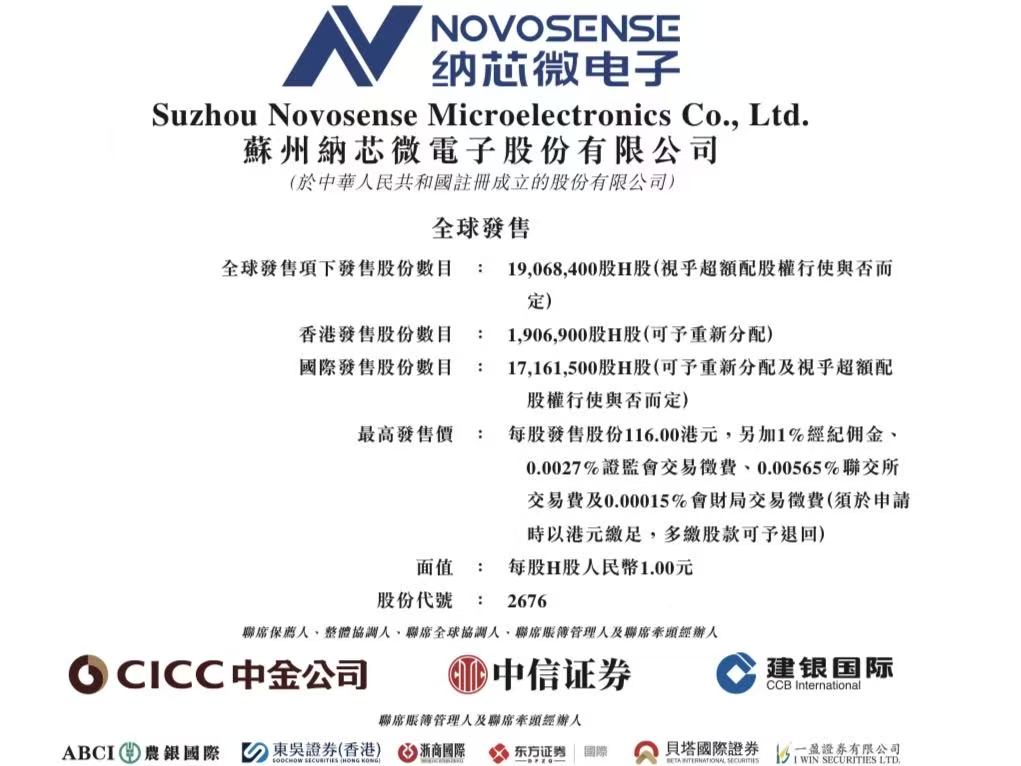

Novosense Microelectronics Co., Ltd. (SUZHOU NOVOSENSE MICROELECTRONICS CO., LTD., 2676.HK) has launched its Hong Kong IPO, with the offering period running from November 28 to December 3. The company plans to issue approximately 19,068,400 H-shares globally, with a 15% over-allotment option. The maximum offering price is set at HK$116.00 per share, with a board lot size of 100 shares and an entry fee of approximately HK$11,716.99. The company is expected to list on the main board of the Hong Kong Stock Exchange on December 8. The joint sponsors for the IPO are CICC, CITIC Securities, and CCB International.

Novosense: China’s Leading Analog Chip Company

Issue Proportion: Approximately 10% for the Hong Kong public offering (1,906,900 H-shares, subject to reallocation) and approximately 90% for international placement (17,161,500 H-shares, subject to reallocation and the exercise of the over-allotment option).

Offer Price: HK$116.00 per share; board lot of 100 shares; entry fee of approximately HK$11,716.99.

Offer Period: November 28 to December 3 (Pricing Date expected on December 4).

Listing Date: December 8.

Joint Sponsors: CICC, CITIC Securities, CCB International.

Company Overview

Novosense operates under a fabless model, focusing on the research and design of chips. Its products cover three main categories: sensor products, signal chain chips, and power management chips. These form a complete system from sensing and signal processing to system power and drive. According to Frost & Sullivan, in terms of revenue from analog chips in 2024, the company ranked 14th in the Chinese analog chip market (with a market share of 0.9%) and 5th among Chinese analog chip companies. The company’s products are widely used in automotive electronics, energy, and consumer electronics. In 2024, its revenue from automotive analog chips ranked first among Chinese companies.

Financial Information

According to the prospectus, Novosense's revenue for 2022 to 2024 was approximately RMB 1.67 billion, RMB 1.31 billion, and RMB 1.96 billion, respectively, while its net profit (loss) was approximately RMB 250 million, a loss of RMB 305 million, and a loss of RMB 403 million. For the six months ended June 30, 2025, the company reported revenue of approximately RMB 1.52 billion and a loss of RMB 78 million. At the maximum offer price of HK$116.00 per share, assuming no over-allotment option is exercised, the company expects to raise a net amount of approximately HK$2.10 billion. The proceeds will be used for enhancing underlying technological capabilities and process platforms (about 18%), expanding product offerings and increasing applications in automotive electronics (about 22%), expanding overseas sales networks (about 25%), strategic investments and acquisitions (about 25%), and working capital and general corporate purposes (about 10%).

uSMART launches “HK IPO Fee-Waiver Offer” – subscribe to new shares at zero cost

Margin subscription: 0 % interest, leverage up to 10×

Cash subscription: HK$0 handling fee

Grey-market trading supported

* 0 % interest applies to margin subscription amounts of HK$10 million or below.

^ All handling fees are waived for cash subscriptions.

This promotion is effective from 20 May 2025 until further notice. Certain high-profile IPOs may be excluded. The actual interest rates and fees charged are those shown in the uSMART App subscription interface; statutory government and exchange levies will still apply. The company reserves the right to amend, suspend or terminate the above offer or its terms and conditions at any time without prior notice, and its interpretation shall be final.

How to Subscribe for Novosense via uSMART HK

The uSMART HK App features an IPO Centre with exclusive perks, allowing clients to subscribe instantly to public offerings. After logging into the app, tap "Trade" at the bottom-right, go to "IPO Subscription," select Novosense, tap "Public Offer," enter your subscription quantity, and submit your order.

(Image source: uSMART HK App)

(Image source: uSMART HK App)