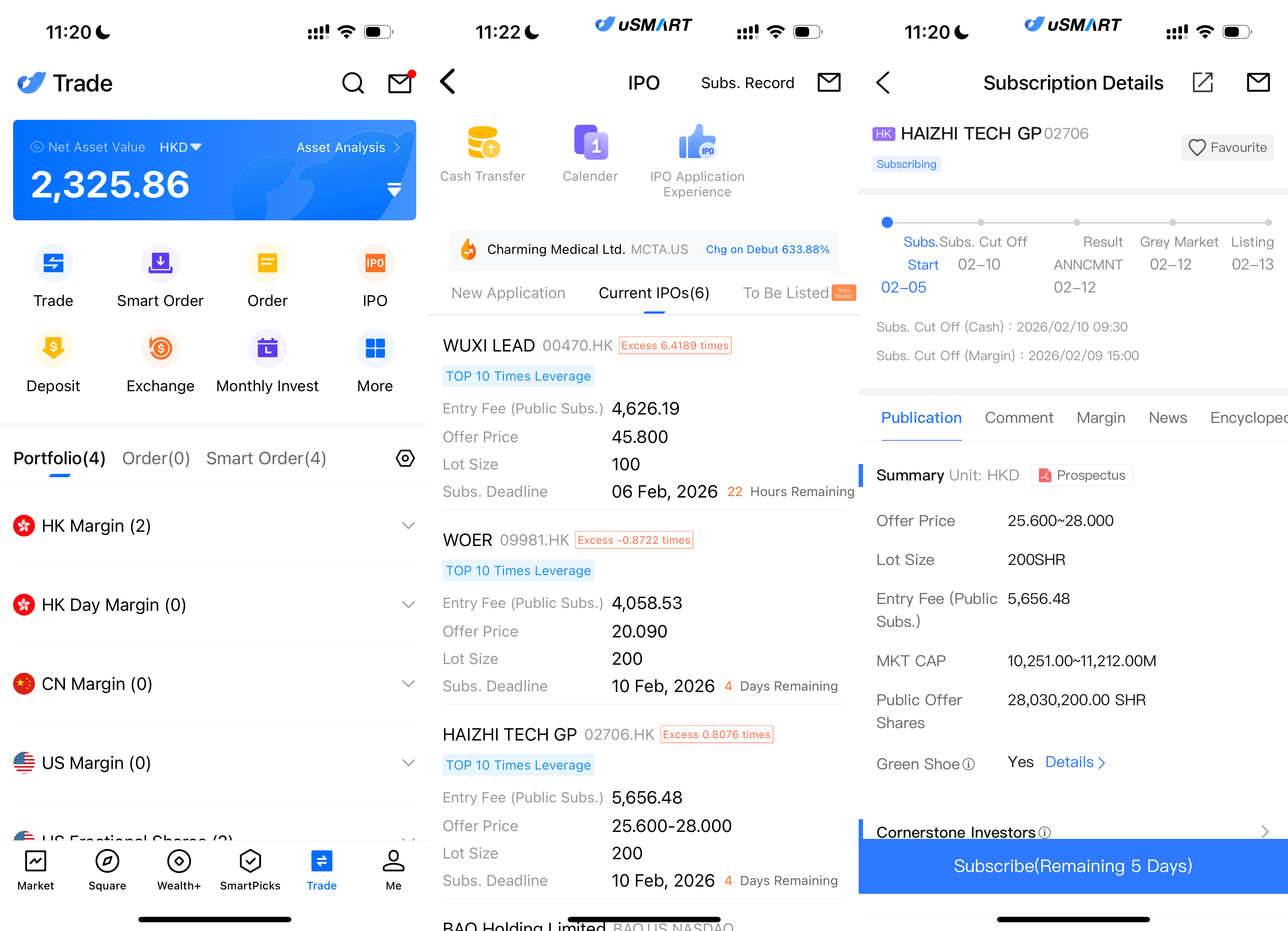

How to Subscribe for Haizhi Technology via uSMART HK

The uSMART HK App features an IPO Centre with exclusive perks, allowing clients to subscribe instantly to public offerings. After logging into the app, tap "Trade" at the bottom-right, go to "IPO Subscription," select Haizhi Technology, tap "Public Offer," enter your subscription quantity, and submit your order.

(Image source: uSMART HK App)