硅谷銀行破產餘波蔓延

當全世界都在評估硅谷銀行(SIVB.US)倒閉的後果時,投資者正以警惕的目光盯着軟銀集團(SFTBY.US)。從很多方面來看,軟銀都是初創企業領域最大的支持者和倡導者。

孫正義旗下的軟銀集團向WeWork(WE.US)、字節跳動、DoorDash(DASH.US)等公司投入了超過1400億美元。在硅谷銀行崩潰之前,軟銀集團投資的公司已經受到疫情後經濟低迷的影響。如今,儘管美國當局承諾要拯救位於硅谷風險資本生態系統核心的硅谷銀行,但投資者正在謹慎撤退。

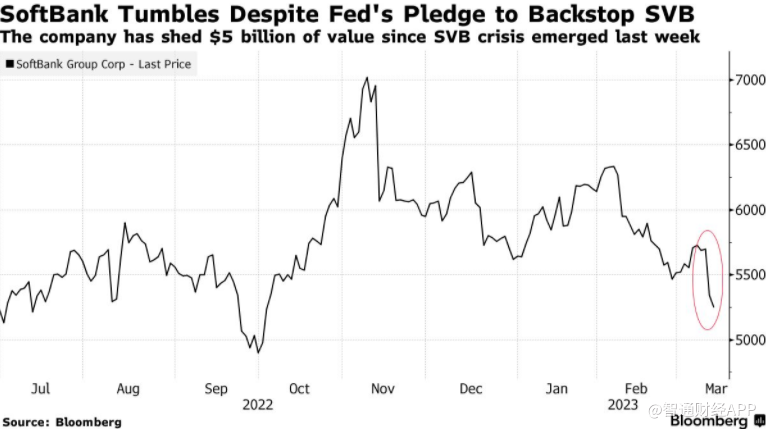

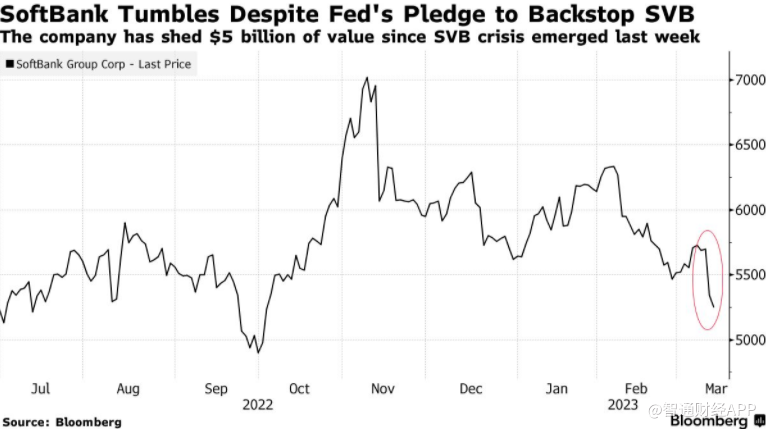

同樣在全球風投領域處於核心地位的軟銀,自硅谷銀行陷入困境的消息傳出以來,其市值已縮水約7%,即50億美元。軟銀的信用違約互換(CDS)連續第二天飆升。市場開始猜測,如果軟銀需要幫助投資組合中的公司擺脫困境,它可能會出售哪些資產。

儘管美國承諾將全面保護所有儲戶的資金,但硅谷銀行破產餘波仍在蔓延。

香港戈壁創投執行合夥人Chibo Tang表示:“考慮到市場情緒的變化,這對初創企業的整體融資環境可能產生巨大的負面影響。”“值得慶幸的是,這次救助進一步加強了世界各國政府對創新和技術生態系統的重視和優先程度。”

軟銀發言人表示,軟銀認爲硅谷銀行的倒閉對其投資組合公司的影響很小,並預計該事件不會影響軟銀的財務狀況。該公司在上個月的財報電話會議上表示,願景基金投資的大多數公司現金充裕。

但硅谷銀行的倒閉表明利率上升可能對已經習慣多年廉價資金的公司和銀行造成損害。創業公司尤其容易受到系統性信心下降的影響,因爲它們依賴於投資者對其長期潛力的信心,而盈利可能要過幾年才能實現。

目前尚不清楚這場危機將如何影響全球的融資和估值。一些觀察人士指出,其他貸款機構可能也會被拖入惡性循環。在Silvergate Capital(SI.US)、硅谷銀行連續暴雷之後,美國監管機構以“系統性風險”爲由關閉Signature Bank(SBNY.US)。據媒體上週報道,長期苦苦掙扎的辦公空間租賃公司WeWork正在洽談籌集數億美元資金以支持業務。

傑富瑞分析師Atul Goyal表示:“這很有可能將私募股權/風險投資領域的‘清算日’提前,並可能迫使包括軟銀在內的私募股權基金提前減記私募資產。”

風投公司一直在建議他們的初創公司撤出放在硅谷銀行的資金。

軟銀可能還會面臨壓力,要求其支持一些初創公司免受溢出效應的影響。Bloomberg Intelligence分析師Marvin Lo和Chris Muckensturm表示,這可能促使軟銀通過出售部分阿裏巴巴(BABA.US)股份來籌集現金。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.