華新環保登陸創業板,股價大漲超24%!

12月16日,華新綠源環保股份有限公司(以下簡稱“華新環保”)登陸創業板,保薦人為東興證券。本次發行價格為13.28元/股,發行市盈率26.88倍,截至發稿時間,最新市值49億元。

華新環保是一家專業從事固體廢物資源化利用和處理處置的高新技術環保企業,主要業務包括電子廢棄物拆解、報廢機動車拆解、廢舊電子設備回收再利用和危險廢物處置等。

截至招股説明書籤署之日,張軍直接持有公司20.23%的股份,沙越直接持有公司13.72%的股份,沙越作為恆易偉業的執行事務合夥人間接控制公司12.25%的股份。張軍、沙越夫婦合計控制公司股份46.20%。因此,張軍、沙越夫婦系公司控股股東及實際控制人。

本次IPO擬募集的資金主要用於危險廢物處置中心變更項目、3萬t/年焚燒處置項目、冰箱線物理拆解、分類收集改擴建項目、補充流動資金。

募資使用情況,圖片來源:招股書

報吿期內,華新環保實現營收分別為5.83億元、5.70億元、7.82億元、3.77億元,淨利潤分別為8578.69萬元、1.32億元、1.56億元、6797.72萬元。

基本面情況,圖片來源:招股書

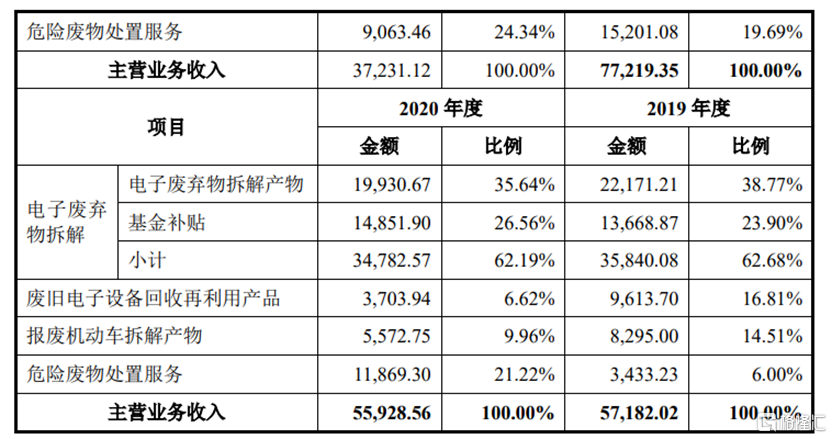

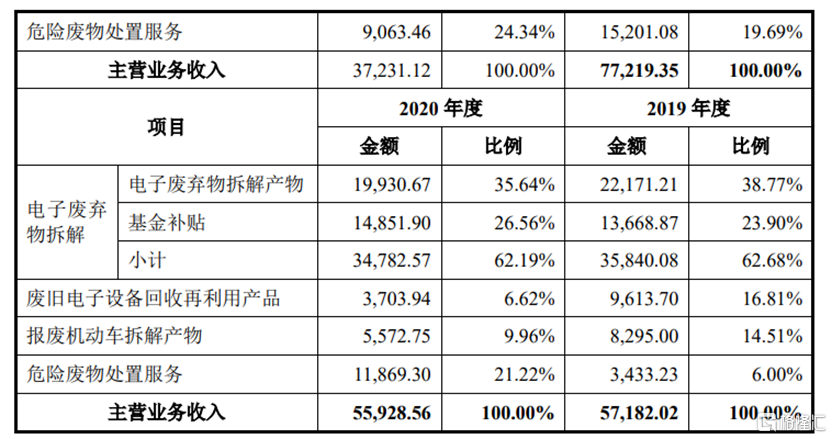

具體來看,華新環保的主營業務為固體廢物的資源化利用和處理處置服務。公司的主要產品包括電子廢棄物拆解產物、報廢機動車拆解產物和廢舊電子設備回收再利用產品;主要服務為危險廢物的處置服務。其中,通過拆解上述電子廢棄物中的“四機一腦”可申領財政部發放的基金補貼。

報吿期內,公司綜合毛利率分別為30.31%、40.10%、33.80%、29.74%。其中,2020年度,公司的綜合毛利率及主營業務毛利率均出現大幅上升,主要系毛利率水平較高的危險廢物處置業務佔比大幅上升所致。

公司主要產品和服務的銷售收入情況,圖片來源:招股書

事實上,公司電子廢棄物拆解和報廢汽車拆解業務的主要原材料為廢棄電器電子產品和報廢的機動車。報吿期內,原材料成本佔公司主營業務成本比重分別為82.64%、73.70%、75.64%、74.49%,原材料成本佔主營業務成本比重較高。 公司主要原材料價格具有一定的波動性,如果公司所處的北京、內蒙古和雲南地區有新的同行業公司進入,則區域內的行業競爭將會加劇,原材料價格有可能隨之上漲,企業的生產成本將會增加,公司的利潤將會減少,對其經營業績產生不利影響。

此外,報吿期各期末,華新環保的應收賬款賬面價值分別為3.70億元、4.37億元、5.28億元、6億元,佔同期總資產的比例分別為41.47%、41.75%、43.68%、41.76%,應收賬款餘額較大,其中應收廢棄電器電子產品處理基金拆解補貼款賬面價值分別為3.47億元、4.26億元、4.95億元、5.52億元,佔應收賬款的比例均超九成。

如果應收賬款不能及時收回,或會對公司的業績和生產經營產生負面衝擊。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.