NVIDIA's stock price fluctuated violently this week, which "unexpectedly" caused the market.

Nvidia, the "AI leader", went on a roller coaster ride this week. It fell 7% on Tuesday, but soared nearly 13% overnight. Its market value increased by an astonishing US$330 billion in a single day, setting a record for the largest increase in a single day; U.S. stocks closed on Thursday. NVIDIA fell another 6.67%.

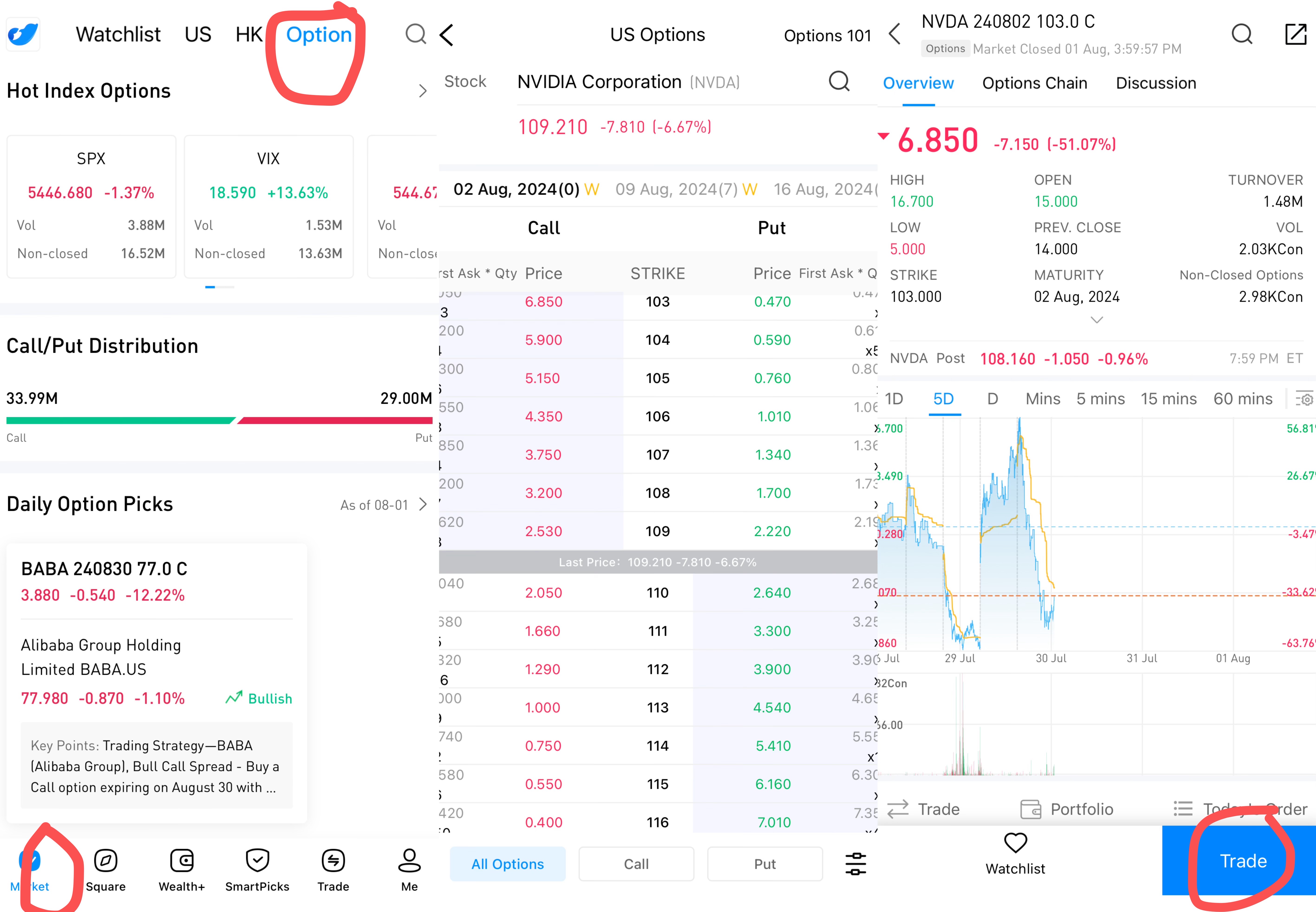

(Source: uSMART)

(Source: uSMART)

According to Bloomberg data, Nvidia’s volatility has even exceeded Bitcoin. The data shows that the implied volatility of Nvidia’s 30-day options has recently surged from 48% to 71%, while the Bitcoin DVOL index (an indicator that measures 30-day implied volatility) ) dropped from 68% to 49%.

Matt Maley, chief market strategist at Miller Tabak + Co., said that the violent fluctuations in Nvidia's stock price reflect investors' uncertainty about the future prospects of technology stocks. On the one hand, they are worried that the technology giant's huge capital expenditures on artificial intelligence will not go as planned. Bringing investment returns, on the other hand, there is the worry of missing out on the rise in technology stocks.

However, in the face of market concerns, major technology companies are still determined to "burn money" in response - these companies would rather overinvest than underinvest, because falling behind in competition in the technology industry means "having nothing."

Judging from the capital expenditures of technology giants, these companies are determined to invest in AI, which is bound to further increase hardware expenditures such as chips, bringing benefits to Nvidia and other chip companies.

Why is Nvidia’s stock price on a roller coaster ride?

Poor performance and market concerns

The technology giant's poor performance and market concerns about the future growth of the AI market are the main reasons for Nvidia's stock price to plummet. Quarterly reports from Google and Microsoft showed that artificial intelligence's contribution to revenue growth was less than expected, and capital expenditures are expected to remain high for a long time, which has triggered market concerns about return on investment.

Microsoft's Azure growth slowed to 29%, and total capital expenditures increased 80% year over year. Google's total capital expenditures increased by 91.4% year-on-year and 9.8% month-on-month, exceeding market expectations.

Rival AMD's revenue surges

Nvidia's main competitor AMD has seen significant growth in revenue in the field of AI chips. AMD's second-quarter data shows that data center segment revenue hit a quarterly high, mainly due to strong sales of AMD Instinct GPUs and fourth-generation AMD EPYC CPUs.

Market structure changes

"Who will win Apple's AI?" has always been the focus of market attention.

Apple revealed in its latest research report that it uses Google's TPU instead of Nvidia's GPU when developing its latest smart features. As the last major technology company to enter the battle, Apple has not publicly reported that it has purchased Nvidia's GPU on a large scale. Record. According to the report, in order to build AI models that run on iPhones and other devices, Apple used 2,048 TPUv5p and 8,192 TPUv4 to support the training and inference of the AI model.

The explosion of large AI models last year caused AI chips to face a frenzy in the market, and high-end GPU cards were hard to come by. NVIDIA captured more than 80% of the market share in this field in one fell swoop, which can be described as a monopoly. But at the same time, Google is also secretly working on TPU. According to Techinsights statistics, Google's own TPU chip volume last year was estimated to be more than 2 million. Its market share is second only to Nvidia and Intel, and it has become the third largest data center chip designer in the world.

Despite having its own TPU chips, Google is still one of the world's largest buyers of Nvidia GPUs. Market research firm Omdia compiled a list of major buyers of Nvidia H100 GPUs that were snapped up last year. Meta and Microsoft tied for first place, and Google, Amazon, Oracle and Tencent tied for second.

CEO Jen-Hsun Huang frequently reduces holdings

Public information shows that between June 13 and 24, Huang Renxun reduced his holdings by more than 840,000 shares and cashed out approximately US$100 million. Nvidia's executives are also reducing their holdings. Chief Financial Officer Colette Kress made $12.7 million from selling stocks, and Executive Vice President Deborah Shoquist also sold more than $45 million in shares. The successive reductions by executives have increased the market's interest in the company. Uncertainty about future developments.

U.S. stock sector rotation

The sector rotation view of the U.S. stock market and the trend of large fluctuations in technology stocks have also had an impact on Nvidia's stock price.

The number of people applying for unemployment benefits for the first time in the United States in the week of July 27 was 249,000, higher than the expected 236,000. The U.S. ISM manufacturing PMI in July was 46.8, significantly lower than the market expectation of 48.8 and the pre-June value of 48.5. The contraction was the largest in eight months, exacerbating concerns about a U.S. recession.

According to CME's FedWatch tool, after Wednesday's Federal Reserve interest rate meeting, federal funds futures currently predict a 100% probability that the Federal Reserve will cut interest rates by at least 25 basis points at the September meeting, including a 15% probability of a 50 basis point rate cut. The continued rise in expectations for interest rate cuts will attract more funds to flow from AI technology stocks into small and mid-cap stocks, and the iShares Russell 2000 ETF (IWM) may become the big winner in this U.S. stock sector rotation.

Long-term prospects and firm investment from tech giants

While concerns about return on investment have impacted Nvidia's stock price in the short term, firm investments in AI by technology giants such as Microsoft, Google and Meta could be positive for Nvidia's long-term revenue prospects. Deutsche Bank's report pointed out that the current return on AI investment is difficult to measure with specific numbers, but the continued investment in AI infrastructure by technology giants may increase demand for Nvidia GPUs.

Technology giants have repeatedly emphasized that investment in AI will not slow down, which has driven a rebound in Nvidia's stock price. Both Google and Meta stated in their financial reports that they will continue to significantly increase capital expenditures in the field of AI, which will support AI research and product development work, thus benefiting chip companies such as Nvidia.

Technical factors

Analysts believe that the Nasdaq 100 index has stepped back to the key support level after the sharp decline on July 30. The over-concentration of the market and the grouping of institutional investors have accelerated the rebound trend of technology stocks, which also provides a rebound for Nvidia’s stock price. support.

Pelosi makes a bet, Morgan Stanley sings well

According to the disclosure, Paul bought 10,000 shares of Nvidia stock on July 26, with a transaction value of between US$1 million and US$5 million; and sold 5,000 shares of Microsoft stock, with a transaction value of between US$1 million and US$5 million.

According to another disclosure a few weeks ago, Paul purchased 10,000 Nvidia shares at the end of June. This means that in just one month, Pelosi has increased her position in Nvidia twice.

In addition to Pelosi's bet, Nvidia also received support from Morgan Stanley. Morgan Stanley said it is optimistic about Nvidia's long-term growth potential and that market concerns about it will diminish over time. Morgan Stanley re-rated Nvidia stock as a "top pick" and maintained an "overweight" rating.

Under the roller coaster market, you can use uSMART for options trading, and you have the opportunity to realize profits when buying up or down!

How to buy options with uSMART?

After logging into uSMART HK APP, click Options from the top of the page to enter the option details page to learn about options. Click on the specific option, click on the exercise price number, then click "Trade" in the lower right corner, fill in the transaction conditions and unlock the transaction; the picture operation instructions are as follows: