U streaming giant Netflix (NASDAQ: NFLX) reported stronger-than-expected results for the third quarter of 2025, with both revenue and earnings surpassing market forecasts. The upbeat performance fueled a sustained post-earnings rally in its share price. As of the latest close, Netflix traded at US$1,241.35, firmly above the US$1,200 level, signaling renewed capital inflows. Analysts attributed the rally to improved profit quality and an optimized business structure.

(Image source: uSMART HK app)

(Image source: uSMART HK app)

Revenue and Profit Both Surpass Market Estimates

According to the earnings release, Netflix posted Q3 revenue of US$11.51 billion, up 11.7% year over year, exceeding market expectations of around US$11.3 billion. Net income reached US$2.246 billion, a sharp increase from US$1.537 billion in the same period last year, with margins continuing to expand. Diluted EPS came in at US$5.92, also above consensus estimates.

|

Financial Metrics (Q3 2025) |

Data |

|

Revenue |

US$11.51 billion |

|

Operating Income |

US$3.248 billion |

|

Net Income |

US$2.246 billion |

|

Diluted EPS |

US$5.92 |

(Image Source: Netflix Q3 Earnings Report)

Management noted that profitability improved mainly due to steady growth in paid subscriptions, alongside higher ARPU (average revenue per user) driven by its advertising tier and membership segmentation strategy. Effective cost control on content spending also supported continued operating margin expansion.

Subscriber Growth Remains Solid, Advertising Emerges as a Second Growth Engine

Netflix said global paid subscriptions continued to rise in the third quarter, supported by its diversified content strategy and expanding ad-supported membership plan. North America maintained steady growth, while the Asia-Pacific region remained a key source of new users. Management emphasized that the affordable ad tier continues to gain traction and is expected to become a major growth driver in the coming years.

Outlook and Risks: Brazil Tax Case Tempers Netflix’s Momentum

Looking ahead, Netflix expects fourth-quarter revenue growth to remain strong and plans to ramp up investment in content production, gaming, and AI-driven recommendations to enhance user engagement and monetization. The company maintained its full-year guidance for profitability and free cash flow, with its strong content ecosystem and expanding ad business expected to underpin industry leadership.

However, alongside its solid fundamentals, Netflix faces a new headwind. The company disclosed that Brazilian tax authorities have launched a back-tax investigation into its local subsidiary, which could result in an additional several hundred million dollars in tax provisions. The news sent Netflix’s shares down more than 4% in after-hours trading. While the tax issue is seen as a one-off event with limited long-term impact, it may temporarily dampen investor confidence in the company’s earnings stability.

Overall, Netflix continues to demonstrate strong operational resilience and a clear growth trajectory. If it can effectively resolve the tax issue and further strengthen its dual growth engines of content and advertising, analysts believe the company’s long-term valuation upside remains intact.

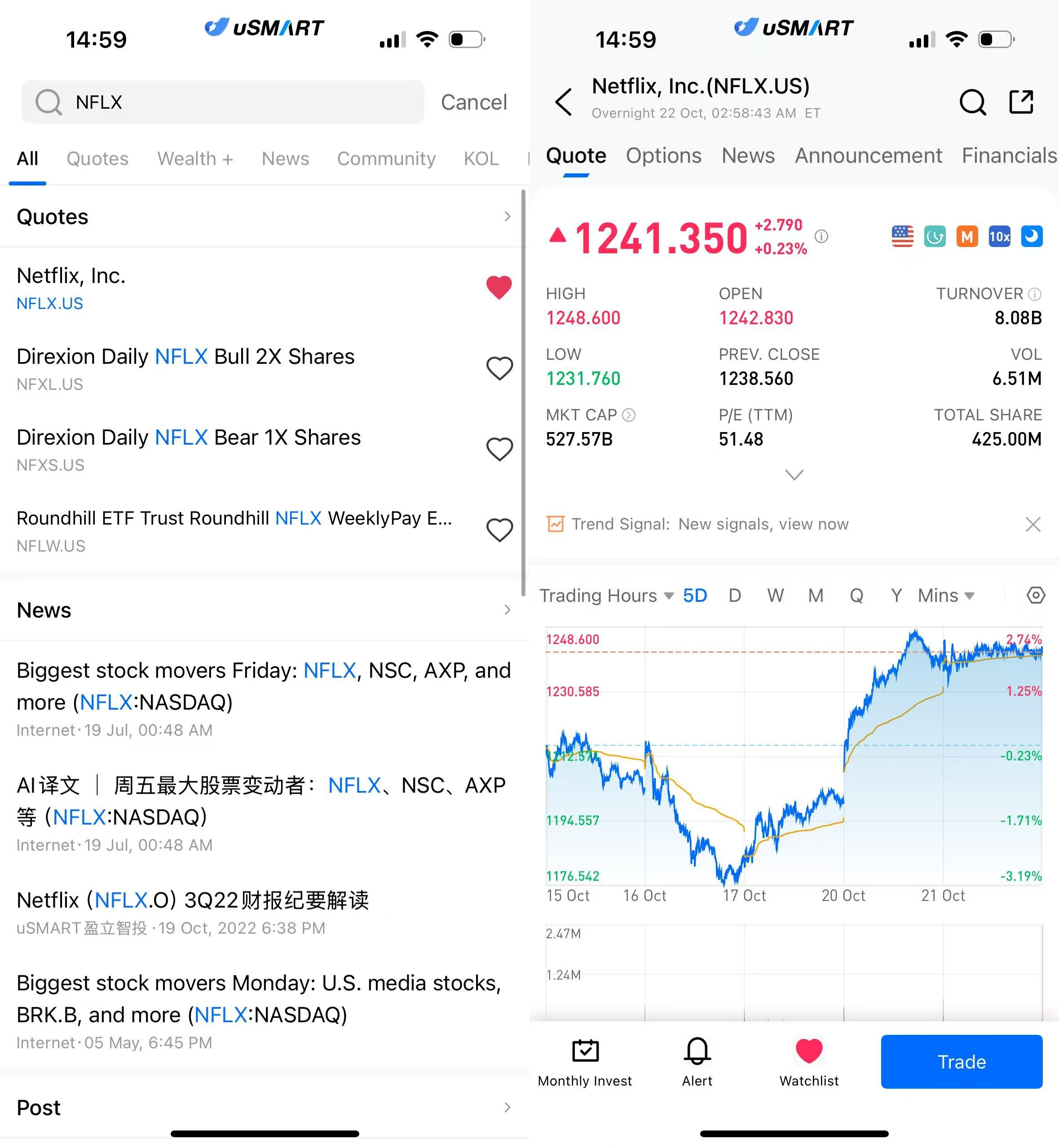

How to Buy Netflix on uSMART HK

After logging into the uSMART HK app, click on “Search” at the top right of the page, input the stock code (NFLX.US) to access the details page and view transaction details and historical trends. Then click the “Trade” button at the bottom right, select the “Buy/Sell” option, fill in the transaction conditions, and submit your order.

(Image Source: uSMART HK app)

(Image Source: uSMART HK app)