牛市將持續到2038年?華爾街大多頭:千禧一代將撐起美股

uSMART盈立智投 09-27 17:16

Fundstrat全球顧問公司創始人在週五表示,數萬億美元的資金流入能夠承受風險的千禧一代,這將在未來數年提振股市基本面,因此很難讓投資者變得悲觀。

在之前研究的基礎上,Lee 公開了四個相關的數據:

- 根據 Fundstrat 估計,每年有 2 萬億美元的遺產通過繼承從嬰兒潮一代流向千禧一代

- 未來20年,千禧一代將從前幾代人那裏繼承76萬億美元

- 千禧一代更喜歡股票和加密貨幣等風險較高的投資標的

- 嬰兒潮一代在財富池中所佔的相對份額正在縮小,這意味着千禧一代的資產偏好將推動一場結構性轉變

Lee表示,從這些數據點中得出的邏輯結論是,投資者應該對股市採取長期看漲的觀點。

不過,他之前也提出過類似的觀點,認爲股市將持續看漲。他指出,還有其他結構性因素推動股市上漲,如寬鬆的貨幣政策和大量現金在場外觀望。

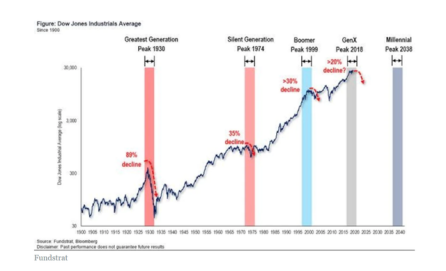

“這輪牛市預計會到 2038 年。因爲人口結構決定長遠發展,所以美國股市將表現不錯,自 1900 年以來的每個股市高峯都與一代人的“消費能力”峯值相吻合。”Lee說道。

他補充說,股市的峯值可以用每一代人的“消費能力”峯值來解釋,由於千禧一代的黃金年齡(30至50歲)預計要到2038年纔會見頂,股市未來應該會有很長的上漲期。

“木頭姐”Cathie Wood也認同他的理論,並引用了 Lee 的研究作爲證據。她說:“我確實相信加密貨幣市場和股票市場的大繁榮都將由千禧一代提供動力。他們這一代人正處於技術變革的前沿,對當今不斷髮展的新技術展現出很濃厚的興趣。”

Lee還提到了美聯儲的新數據,該數據顯示,美國家庭財富在第二季度飆升至 142 萬億美元。其中只有 46 萬億美元投資於美國股票,理論上仍有 100 萬億美元可以分配給股票市場,這突顯出股市還有巨大的上漲空間。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.