全球還在缺芯?供過於求已初露端倪

uSMART盈立智投 10-15 22:24

全球對半導體的訂單不斷增加,但這種強勁需求可能是由業界囤貨推動的。當供應鏈瓶頸緩解時,這可能是一個大問題。

得益於蘋果(AAPL.US)、英偉達(NVDA.US)和美國超微公司(AMD.US)等客戶的訂單,臺積電(TSM.US)週四公佈了創紀錄的利潤。 這種樂觀情緒將在可預見的未來持續下去,該公司預計全年營收將增長24%。

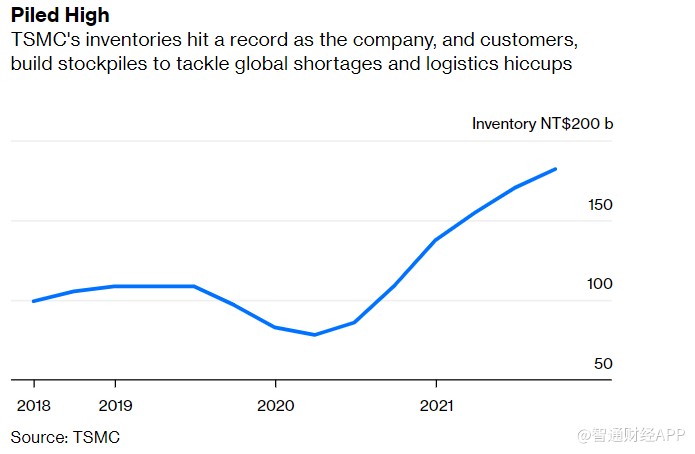

但這些訂單中的很大一部分並非用於滿足全球對電子產品、聯網汽車和加密貨幣礦場的需求。 截至9月底,臺積電的庫存較上年同期增長66%,這是該數字連續第四個季度攀升超過65%。另一個衡量庫存的指標——庫存天數保持在85天的高位。

臺積電也意識到了這一情況。該公司首席執行官魏哲家告訴投資者,他預計客戶和供應鏈上的其他公司在年底前繼續增加庫存,並在較長一段時間內保持較高的庫存水平。這意味着臺積電並不是業內唯一一家存在高庫存問題的製造商。

Bloomberg專欄作家Tim Culpan認爲,這是一個令人擔憂的問題。臺積電一半以上的營收來自其最先進的5NM和7NM工藝。 一般來說,製程越先進,上架銷售的時間就越短:需要最新、最好芯片的客戶需要不斷升級。但全球瓶頸正迫使客戶下比平時更大的訂單,以避免在物流中斷時出現短缺。

Culpan表示,有很多行業可以在沒有太多風險的情況下儲存產品,比如煤炭、穀物,甚至較老的電子元件。 然而,在芯片行業的前沿,產品可能會在半年之內變得過剩,這一點客戶都知道。 如果客戶開始看到終端需求下滑,那麼他們很有可能會大幅削減訂單,以便消化已經囤積起來的庫存。

最後,Culpan警告稱,儘管全球仍面臨芯片短缺,但現在是時候清理積壓的芯片了。當前對芯片的高需求可能很快導致供過於求,當供應鏈重新開始平穩運轉時,要想消除這種供過於求可能會很痛苦。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.