Hong Kong Exchanges and Clearing Limited (HKEX, 00388.HK) released its financial results for the third quarter of 2025, showing continued strong growth momentum. During the period, revenue and other income reached HK$7.484 billion, up 54% year-on-year, mainly driven by higher trading volumes and an increase in IPO activities.

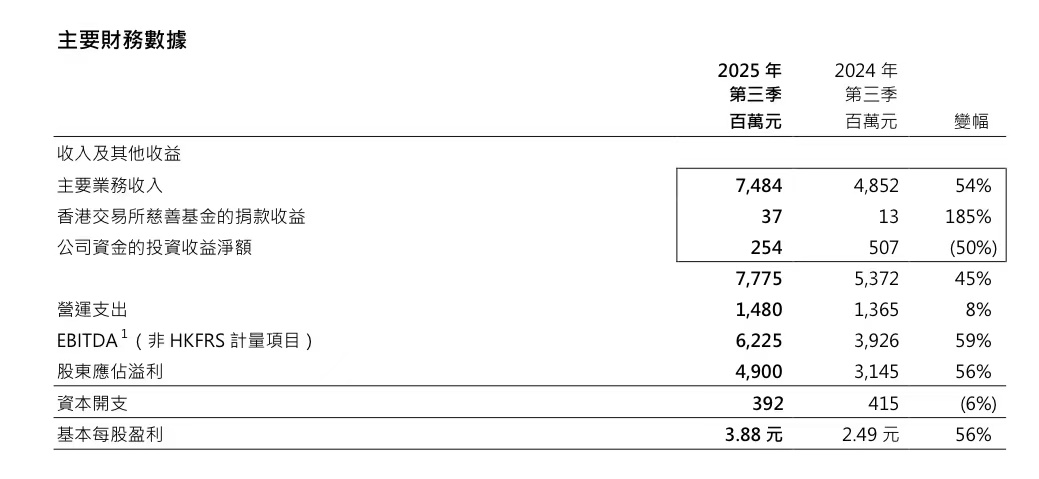

(Image source: HKEX Q3 2025 Key Financial Data, in HK$ million)

(Image source: HKEX Q3 2025 Key Financial Data, in HK$ million)

The report showed that core business revenue was HK$7.484 billion, up 54% from HK$4.852 billion in the same period last year. Meanwhile, donations from the HKEX Charitable Foundation surged 185% year-on-year to HK$37 million, reflecting the Group’s commitment to corporate social responsibility while maintaining steady business growth.

Management noted that overall market liquidity in Hong Kong improved significantly in the third quarter, with the average daily turnover rising compared to the first half of the year. Several large-scale enterprises also resumed Hong Kong listing plans, contributing to a notable increase in trading-related revenue.

Investment Income Declines, Operating Expenses Rise

Despite robust core business performance, HKEX recorded a decline in investment income. Affected by market interest rate fluctuations and asset price volatility, net investment income dropped 50% year-on-year to HK$254 million. Meanwhile, operating expenses increased 45% to HK$7.775 billion, mainly due to higher staff costs and increased spending on technology infrastructure.

HKEX stated that as market demand for fintech innovation and system stability continues to grow, the company has been stepping up investments in market infrastructure and information security to ensure efficient and secure market operations.

Strong Profitability with Double-Digit Growth in EBITDA and Net Profit

Despite higher expenses, HKEX maintained strong profitability. EBITDA (non-HKFRS) reached HK$6.225 billion, up 59% year-on-year, while shareholders’ profit rose 56% to HK$4.9 billion, compared with HK$3.145 billion in the same period last year — marking one of the best quarters in recent years.

Basic earnings per share (EPS) climbed 56% to HK$3.88, up from HK$2.49 a year earlier. HKEX said the results reflected sustained improvement in core profitability, supported by market activity recovery and effective cost management.

With trading sentiment rebounding, IPO activities accelerating, and Southbound capital inflows remaining strong, HKEX’s revenue structure has become more diversified. Beyond traditional trading operations, clearing, derivatives, and index services have also emerged as new growth drivers.

Stable Capital Expenditure and Ongoing Technology Investment

Capital expenditure for the quarter was HK$392 million, down 6% year-on-year. Management said HKEX continues to allocate resources to upgrade the Connect schemes, expand the offshore RMB product ecosystem, and strengthen initiatives in artificial intelligence and blockchain technologies.

The company emphasized that it will continue to support the ongoing reform and innovation of Hong Kong’s capital markets and further reinforce the city’s role as an international financial hub.

Market Reaction and Outlook

Following the better-than-expected results, HKEX shares rose over 1% in early trading after the earnings release. Market participants viewed the third-quarter performance as a positive sign of improving profitability and a gradual recovery in overall market activity.

Several investment banks noted that HKEX’s medium- to long-term growth outlook remains positive, supported by mainland policy initiatives to deepen capital market reforms, more quality Chinese companies listing in Hong Kong, and the ongoing internationalization of the RMB. Analysts expect that, if global liquidity conditions continue to improve, IPO financing and cross-border fund flows will further support HKEX’s earnings performance.

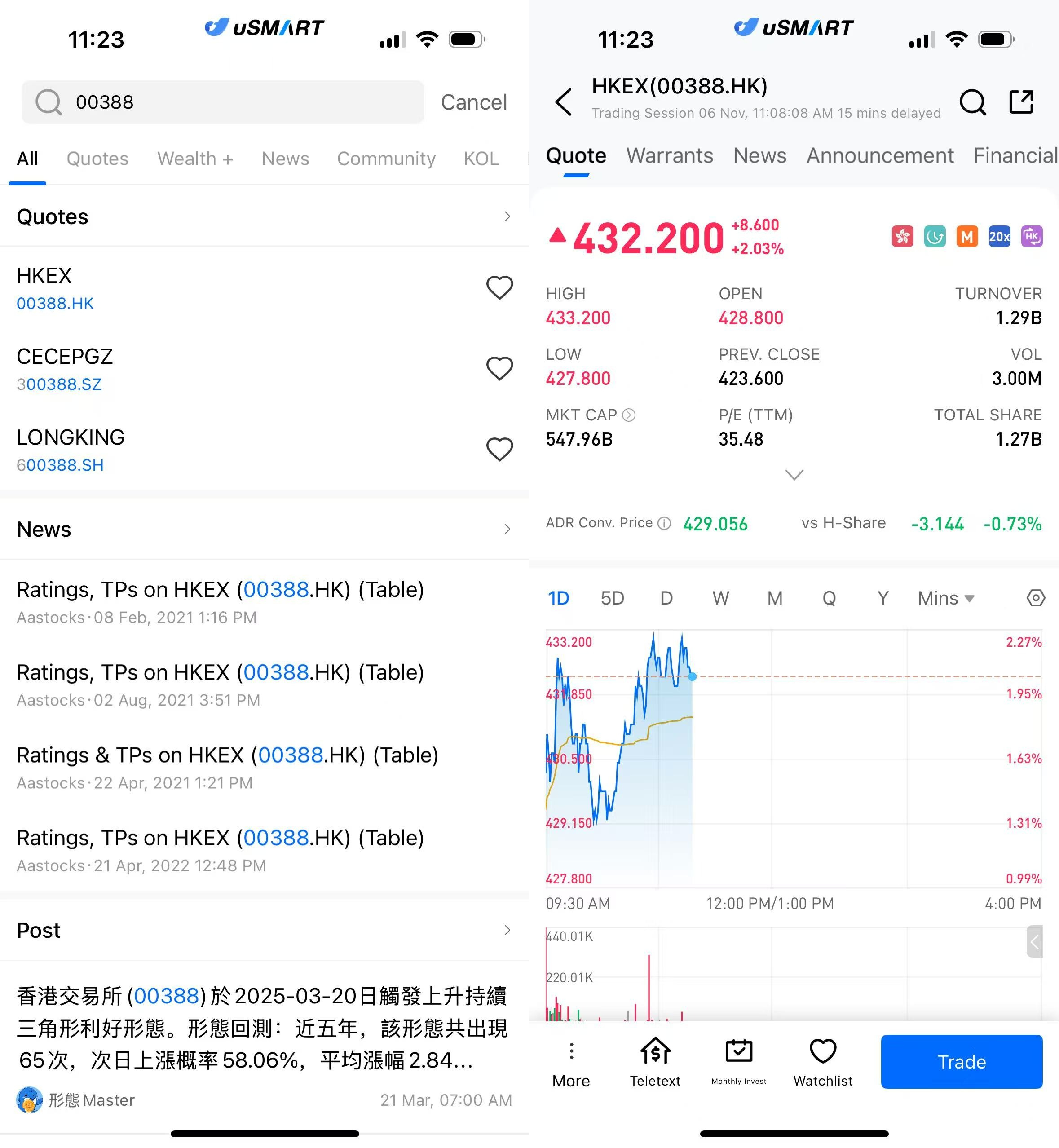

How to Buy HKEX on uSMART

After logging into the uSMART HK App, tap the search icon in the top-right corner, enter the stock code (00388.HK), and open the details page to view trading and historical information. Then tap “Trade” at the bottom-right, select the order type, enter your trading conditions, and submit your order.

(Image Source: uSMART HK app)

(Image Source: uSMART HK app)