ON Semiconductor, a major power semiconductor manufacturer, announced its second-quarter financial report for fiscal year 2024 before the U.S. stock market opens on Monday. Although the outlook for the automotive chip market is uncertain, demand remains strong. Revenue and profits for the quarter were both higher than expected, and it was also Gives a good financial forecast for the third quarter.

overall revenue

The financial report shows that ON Semiconductor achieved revenue of US$1.7352 billion (note: currently approximately 12.603 billion yuan) in the last quarter, with a gross profit margin of 45.2%, an operating profit margin of 22.4%, and diluted earnings per share calculated according to non-GAAP rules of 0.96 Dollar.

ON Semiconductor's revenue in the last quarter fell 17% year-on-year and 7% quarter-on-quarter; its gross profit margin and operating profit margin were also lower than in the previous quarter and the same period last year.

(Source: ON Semiconductor)

business revenue

Revenue is divided by business. All three business units of ON Semiconductor experienced double-digit declines in revenue in the second quarter.

Power Solutions Group (PSG) revenue fell 15% annually to $835.2 million;

Advanced Solutions Group (ASG) revenue fell 18% to $647.8 million;

Smart Sensing Group (ISG) revenue fell 22% to $252.2 million.

However, this performance level is still slightly higher than the outside world had expected. Analysts' average estimates for ON Semiconductor's second-quarter revenue and non-GAAP diluted earnings per share were $1.73 billion and $0.92, respectively, according to data compiled by Bloomberg.

Hassane El-Khoury, President and CEO of ON Semiconductor, said:

"We remain committed to driving growth by expanding market share, doubling down on investment in strategic markets, and expanding the breadth of our industry-leading product portfolio with analog and mixed-signal solutions. As our recent supply agreement with the Volkswagen Group demonstrates As reflected in this, we will also continue to strengthen our silicon carbide (SiC) leadership position in the automotive industry as our production cooperation with leading global automotive OEMs in Europe, North America and China continues to expand.”

ON Semiconductor's stock price surged 11.54% during the trading session on July 29, U.S. time, closing at $78.27, the largest single-day increase since 2022.

(Source: uSMART)

(Source: uSMART)

About ON Semiconductor

ON Semiconductor (ON.US) is committed to promoting disruptive innovation and creating a better future. ON Semiconductor focuses on the general trends in the automotive and industrial end markets, accelerating the transformation and innovation in the electronics of automotive functions and automotive safety, sustainable power grids, industrial automation, and 5G and cloud infrastructure. ON Semiconductor provides a highly differentiated portfolio of innovative products and smart power and smart sensing technologies to solve the world's most complex challenges and lead the way in creating a safer, cleaner and smarter world. ON Semiconductor ranks among the Fortune 500 companies in the United States and is included in the Nasdaq 100 Index and the S&P 500 Index.

Will ON Semiconductor continue to rise?

JPMorgan Chase issued a report stating that the adjustment of Asian technology stocks in the past two weeks has caused the market to worry about whether the upward cycle driven by generative AI has ended, and the bank’s answer is that it has not ended. This round of adjustments is similar to the mid-term adjustments from August to September 2023 and April 2024. It is believed that spending on AI hardware will continue to grow in the next one to two years.

Signed agreement with Volkswagen Group

On July 23, ON Semiconductor (ON.US) announced that it has signed a multi-year agreement with the Volkswagen Group to become the main supplier of its scalable system platform (SSP) next-generation main drive inverter, providing a complete power box solution. The solution uses silicon carbide-based technology in an integrated module that is scalable to all power levels, from high power to low power main drive inverters, and is compatible with all vehicle categories.

"By providing a complete power system solution covering the entire power sub-assembly, we provide the Volkswagen Group with a single, simplified, modular and scalable platform to maximize the efficiency and performance of its various vehicle series." Anson Hassane El-Khoury, President and CEO of U.S. Motors, said, "This new approach can tailor power requirements and add features to different vehicles without compromising performance, while reducing costs."

ON Semiconductor has become a major supplier of fully optimized power system solutions with its latest generation EliteSiC M3e platform.

Based on EliteSiC M3e MOSFETs, ON Semiconductor's unique power box solution handles more power in a smaller package and significantly reduces energy consumption. Three integrated half-bridge modules are mounted on the cooling channels, further increasing system efficiency by ensuring efficient management of heat from the semiconductor devices to the coolant housing. This will result in better performance, better heat control and greater efficiency, allowing electric vehicles to travel longer distances on a single charge. By using this integrated solution, the Volkswagen Group will be able to easily transition to future EliteSiC-based platforms and remain at the forefront of electric vehicle innovation.

Additionally, Goldman Sachs Group Inc. analyst Toshiya Hari maintained a buy rating on ON Semiconductor and raised his price target to $95 from $89. Investors can continue to pay attention to ON Semiconductor, which has room to continue to rise in the future.

How to invest in ON Semiconductor on uSMART?

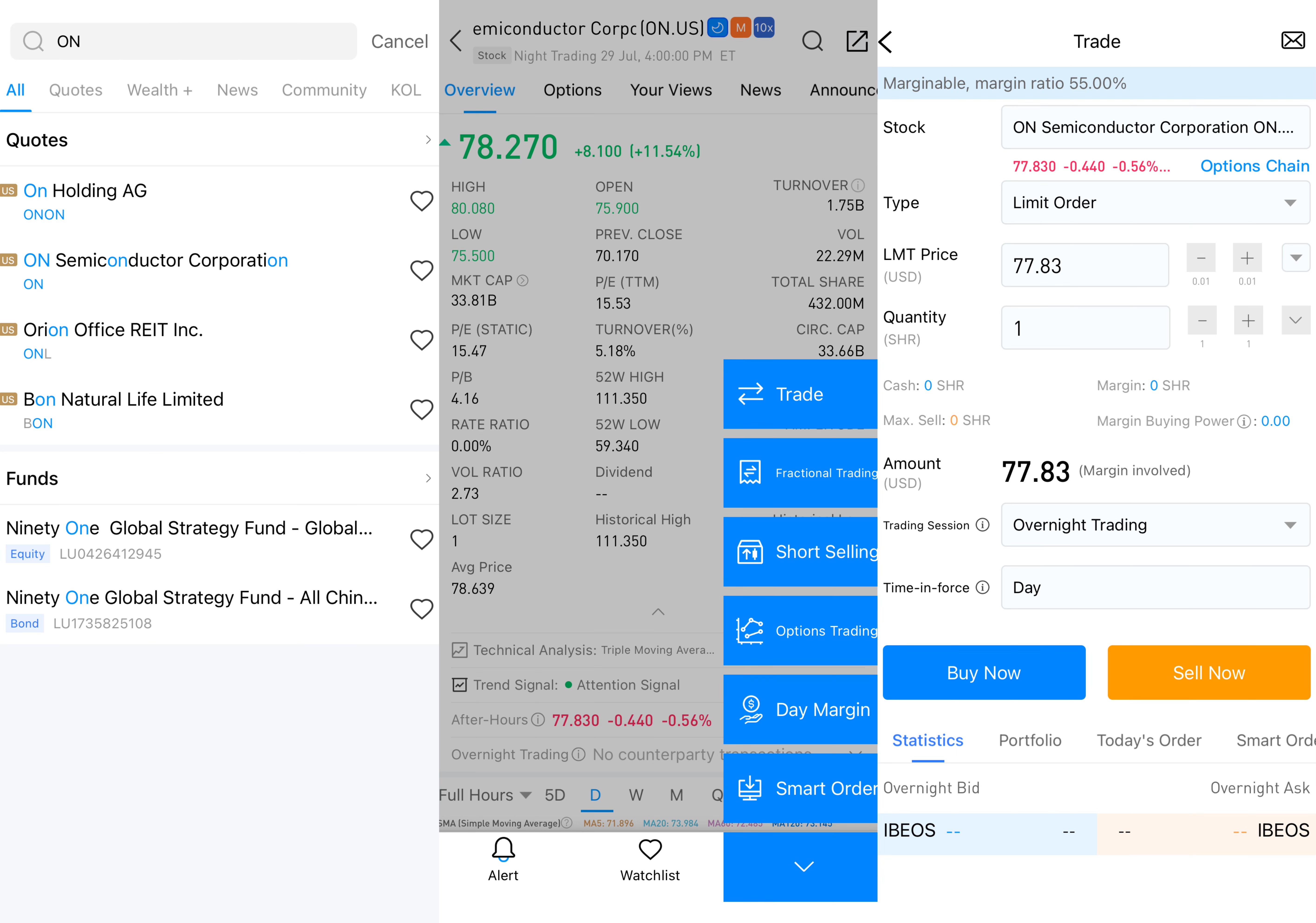

After logging in to the uSMART HK APP, click "Search" from the upper right corner of the page, enter "ON" or "ON Semiconductor" to enter the details page to learn about transaction details and historical trends. Click "Trade" in the lower right corner and select "Buy/ "Sell" function, finally fill in the transaction conditions and send the order; the picture operation instructions are as follows:

(Source: uSMART)