個股熱度排行 | 3月28日港股盤前

根據uSMART輿情監測數據,週末期間,市場關注指數最高的5只股票是騰訊控股、美團-W、比亞迪股份、康龍化成、中國石油化工股份。

3月28日—港股關注排行TOP5

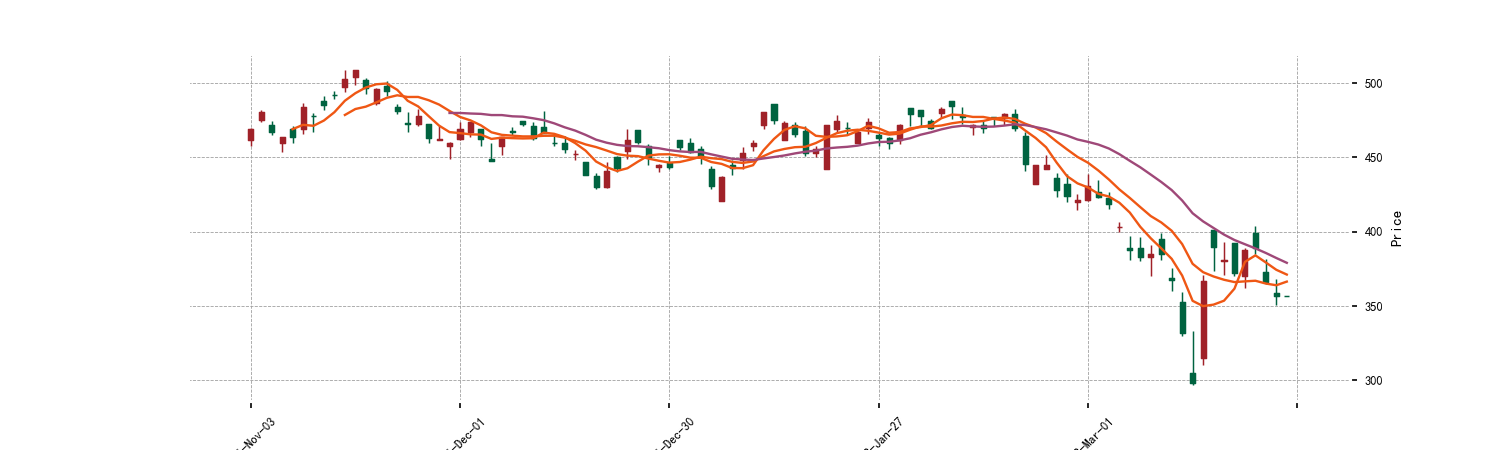

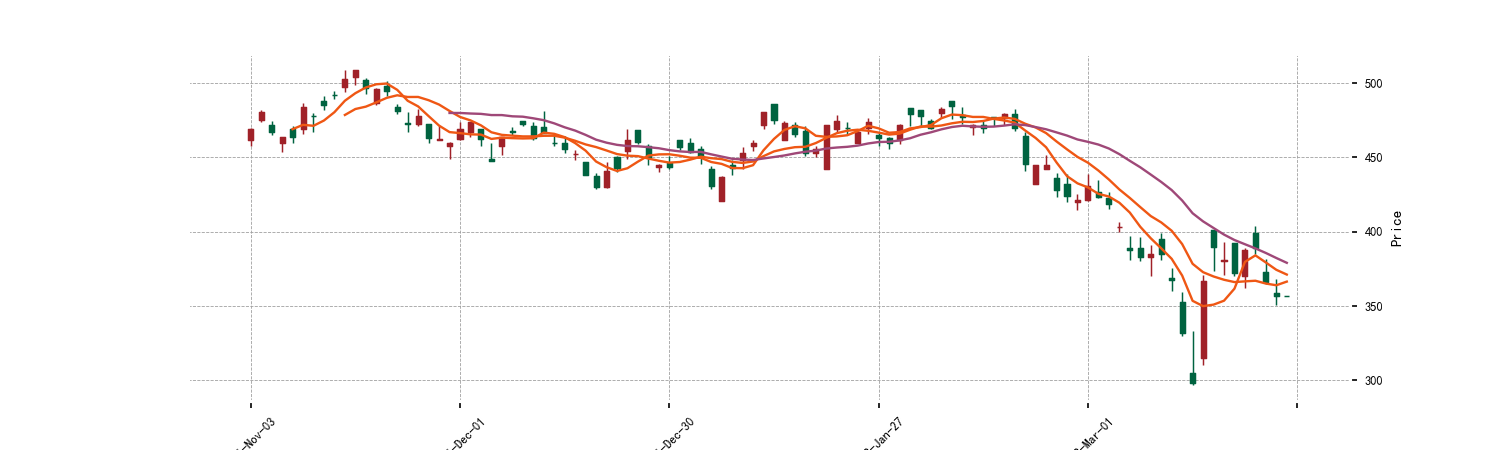

騰訊控股

關注度第一爲騰訊控股,該股上個交易日收盤下跌2.62%,報於356.40港元。近5個交易日累計下跌6.46%。在消息面和社交媒體方面,輿情以看多爲主。較被市場關注的消息有:

騰訊控股:3月25日耗資約3億港元回購83.8萬股

港股通騰訊淨流出8.7億港元

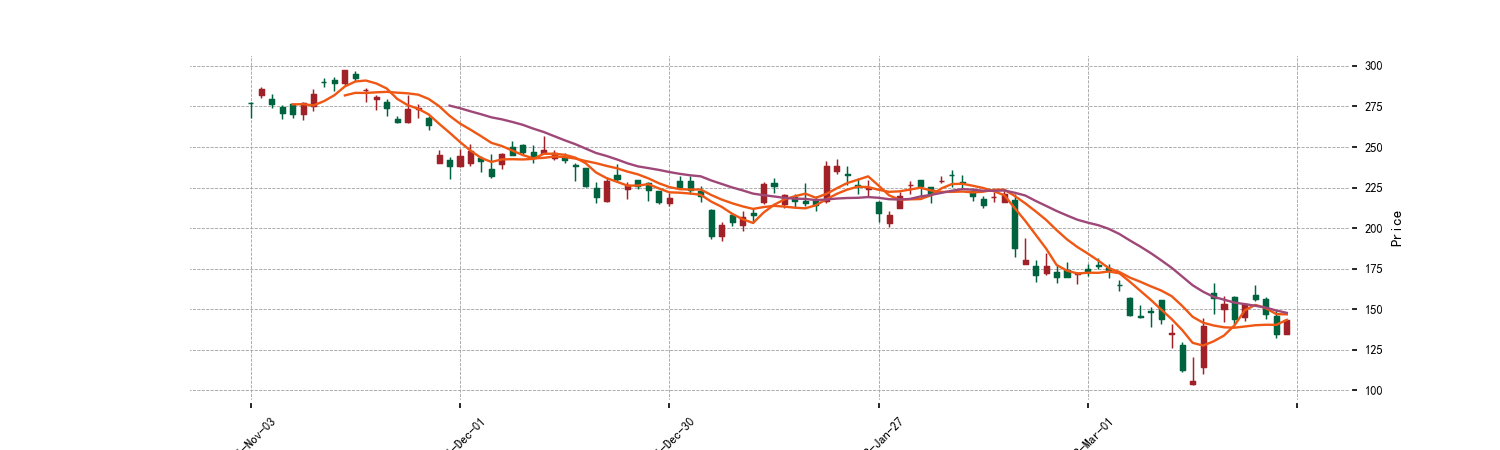

美團-W

關注度第二爲美團-W,該股上個交易日收盤下跌8.16%,報於135.00港元。近5個交易日累計下跌11.94%。在消息面和社交媒體方面,輿情以看多爲主。較被市場關注的消息有:

美團2021年由盈轉虧,騎手成本與研發費用等支出走高

美團-WQ1每股盈利及營收勝預期

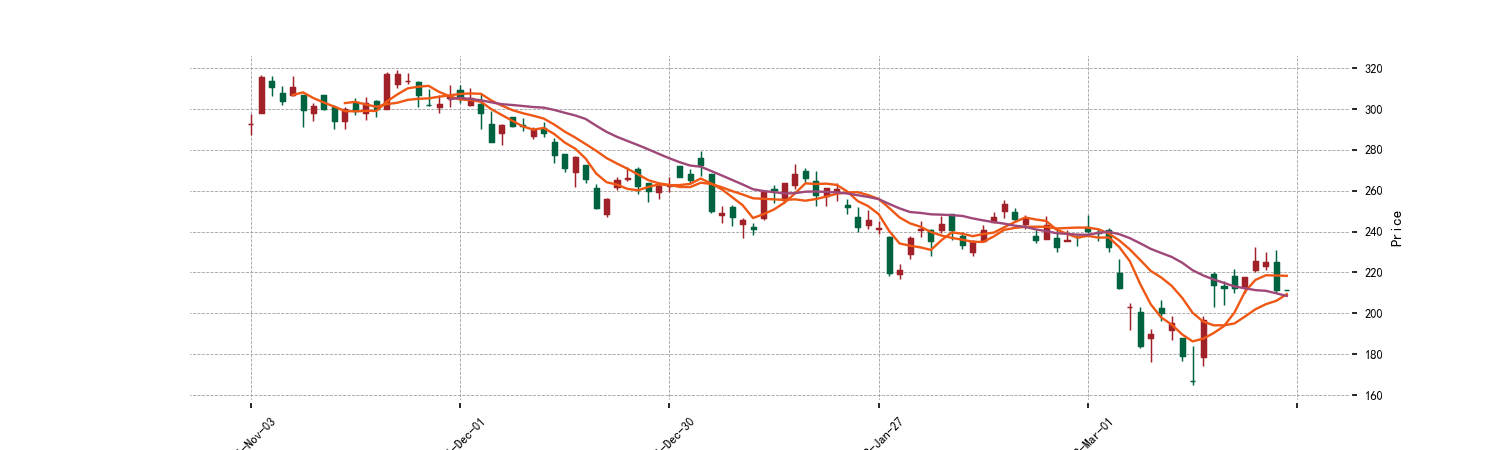

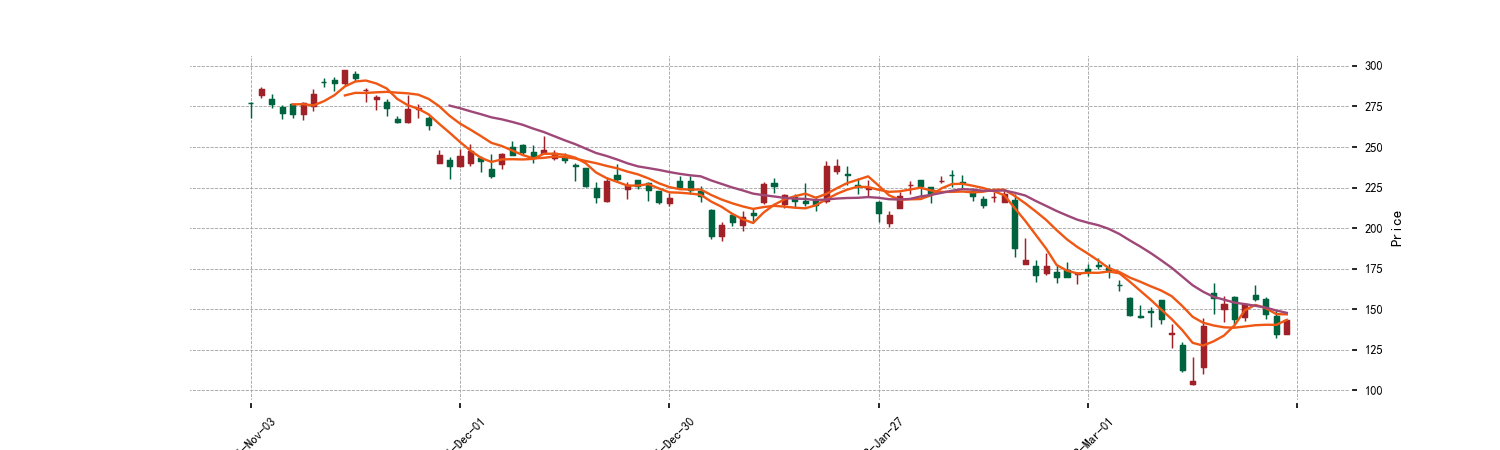

比亞迪股份

關注度第三爲比亞迪股份,該股上個交易日收盤下跌6.04%,報於211.60港元。近5個交易日累計下跌0.28%。在消息面和社交媒體方面,輿情以看多爲主。較被市場關注的消息有:

比亞迪王傳福:預計年底內地新能車滲透率可達35% 建議全面梳理碳酸鋰資源產能

比亞迪王傳福:量密度不再是動力電池最重要指標 預計今年底我國新能源汽車滲透率可達35%

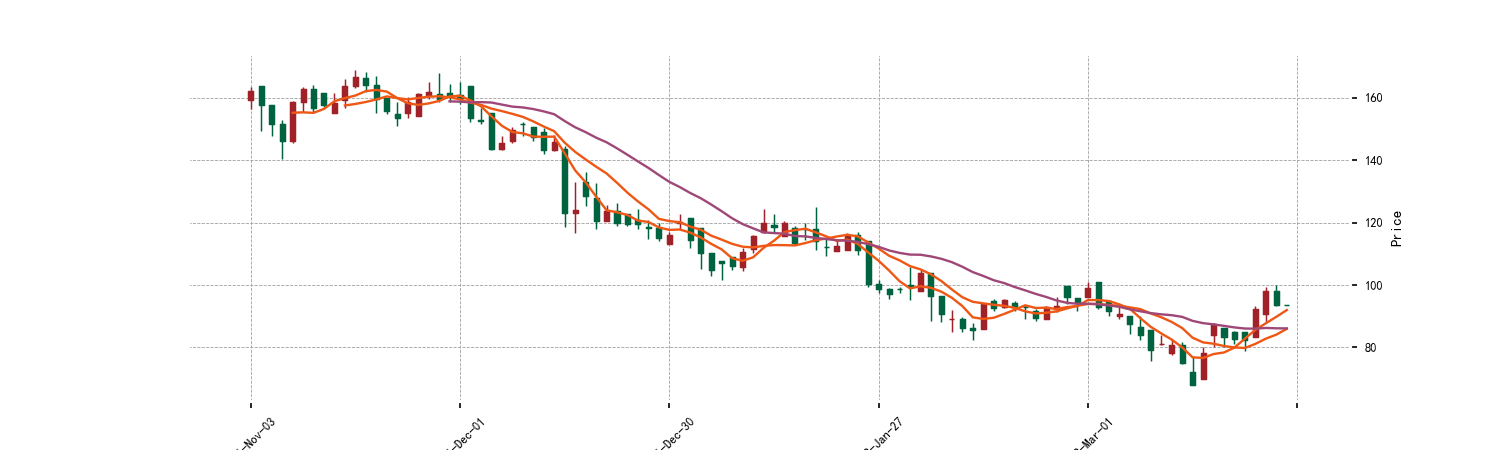

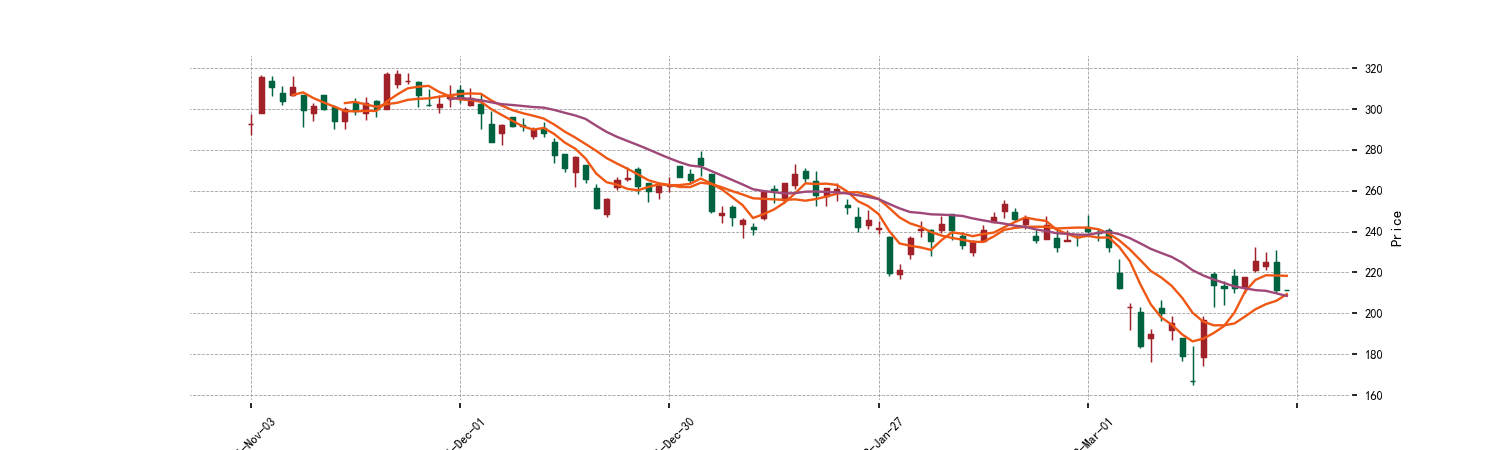

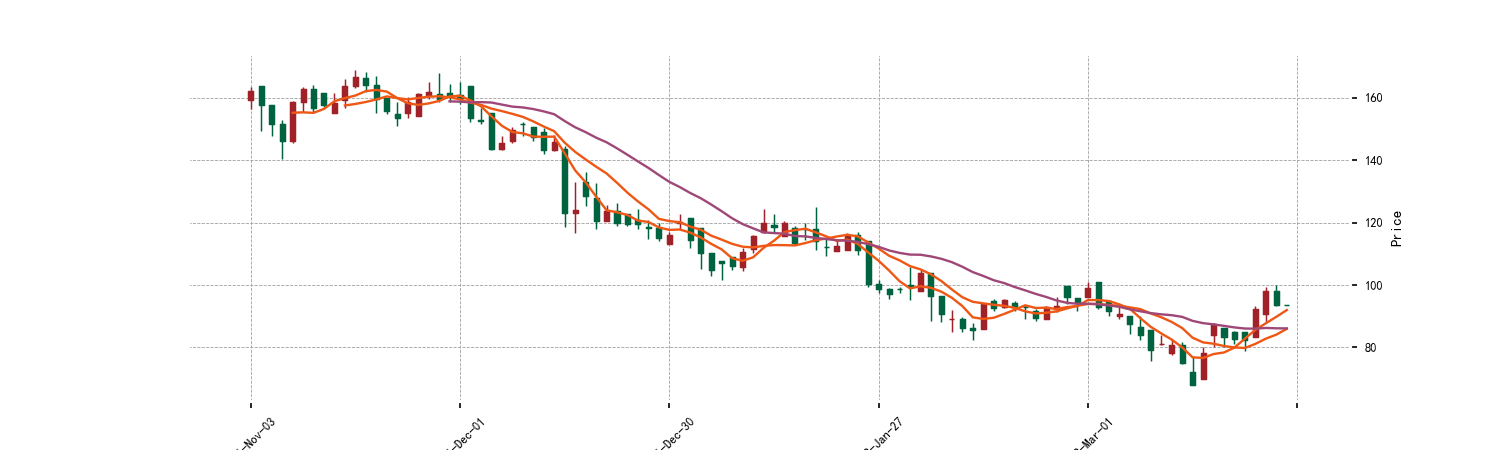

康龍化成

關注度第四爲康龍化成,該股上個交易日收盤下跌4.34%,報於93.65港元。近5個交易日累計上漲12.36%。在消息面和社交媒體方面,輿情以看多爲主。較被市場關注的消息有:

康龍化成發佈2021年業績,淨利16.61億元,增長41.68%,擬10轉5派4.5元

康龍化成公佈2021 年度利潤分配預案 擬每10股派4.5元轉增 5 股

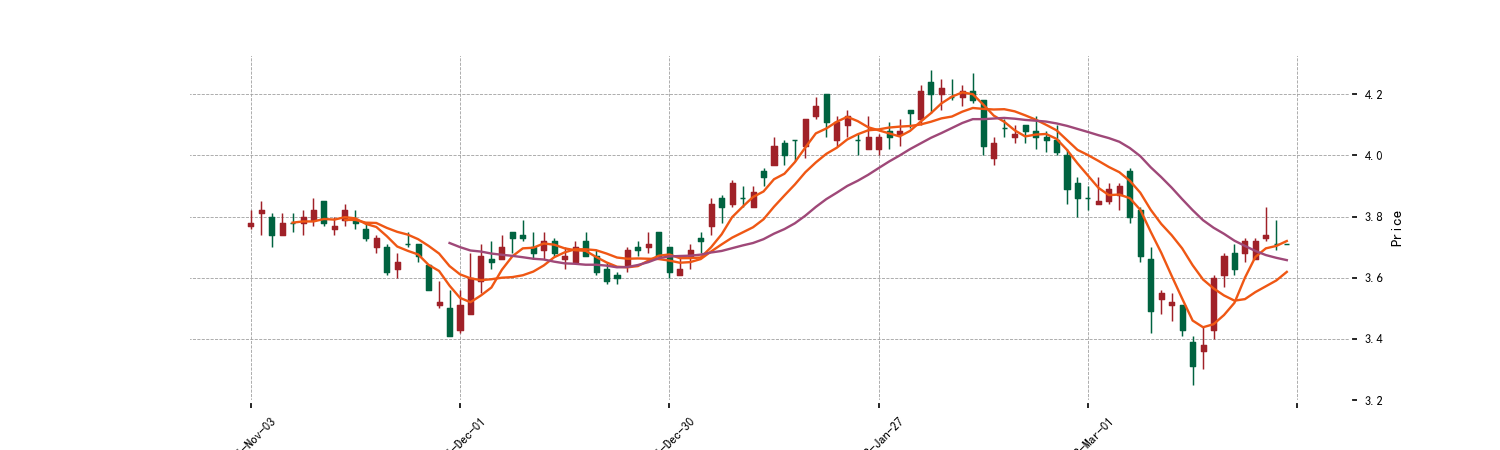

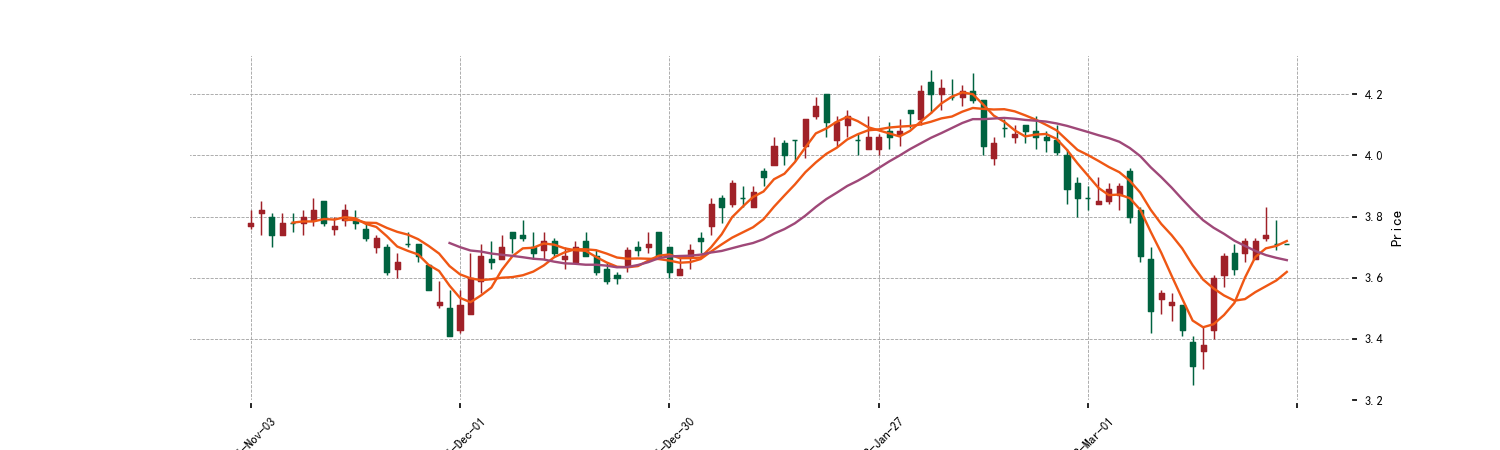

中國石油化工股份

關注度第五爲中國石油化工股份,該股上個交易日收盤下跌0.80%,報於3.71港元。近5個交易日累計上漲1.09%。在消息面和社交媒體方面,輿情以看多爲主。較被市場關注的消息有:

中國石油化工股份發佈2021年業績 股東應佔利潤719.75億元 同比增長115.2%

中石化去年純利712.08億人幣按年升1.1倍 末期息0.31元人幣

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.