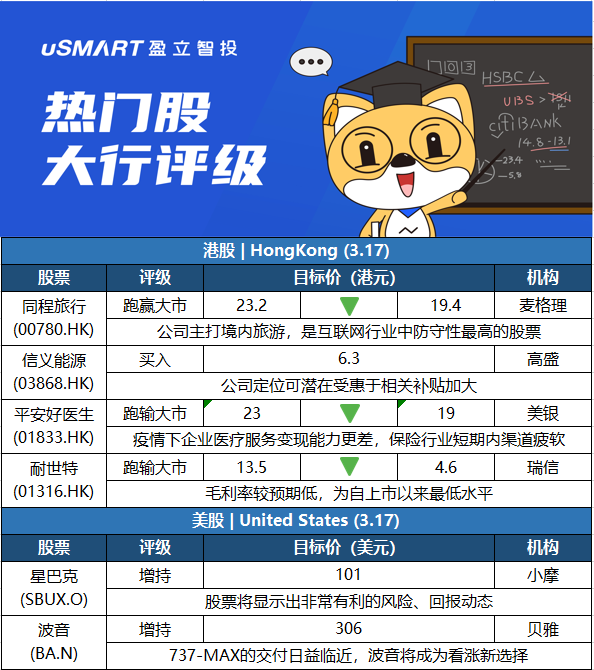

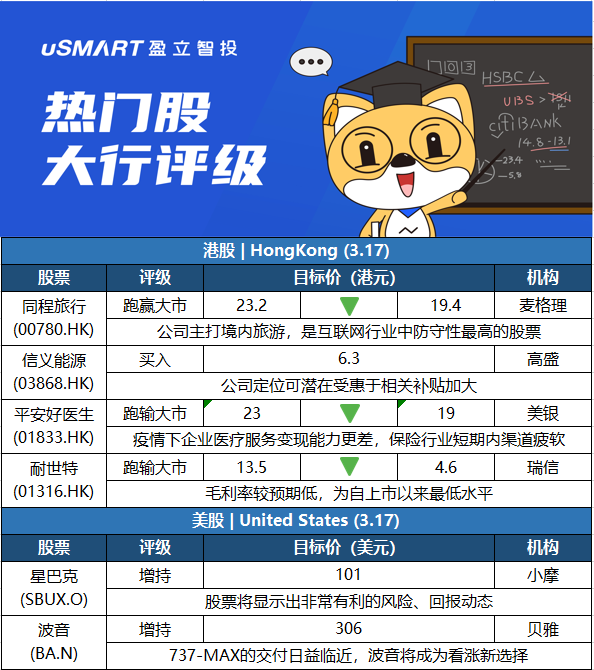

大行每日評級 |

麥格理:下調同程旅行(00780.HK)目標價至19.4港元 評級跑贏大市麥格理認爲,在近期市場波動下,同程旅行(00780.HK)主打境內旅遊,是互聯網行業中防守性最高的股票,主要是其現金狀況穩健及監管風險低的行業,評級跑贏大市。基於近期奧密克戎疫情爆發,該行下調同程2021年至2023年各年經調整純利預測7%、27%及16%,目標價調低16.4%,由23.2港元降至19.4港元。

高盛:將信義能源(03868.HK)納入確信買入名單 目標價6.3港元

高盛發表報告表示,將信義能源(03868.HK)納入確信買入名單,維持買入評級及目標價爲6.3港元,指公司定位可潛在受惠於相關補貼加大,並指其現估值相當於預測內含價值對EBITDA的11.7倍,接近過去三年平均,加上,考慮到加速的可再生能源補貼支付時間表,該行將信義能源2022年2025年淨收入預測上調0.4%至1%。該行表示,即使市場在2021年第四季太陽能需求較低、及在2022年市場存有不確定因素,指公司2021年業務仍有穩健表現,加上較少受到貿易緊張局勢和國際貨運影響,信義能源定位爲更具防禦性的下遊運營商,令其股票仍於過去一年表現超出預期。

美銀證券:將平安好醫生(01833.HK)目標價由23港元調低至19港元,重申評級跑輸大市美銀證券發表研究報告,平安好醫生(01833.HK)去年下半年收入、經調整虧損與市場預期相若,其將業務重新分爲兩部份,包括醫療服務及健康服務,但二者2021年下半年收入均按年下跌。該行預期,由於宏觀環境及企業渠道的疫情風險,平安好醫生的醫療服務變現能力更差,保險行業短期內保險渠道疲軟,將2022年收入按年增長預測降至6%,預期經調整淨虧損12億元。

瑞士信貸:將耐世特(01316.HK)評級由跑贏大市降至跑輸大市,目標價由13.5港元下調至4.6港元瑞信發表報告指,耐世特去年下半年純利按年下跌69%至3500萬美元,遠低於市場預期;主要令人驚訝之處是毛利率較預期低,按年下跌7.5個百分點,較上半年亦下跌4.6個百分點,至8.4%,爲自上市以來最低水平。該行表示,公司認爲毛利率下跌是因原材料成本上升,僅能被客戶恢復(約66%)所部分抵銷。此外,運輸及物流成本也有增加,且生產效益亦因下遊車廠暫停生產而受到挑戰。瑞信降耐世特今明兩年盈測介乎31.6%至50.1%,下調目標價和評級以反映下調毛利率預測。

摩根大通:將星巴克(SBUX.O)評級上調至增持,目標價維持爲101美元摩根大通分析師John Ivankoe將星巴克(SBUX.O)評級從中性上調至增持,目標價維持爲101美元。John Ivankoe預計星巴克2023財年的總國際營業利潤水平爲12.9億美元,與2019年持平,而不是他之前預計的19.3億美元。Ivankoe表示,即便是按照這個新的預估值,星巴克的股票“也將顯示出非常有利的風險/回報動態”。他認爲,星巴克品牌應該保持其“平價奢侈品”的地位,估值可以推動股價上漲。

貝雅:重申波音(BA.N)增持評級以及306美元的目標價貝雅分析師Peter Arment 重申波音(BA.N)增持評級以及306美元的目標價。Arment表示,隨着737-MAX的交付日益臨近,波音將成爲看漲新選擇。他注意到了近期的拋售,但同時預計第一季度末或第二季度初將恢復交付。他還指出,恢復在中國的交付計劃對於該公司的波音737-MAX生產率計劃和長期費用現金流恢復至關重要。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.