期權大單 | 亞馬遜業績預示經濟衰退,阿裏巴巴出現看漲大單

uSMART盈立智投 10-31 17:25

一、期權異動

10月28日,美股Amazon、Apple、Meta等標的出現了期權成交量上的較大變化,分別爲日常成交量的4.3、2.3、3倍。

科技巨頭上週接連“業績殺”,Meta淨利潤同比腰斬,谷歌增速回到2013年最低水平,亞馬遜業績遜於預期,蘋果則成爲“黑暗財報周”的大亮點。蘋果營收和利潤均超預期,績後周五收漲近8%,市值一夜暴漲約1761億美元,大摩分析師指“蘋果仍然是最好的持股之一”。

阿裏巴巴出現2023年1月20日到期、行權價爲65美元的看漲期權大單。淘寶“雙十一”預售在10月24日20點開啓,直播間預售火爆。國泰君安證券認爲阿裏即將公佈的最新業績中,核心商業利潤率將維持穩定,新業務預計持續減虧並驅動利潤率回暖。

財報顯示,亞馬遜三季度營業利潤絕對值下滑48%,營業利潤率僅爲2%,近年來最低。更重要的是,亞馬遜給出的四季度營收指引在1400億美元至1480億美元之間,同比增長僅2%至8%;營業利潤預計在0至40億美元之間,表明低利潤率還在持續。

要知道四季度是電商旺季,有聖誕節,有黑五促銷,有元旦,這樣都帶不動營收,可見亞馬遜對美國消費市場的信心嚴重不足。由此推導,我們可以判斷美國的宏觀經濟形勢真的不容樂觀,明年一季度開始衰退,或許並不是危言聳聽。

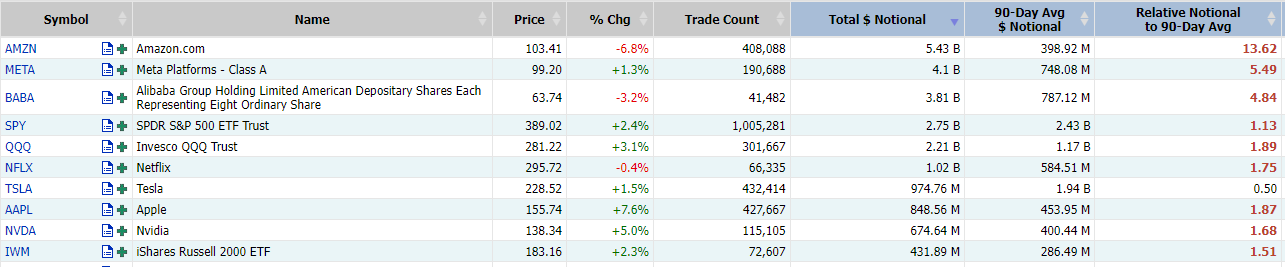

二、總成交量前10

美東時間上週五(10月28日),美股全線收漲,道指收漲2.59%,標普500指數漲2.46%,納指漲2.87%。期權市場方面,交易活躍度大增,期權成交總量爲47,442,174張,前值39,094,088張,遠高於90日平均成交量37,200,503。其中,看跌期權合約佔比47%,看漲期權合約佔比53%。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.