Shanghai Baoji Pharmaceuticals Co., Ltd. (2659.HK) has launched its initial public offering (IPO) in Hong Kong. The offer period is from December 2 to December 5, 2025, with a global offering of approximately 37,911,700 H-shares. The offer price is HKD 26.38 per share, with each board lot consisting of 100 shares and an entry fee of approximately HKD 2,664.60. The shares are expected to be listed on the Hong Kong Stock Exchange's Main Board on December 10, 2025. CITIC Securities, Cathay Securities, and Haitong International are joint sponsors of the offering.

Baoji Pharmaceuticals: A Biotech Company Focused on Four Strategic Areas

Offer Composition: Approximately 10% of the shares (3,791,200 H-shares, subject to reallocation) will be offered in the Hong Kong public offering, while approximately 90% (34,120,500 H-shares, subject to reallocation) will be offered internationally.

Offer Price: HKD 26.38 per share, with each board lot consisting of 100 shares and an entry fee of approximately HKD 2,664.60.

Offer Period: December 2–5, 2025 (expected pricing date: December 5, 2025).

Listing Date: December 10, 2025.

Sponsors: CITIC Securities, Cathay Securities, Haitong International.

Company Overview

Founded in 2019, Baoji Pharmaceuticals is a biotechnology company focusing on four major therapeutic areas: large-volume subcutaneous drug delivery, antibody-mediated autoimmune diseases, assisted reproduction, and recombinant biopharmaceuticals. The company has 12 self-developed products in its pipeline, with key products including the long-acting recombinant human follicle-stimulating hormone SJ02 (Shengnuo®), which has received New Drug Application (NDA) approval, recombinant hyaluronidase KJ017, which is in the NDA stage, and innovative recombinant IgG-degrading enzyme KJ103, which is in Phase III development. The company possesses commercial-scale production capabilities and operates a GMP-compliant production facility in Shanghai.

Financial Information

According to the prospectus, Baoji Pharmaceuticals reported revenue of approximately RMB 6.93 million and RMB 6.16 million for the fiscal years 2023 and 2024, respectively, with net losses of approximately RMB 160 million and RMB 364 million for the same periods. In the first half of 2025, the company achieved revenue of approximately RMB 41.99 million and incurred a net loss of approximately RMB 183 million. Based on the offer price of HKD 26.38 per share, the company expects to raise a net amount of approximately HKD 922 million. The funds will be used for core product research and commercialization (about 53.5%), advancing other pipeline products (about 17.7%), optimizing technology platforms and developing new drug candidates (about 8.4%), enhancing and expanding production capacity (about 10.4%), and supplementing working capital (about 10.0%).

uSMART launches “HK IPO Fee-Waiver Offer” – subscribe to new shares at zero cost

Margin subscription: 0 % interest, leverage up to 10×

Cash subscription: HK$0 handling fee

Grey-market trading supported

* 0 % interest applies to margin subscription amounts of HK$10 million or below.

^ All handling fees are waived for cash subscriptions.

This promotion is effective from 20 May 2025 until further notice. Certain high-profile IPOs may be excluded. The actual interest rates and fees charged are those shown in the uSMART App subscription interface; statutory government and exchange levies will still apply. The company reserves the right to amend, suspend or terminate the above offer or its terms and conditions at any time without prior notice, and its interpretation shall be final.

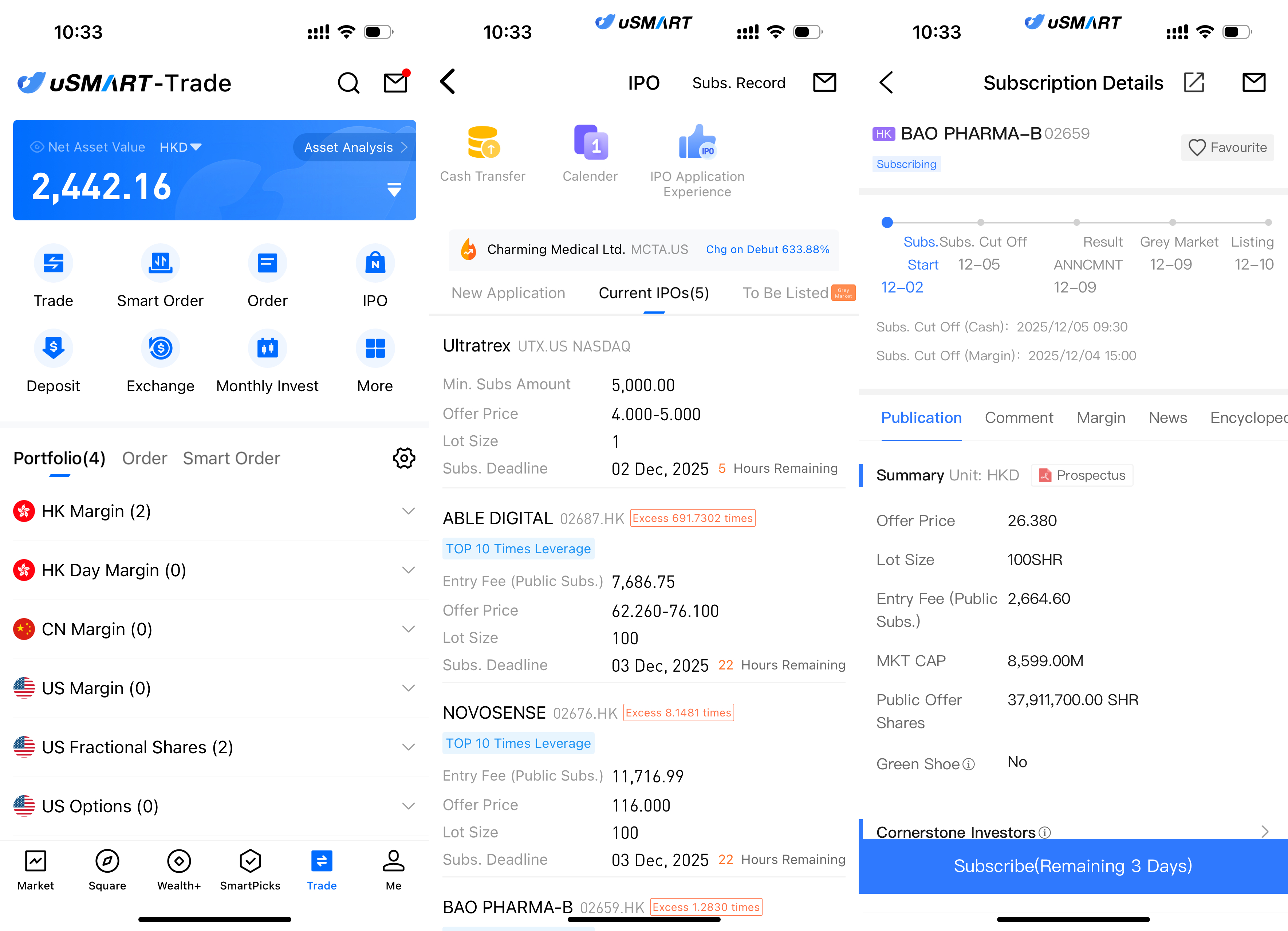

How to Subscribe for Baoji Pharmaceuticals via uSMART HK

The uSMART HK App features an IPO Centre with exclusive perks, allowing clients to subscribe instantly to public offerings. After logging into the app, tap "Trade" at the bottom-right, go to "IPO Subscription," select Baoji Pharmaceuticals, tap "Public Offer," enter your subscription quantity, and submit your order.

(Image source: uSMART HK App)