投資者能從美國零售商看到希望嗎?

隨着美國今年最重要的購物季將於當地時間週五開始,在通脹高企的背景下,投資者正密切關注美國零售股,並將其視爲衡量消費者信心的晴雨表。

由於通脹飆升和美聯儲自20世紀70年代以來最快的加息舉措打擊了消費者信心,今年以來,標普500指數非必需消費品板塊已累計下跌32%,是標普500指數15.5%跌幅的兩倍多。

然而,在美國10月消費者價格指數(CPI)低於市場預期,同時也是8個月來首次低於8%的推動下,市場普遍認爲,通脹在接近40年高點後終於見頂,美國股市也迎來了全面反彈。

Leuthord Group首席投資策略師Jim Paulsen表示:“這些(零售)股票將成爲經濟放緩速度以及通脹放緩是否正在提振大衆信心的線索。”

假日季消費增速放緩

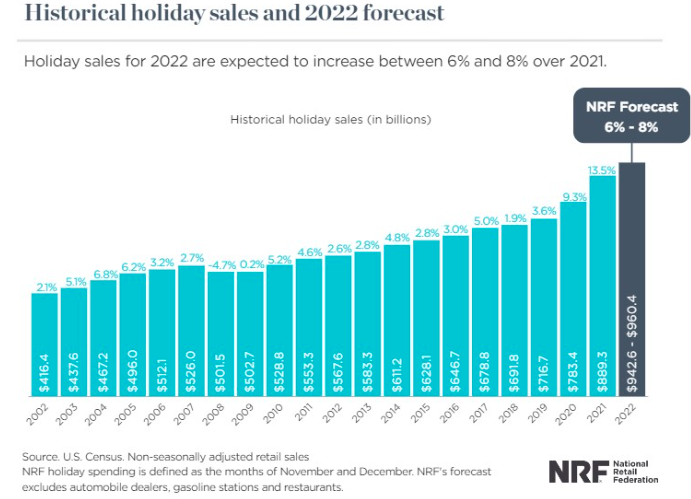

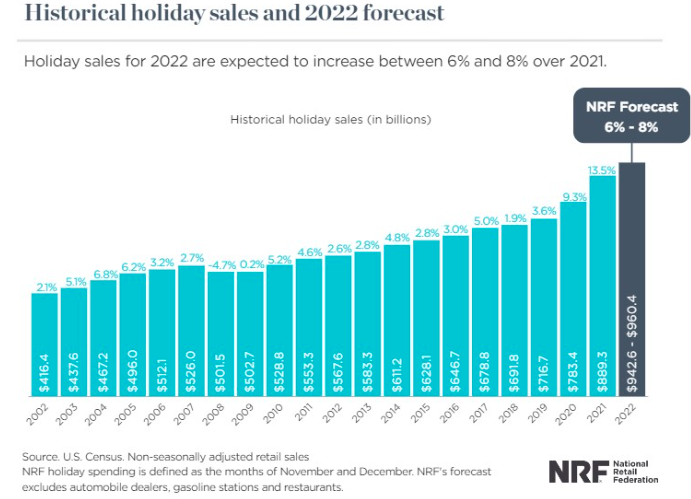

總體而言,行業組織全美零售聯合會預計,包括電子商務在內的假日銷售額在11月和12月將增長6%至8%,達到9426億美元至9604億美元,但這低於2021年的13.5%和2020年9.3%的漲幅。

並且,美國零售商今年也似乎不同尋常地提前打折,以吸引消費者。

例如,包括塔吉特(TGT.US)、柯爾百貨(KSS.US)和亞馬遜(AMZN.US)在內的零售公司都提前推出了所謂的暖場促銷(Early Black Friday Deals)活動,活動上玩具和其他一些商品的折扣高達50%。

然而,據DataWeave提供的數據顯示,即使有大幅折扣,多數受歡迎產品的價格上漲幅度仍超出了促銷折扣。

與此同時, 美國11月密歇根大學消費者信心指數終值也從54.7上修至56.8,超過了普遍預期的55.0,但仍低於10月份的59.9。調查發現,由於高利率和高物價,消費者對採購耐用品的預期下降了21%。

“信心數據一直在下滑,”Jefferies經濟學家Thomas Simons對此表示,“因爲消費者試圖在穩定的經濟與受經濟衰退和通脹預期影響的勞動力市場狀況之間找到平衡。”

美國零售商表現“天差地別”

另一方面,由於消費者完全擺脫了疫情影響,有零售商不斷增加產品訂單以提高銷售額,但在通脹的衝擊下,也有不少企業陷入了庫存過剩的困境。

例如,儘管物價持續上漲,但由於預計食品雜貨需求將保持增長,主要深耕生活必需消費品領域的沃爾瑪(WMT.US)上調了年度銷售額和利潤預測。但依賴於非必需品的塔吉特預計,公司假日季度銷售額將有可能出現意外下滑。

本月迄今爲止,沃爾瑪股價上漲了7.1%,塔吉特股價跌幅則一度超過10%,截至週三收盤,塔吉特月度漲幅僅爲0.11%。

上週,百貨公司梅西百貨(M.US)也上調了年度利潤預測,該公司股價本月迄今上漲了超12%。但與此同時,由於價格上漲導致需求疲軟,柯爾百貨撤回全年業績指引,本月迄今爲止,該公司股價上漲了8.51%。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.