You are browsing the Hong Kong website, Regulated by Hong Kong SFC (CE number: BJA907). Investment is risky and you must be cautious when entering the market.

互聯網行業投資策略:憑誰問,廉頗老矣

本文來自格隆匯專欄:浙商互聯網謝晨,作者:謝晨

報吿要點

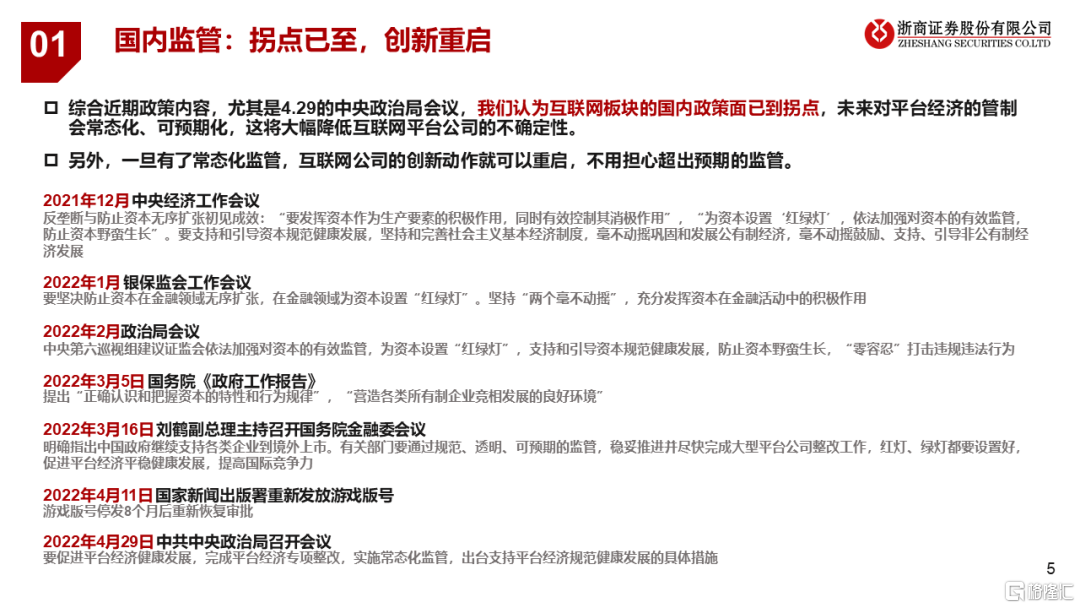

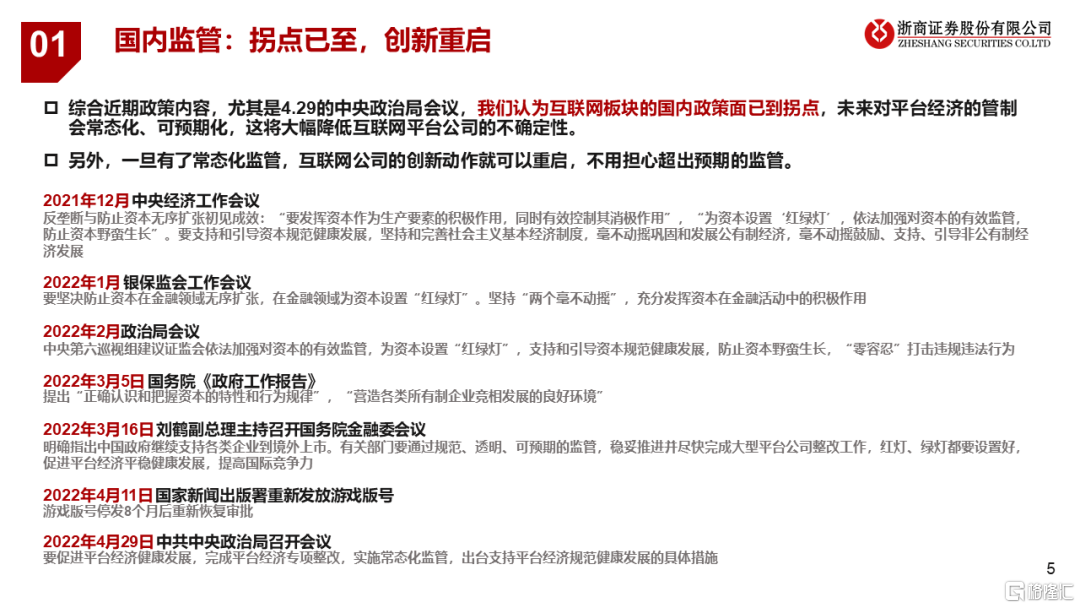

互聯網板塊長期向好,已是最佳窗口期。國內監管是壓制互聯網公司前期估值的核心因素,我們判斷拐點已至。互聯網行業將重新走向創新和成長

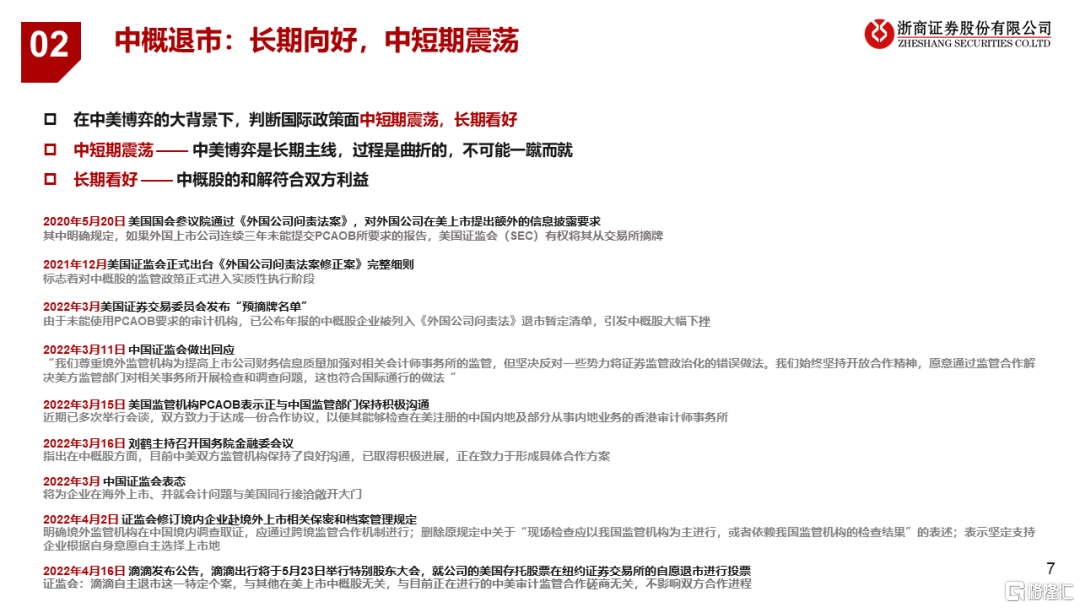

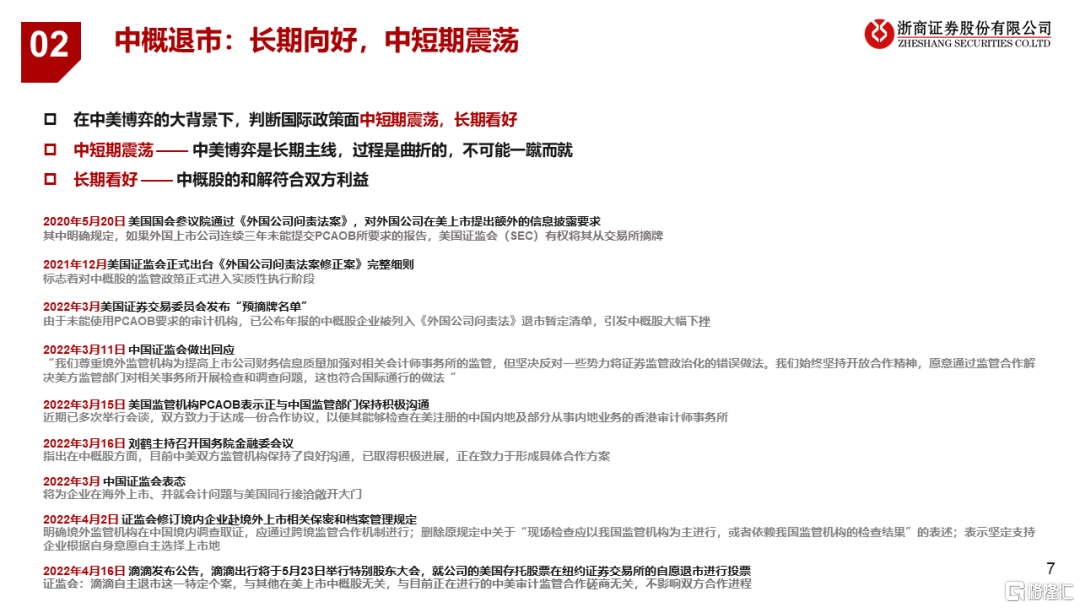

中概退市依然是中期波動率的核心來源。中概退市是中美博弈的一部分,過程必然是曲折的,但長期而言,和解符合雙方利益

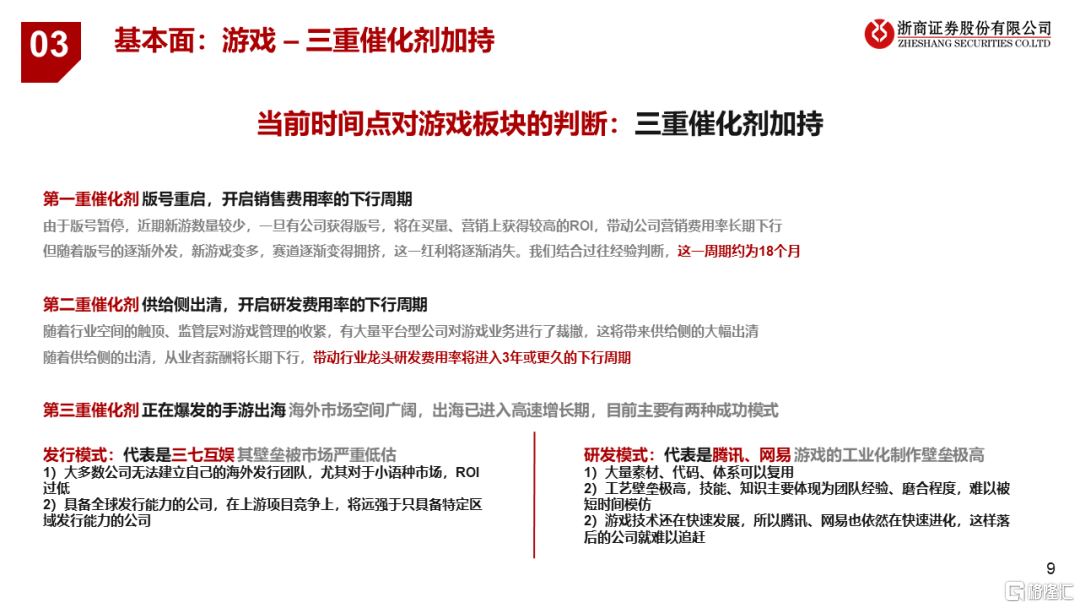

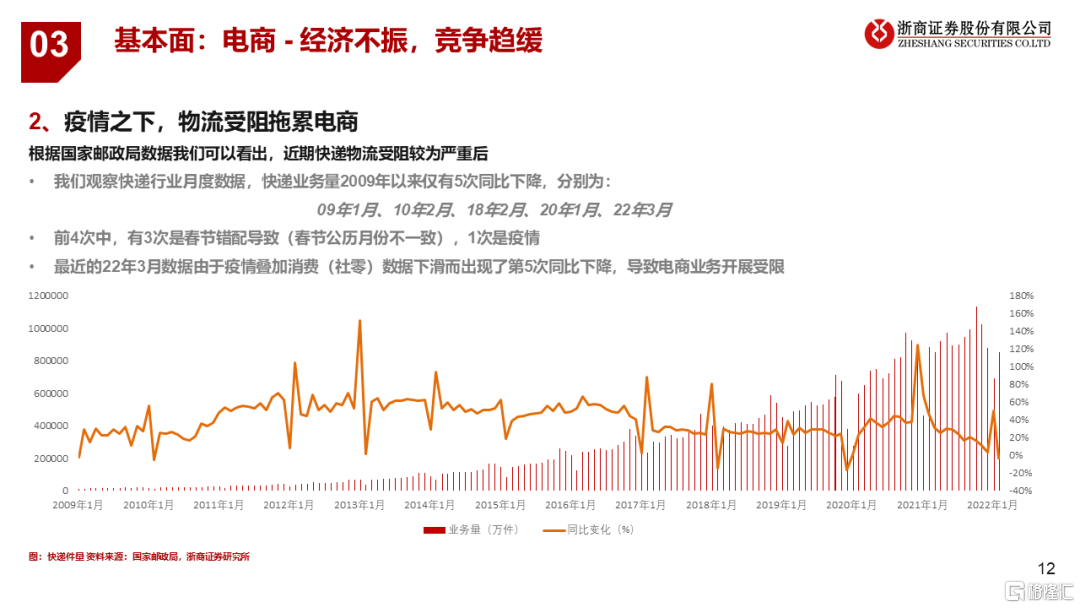

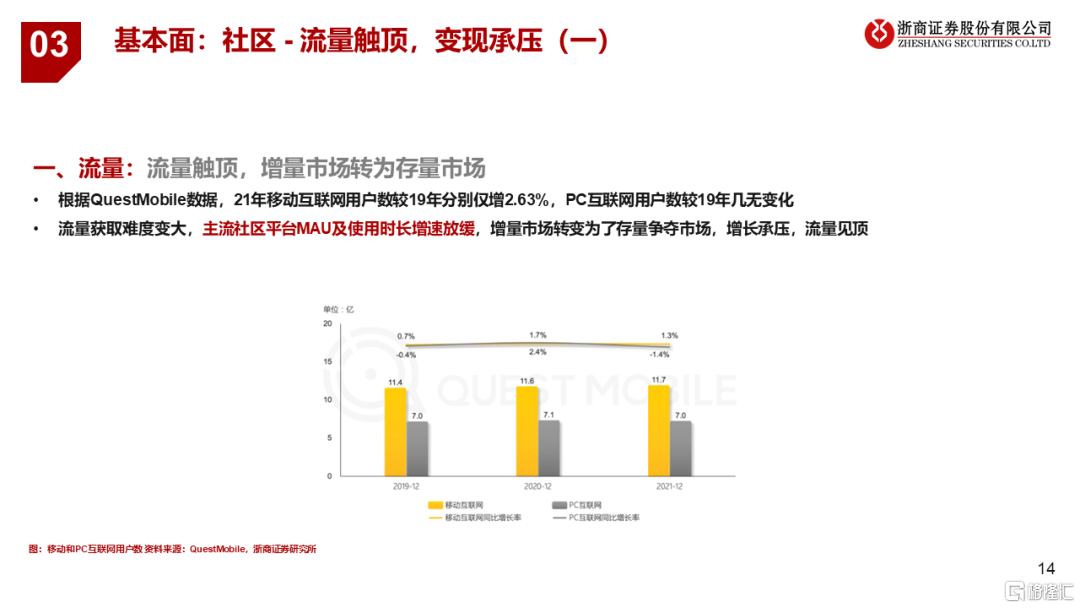

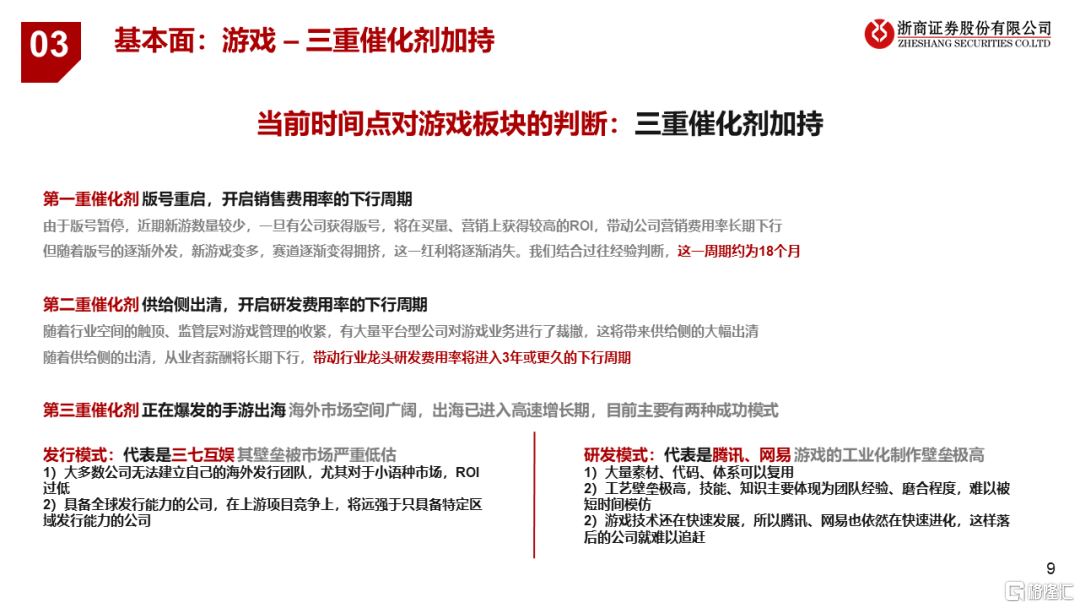

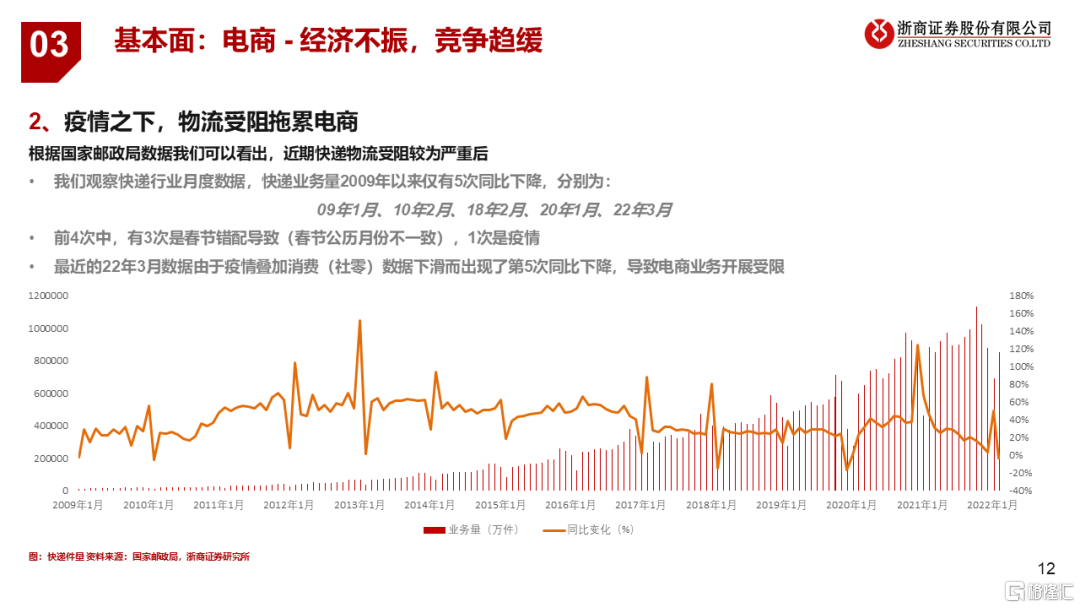

基本面或在Q2觸底。隨着經濟和疫情的恢復,整體業績將出現提升。遊戲行業可以期待出海業務帶來增量,電商行業可以看到競爭格局趨緩

投資標的

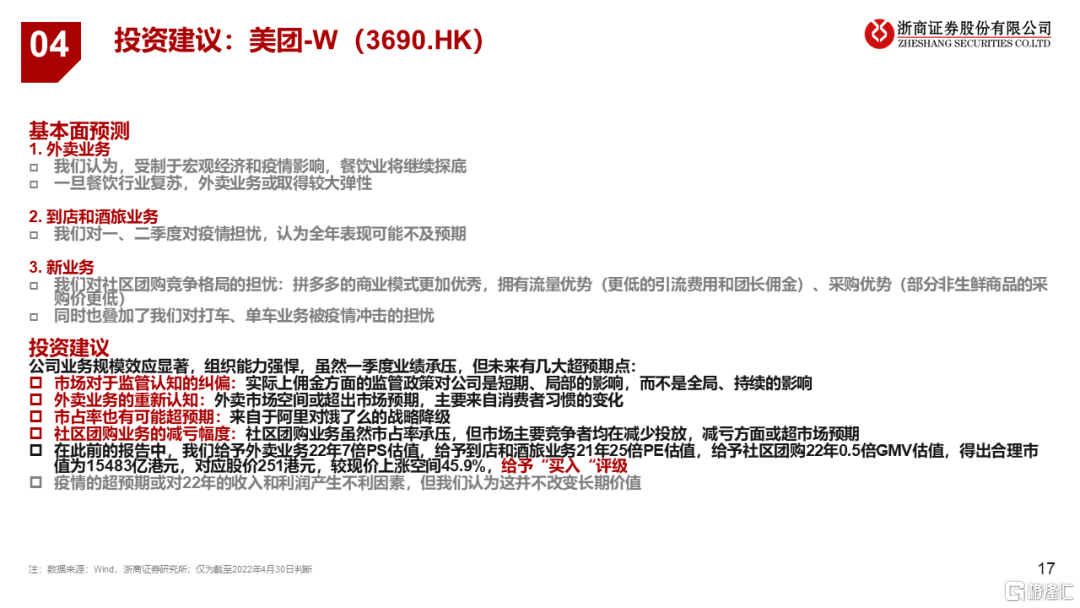

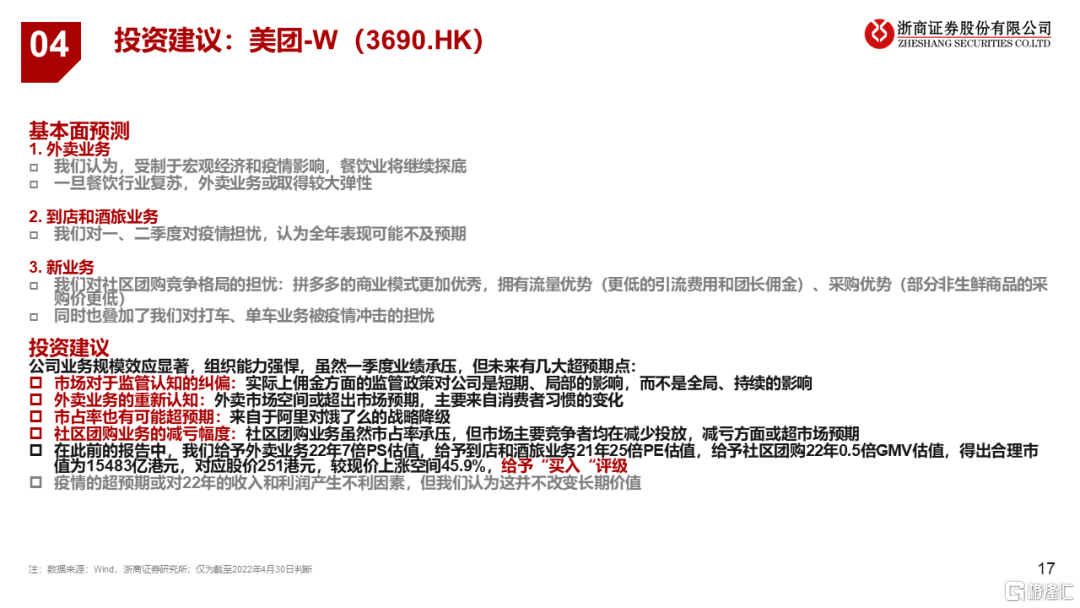

美團-W(3690.HK)

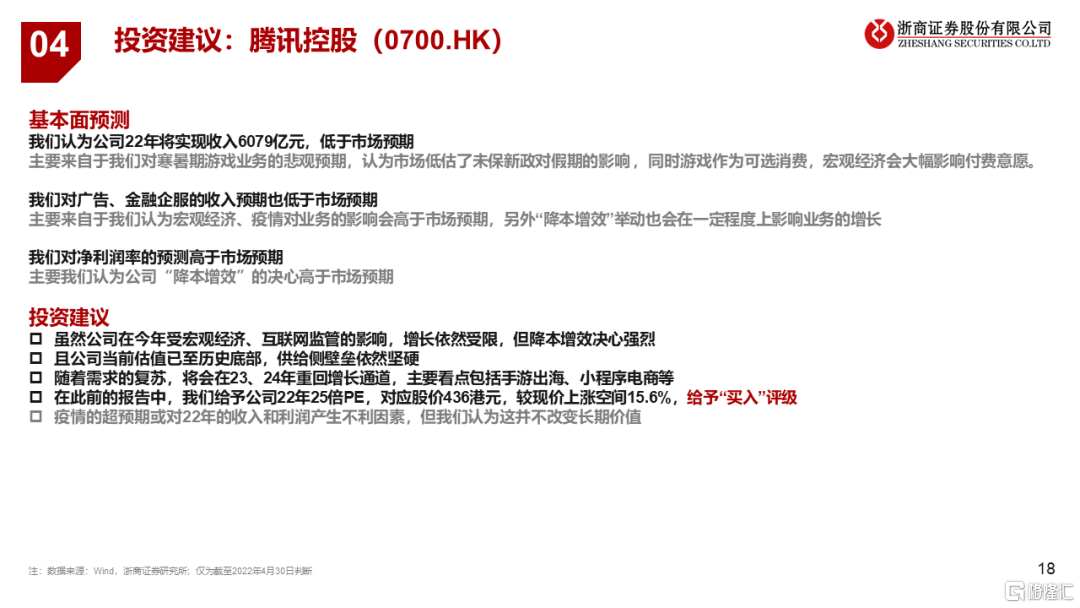

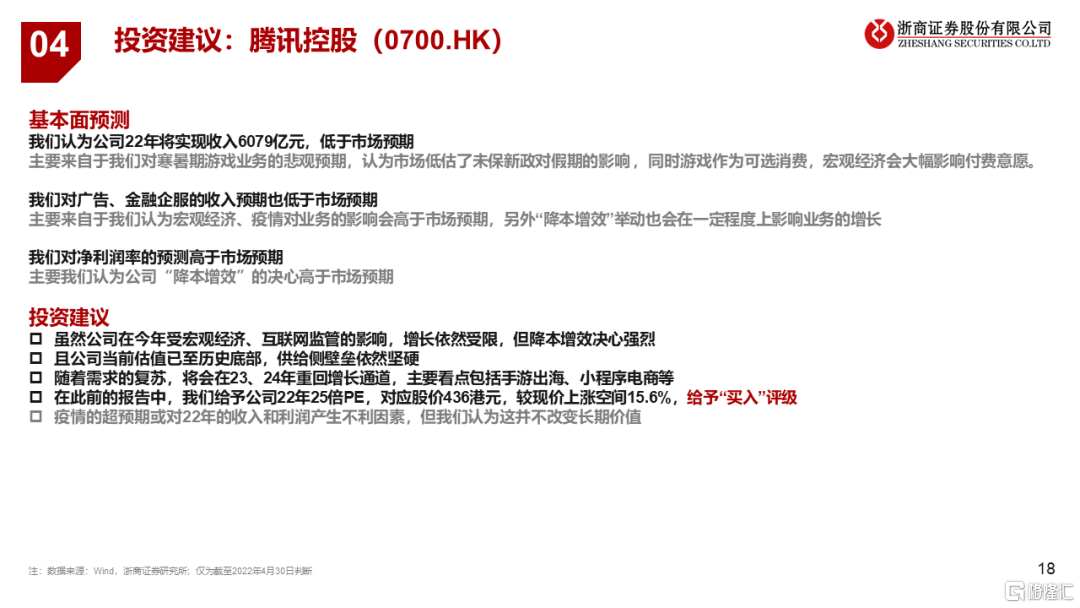

騰訊控股(0700.HK)

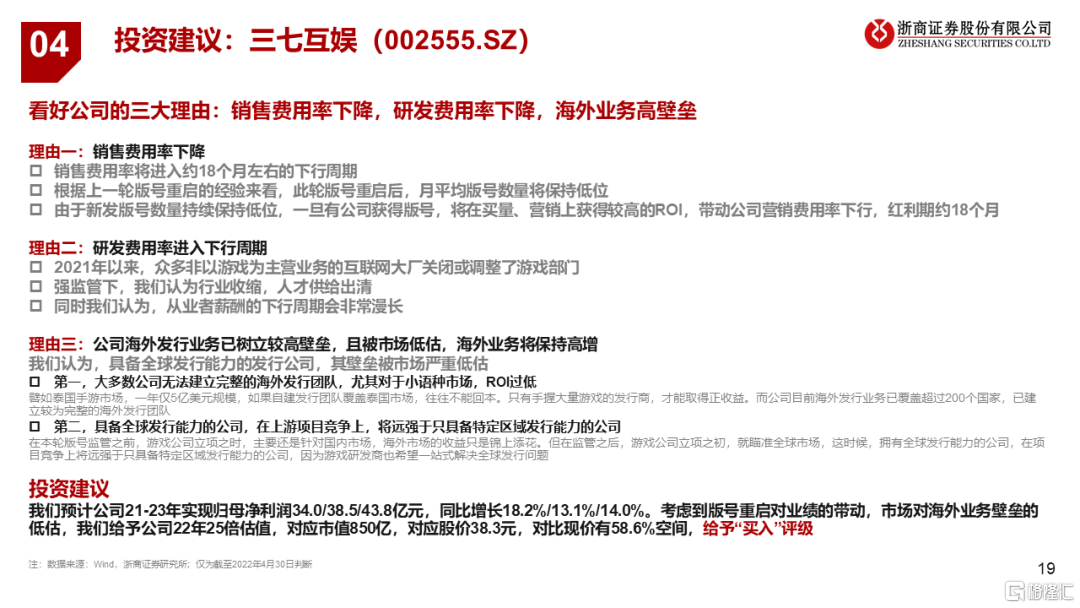

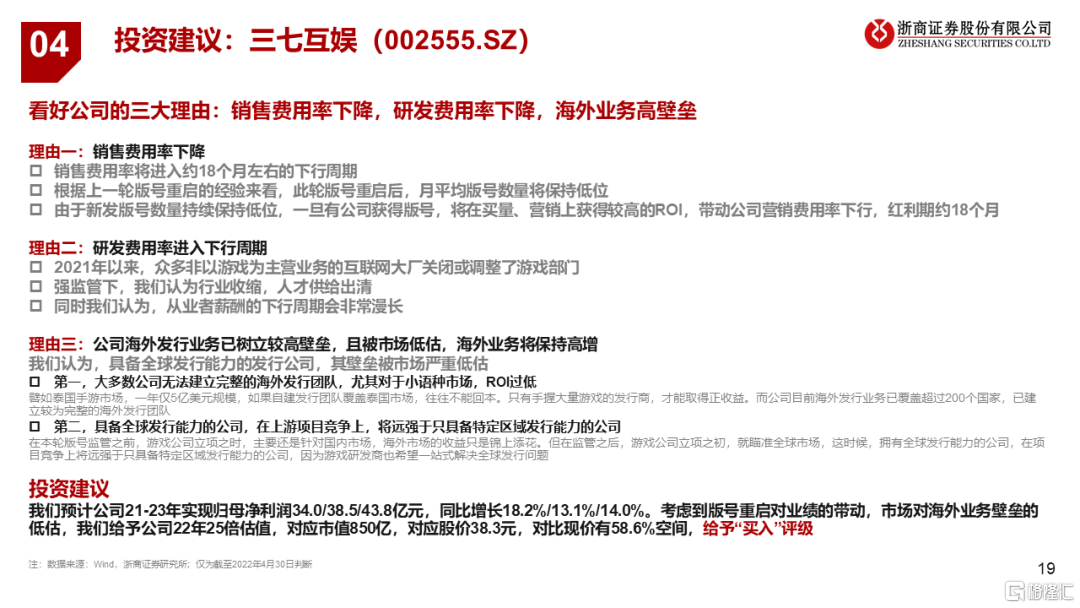

三七互娛(002555.SZ)

報吿正文

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.