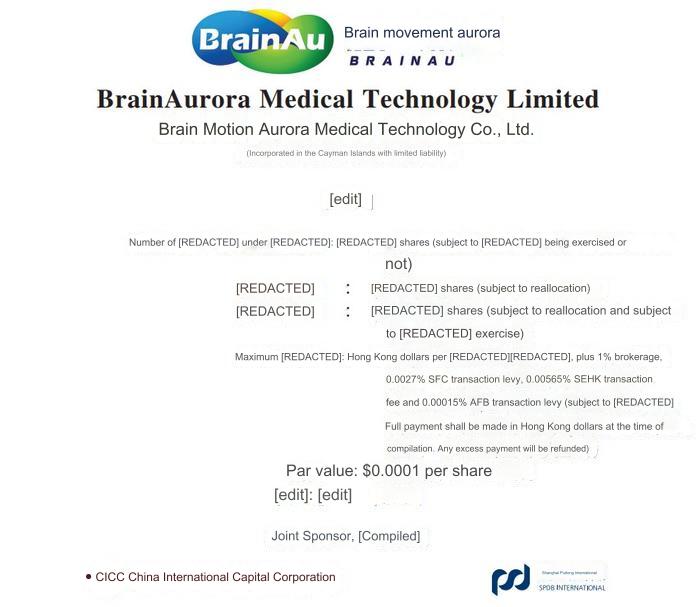

According to news from the Hong Kong Stock Exchange on August 22, BrainDong Aurora Medical Technology Co., Ltd. (Naodong Aurora Medical) passed the listing hearing on the main board of the Hong Kong Stock Exchange, with CICC and SPDB International as its joint sponsors.

(Source: Brain Hole Aurora)

About Brain Hole Aurora Medical

Brain Hole Aurora Medical was established in 2012. Its product pipeline covers the assessment and intervention of a wide range of cognitive disorders caused by vascular diseases, neurodegenerative diseases, mental diseases and children's developmental defects. As of July 5, 2024, the company's core product brain function information management platform software system has been commercialized for eight indications of four major types of cognitive impairment, and is developing 21 other indications for cognitive impairment.

Specifically, these four types of cognitive impairment include: cognitive impairment caused by vascular disease (VDCI), cognitive impairment caused by neurodegenerative diseases (NCI), cognitive impairment caused by mental illness (PCI), and child development. Deficit-induced cognitive impairment (CDDCI). Eight of the specific indications include: vascular cognitive impairment, aphasia, Alzheimer's disease, depression, schizophrenia, sleep disorders, attention deficit hyperactivity disorder (ADHD) and autism.

Losses exceeded 1.5 billion in three years

In terms of finance, in the three months ended March 31 in 2021, 2022, 2023 and 2024, the revenue of Brain Hole Aurora Medical was 2.299 million yuan, 11.291 million yuan, 67.20 million yuan and 25.884 million yuan respectively; and Different from the rapidly growing revenue, Aurora is still in the stage of annual losses. From 2021 to 2023, the company lost 698 million yuan, 502 million yuan, 359 million yuan and 51.608 million yuan respectively during the year. The total loss in the three years exceeded 15 billion.The reason why Jiuguang suffered a large loss was due to the fair value loss of its financial liabilities that were included in the profit and loss at fair value due to its financing.

When BrainDynamic Aurora warned of risks in its prospectus, it said the company's future growth depends to a large extent on its ability to successfully develop products. If it is unable to successfully complete clinical development, obtain regulatory approval and commercialize its product candidates, or if the above matters are materially delayed, the company's business and financial prospects will be materially and adversely affected.

Digital therapeutics market for cognitive impairment is growing rapidly

From the perspective of industry development trends, the global and Chinese digital therapy markets for cognitive impairment are growing rapidly.

According to Frost & Sullivan, the global digital therapy market for cognitive impairment will reach US$2.1 billion in 2022, and is expected to double to US$4.2 billion in 2025. In comparison, China's market size in 2022 is 149 million yuan, and is expected to grow to 1.952 billion yuan in 2025, with a compound annual growth rate of 135.5%, faster than the 25.5% of the global market in the same period.

As of March 20, 2024, in the Chinese market, approximately 30 digital therapy products for cognitive impairment, including Brain Movement Aurora products, have been approved by the State Food and Drug Administration or local Food and Drug Administration, and there are at least 15 similar products. The product is undergoing clinical trials and has obtained relevant medical device registration certificates.

Facing an increasingly competitive market, Aurora still occupies a certain leading position at this stage by virtue of its first-mover advantage. Calculated based on revenue in 2023, Aurora has a market share of 25.0% and 91.6% respectively in China's cognitive impairment digital therapy market and China's medical cognitive impairment digital therapy market.

Received 7 rounds of financing, with post-money valuation of C+ round reaching 2.7 billion

Company establishment and initial development

Brain Aurora first started operating through Zhejiang Brain Aurora in 2012. It was jointly funded by Wang Xiaoyi, Xiang Huadong and others, with a registered capital of 1.005 million yuan, of which Wang Xiaoyi holds 33.91% of the equity and is the largest shareholder.

After its establishment, Jiuguang did not receive any investment for nearly three years. It was not until the research direction of its core products became clear in 2015 that the company received angel investment for the first time. Shanghai Pegasus Travel and Zhongwei Growth each acquired the company's registered capital of 133,600 yuan, with a transaction consideration of 2.564 million yuan, which brought the company's post-investment valuation to 36.6285 million yuan.

Series A financing and shareholder changes

In 2016, Jiuguang received Series A financing from Zhuojun Limited and Explorer Three Limited, with a total financing amount of US$4 million, and its post-investment valuation quickly increased to 129 million yuan. NLVC, a venture capital firm that owns multiple U.S. dollar and RMB funds in early-stage opportunities in the corporate, healthcare and consumer industries, became an important investor in the company. As of the end of 2022, its assets under management reached HK$33.62 billion.

After the Series A financing, Jiuguang was silent in the capital market for more than four years. It was not until 2020 that the digital medical industry received widespread attention due to the epidemic, and the company once again became favored by the investment community.

Series B financing and key shareholders joining

In 2020, Brain Motion Aurora got acquainted with Tan Zheng, chairman of the board of directors of Yongtai Biotech (06978.HK). Tan Zheng recognized Brain Motion Aurora’s digital therapy for cognitive impairment and acquired Zhejiang Brain Motion Aurora for 1.3838 million yuan through Shuhui Co., Ltd. The registered capital is RMB 4.5 million. In the same year and the following year, Tan Zheng participated in Series B investments with his own funds many times, with the total investment amount reaching 85.8571 million yuan, making the company's first single financing amount exceed 100 million yuan, reaching 117 million yuan, and the post-investment valuation further increased to 400 million yuan.

Subsequent financing and valuation increase

Subsequently, BrainDong Jiguang continued to receive investments exceeding 100 million yuan in multiple financings. In the C round of financing in 2022, the company received 138 million yuan in financial support. After the C+ round of financing in 2023, the company has completed a total of 7 rounds of financing, and its post-investment valuation reached 2.691 billion yuan, a record high.

Equity Structure and Company Leadership

After the financing and equity changes, the main shareholders of BrainDong Jiguang are Tan Zheng and Wang Xiaoyi, as well as companies controlled by their close contacts, such as ZTan Limited, Wispirits Limited, etc. ZTan Limited holds 25.38% of the company's shares and is the largest shareholder; NLVC holds 11.69% of the shares, and Wispirits Limited holds 10.05%.

Tan Zheng currently serves as the company's chairman of the board of directors and chief strategy officer, while Wang Xiaoyi serves as chief executive officer and chief research and development officer. Both of them have rich experience in the medical and health field, especially Wang Xiaoyi. Under her leadership, BrainDong Aurora has successfully developed a number of digital therapy products and promoted the company's continued development and growth.