夜讀 | 消費電子過氣啦?

作者:ZHR

來源:格上研究

中國智能手機市場在近三年來一直持續走低,2022年1-6月,智能手機出貨量1.34億部,同比下降21.7%。其中第二季度中國智能手機銷量同比下降14.2%,而上一次銷量低於二季度的數值出現在近十年前的2012年第四季度。與此同時,英特爾二季度出現了4.54億美元的淨虧損,作爲對比,去年二季度,英特爾獲得了50億美元的淨利潤。在毛利潤率上,英特爾從一季度的50.4%下降到了二季度的36.5%。

從去年年底很多領域處於缺貨和追貨的階段,到今年春節之後整個市場的需求斷崖式下滑,反應時間可能只有一兩個月,對於今年的市場,是否意味着曾經高景氣的消費電子行業進入了寒冬?

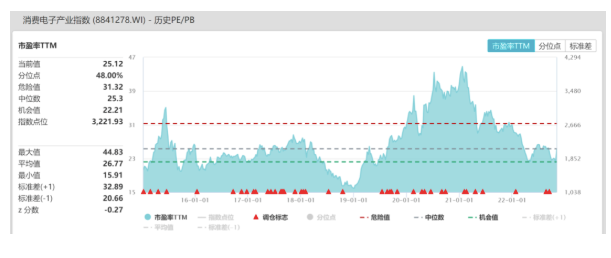

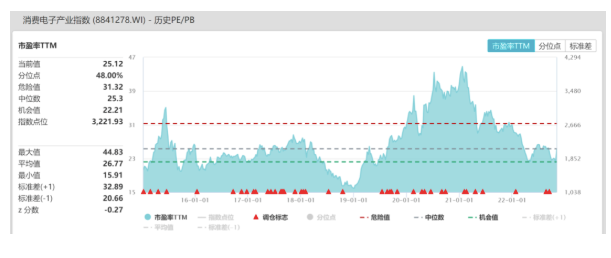

從下圖,我們可以看到消費電子產業當前的市盈率是低於中位數的,整體的估值是較低的,當前進入佈局安全墊是有的。

下面,我們來了解一下隨着智能化時代的到來而應運而生的這個產業吧!

消費電子是指可供消費者日常使用的電子設備,通常具有小巧輕便、操作簡單和節能設計等優點。消費電子產品的使用增加了生活的便利性,豐富了日常娛樂生活,提升了生活品質,已經成爲人們生活的重要組成部分。

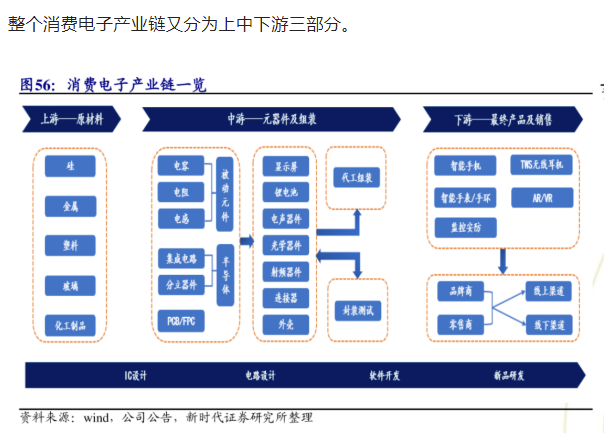

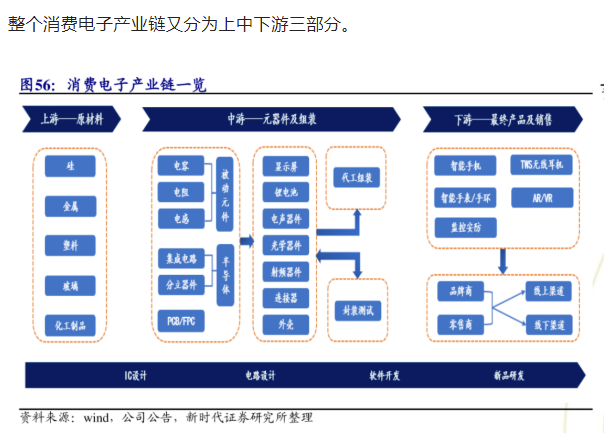

消費電子產業鏈上遊爲原材料,包括硅、金屬、塑料、玻璃、化工製品等;產業鏈中遊爲元器件及組件,包括芯片、傳感器、半導體、顯示屏、塑料、鋰電池等;產業鏈下遊包括智能手機、平板電腦、筆記本電腦、可穿戴設備、汽車消費電子等主要產品,以及專賣店、自營店、大型商超、電商平臺等銷售渠道。通常在A股中,消費電子分爲三條主線:蘋果產業鏈,華爲產業鏈和特斯拉產業鏈。

消費電子龍頭企業案例分析-立訊精爲什麼大衆十分熱衷的電子產品如今進入了寒冬呢?其實主要來源於兩點:對於電子產品本身來說,目前硬件的提升已經進入瓶頸,性能已經大幅過剩。大家可以試想一下已經多久沒有因爲型號更新而置換手機了,主要是因爲花了錢,買了新的硬件產品,但是得到的性能提升感知不明顯。

而對於消費者來說,如今經濟形勢不好,在經濟增速放緩的大背景下,大家的收入也出現了不同程度的影響,節流開源,現金爲王、適度消費成爲了大衆的主流選擇,除非剛需,否則很少會動不動買手機、電腦等這樣的大件。

還有就是芯片短缺造成的影響。因爲芯片產能不夠,廠商能夠拿到芯片的成本變高,羊毛出在羊身上,最終還得是消費者爲原材料的漲價買單,因此消費者的消費情緒也就更理性了。

疫情三年,消費電子行業的發展也是起起伏伏,從全球多個國家和地區封控衍生出大批居家辦公、線上教育需求,帶動筆電平板市場出現爆發式增長;再到如今經濟環境持續低迷,市場需求疲軟。可以預見的是,經濟未見回暖跡象之前,消費電子產業鏈需求萎縮的局面還將繼續。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.