鮑威爾重磅講話來襲

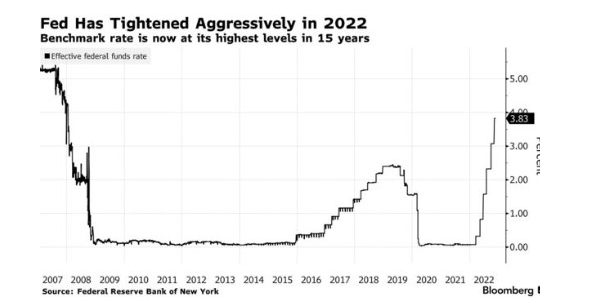

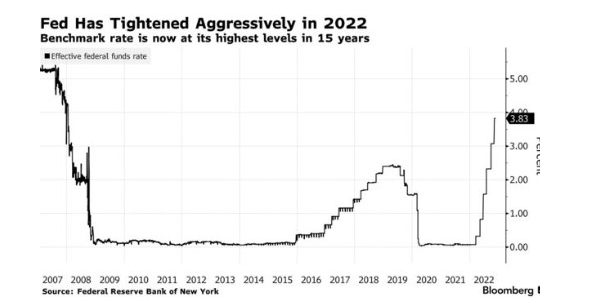

美聯儲主席鮑威爾將於北京時間週四2:30在華盛頓布魯金斯學會主辦的一次活動上發表以就業市場爲主題的講話。這次講話可能將鞏固美聯儲將在12月放慢加息步伐(50個基點)的預期,同時鮑威爾可能指出美聯儲與通脹的鬥爭將持續到2023年。在美聯儲連續四次加息75個基點之後,此次鮑威爾的講話或對美聯儲是否在12月將基準利率提高50個基點或更高的市場預期做出迴應。但由於美國現通脹率仍遠高於該行2%的通脹目標,鮑威爾可能會在任何有關利率的聲明中強調明年利率或進一步上升。

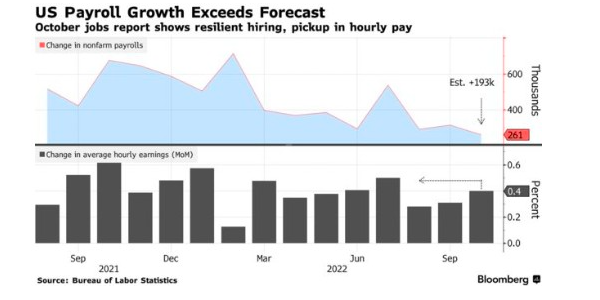

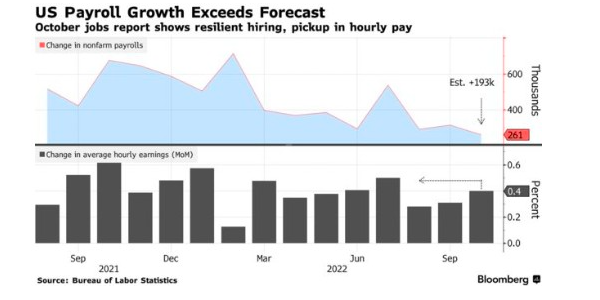

Macro Policy Perspectives的創始合夥人Julia Coronado表示:“鮑威爾可能會在本次演講中對維持鷹派貨幣政策的態度更爲強勢,並可能指出勞動力市場失衡的範圍。”Coronado稱,“鮑威爾可能將美國非農就業數據描述爲美聯儲需要長期堅持貨幣緊縮政策的主要原因。”

根據期貨市場合約定價,市場投資者預計美聯儲下個月將放緩加息步伐,並預期明年利率水平將從目前的3.75-4.00%升至5%左右的峯值。

市場的預期與鮑威爾在本月早些時候於美聯儲會議後的言論一致,彼時他表示美聯儲可能會在下個月放慢加息步伐,即使未來利率最終將上調至更高的峯值水平。

摩根大通首席美國經濟學家Michael Feroli表示:“我認爲,對於讓市場與美聯儲看到一致通脹情況來說,後者並沒有太多繁重的工作要做。”

另有經濟學家稱,“最終鮑威爾將主導利率政策的最終決定,提醒市場美聯儲不會轉鴿並會繼續收緊政策,直到有確切的證據表明通脹正持續下降。”

11月的美聯儲會議紀要顯示,絕大多數美聯儲官員同意在未來放緩加息步伐。但關於最終需要將利率提高到多高的觀點並不明確,政策制定者認爲有必要將利率提高到比預期更高的水平。

根據會議後所發佈的利率預期中值,今年年底市場貨幣利率將達到4.4%,到明年年底將達到4.6%。這些預測數據將會在下個月的會議上更新。

在鮑威爾發表講話之前,美國將於週三晚間發佈該國職位空缺和勞動力流動調查(JOLTS)更新數據,而鮑威爾經常引用這份報告作爲勞動力供不應求的證據。由於9月份市場的職位空缺出人意料地增加,該國社會工資壓力也將加劇。

緊隨鮑威爾講話,11月非農就業報告也將在週五晚間出爐,政策制定者也將在12月利率決議之前審查該報告以及週四晚間將發佈的通脹數據11月PCE物價指數。

Amherst Pierpont Securities LLC首席經濟學家Stephen Stanley表示,“自美聯儲11月會議以來,金融市場現狀有所緩和,股市有所上漲,債券市場的風險利差正在收窄。”

但鮑威爾不太可能在他的言論中提及股市相關信息,而大概率會重申其於本月早些時候的言論:該行可能很快會放緩加息步伐,但利率可能需要略高於先前的預期,才能使價格降溫。

Stanley表示。“如果市場有美聯儲將把12月利率提高到鮑威爾先前暗示的5%水平的準備,那麼我覺得鮑威爾已經完成了其對市場的提示工作。”

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.