蘋果股價上漲的原因,你找到了嗎?

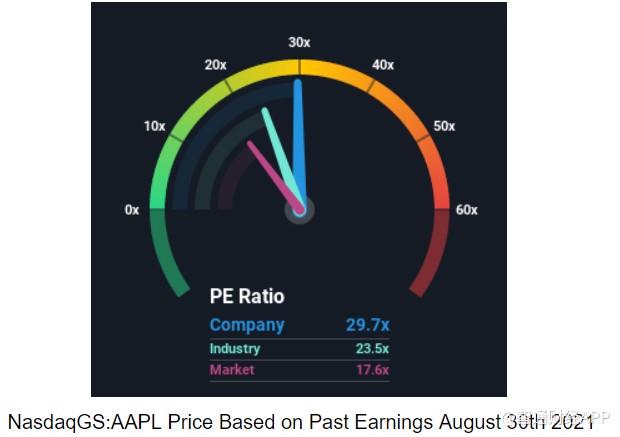

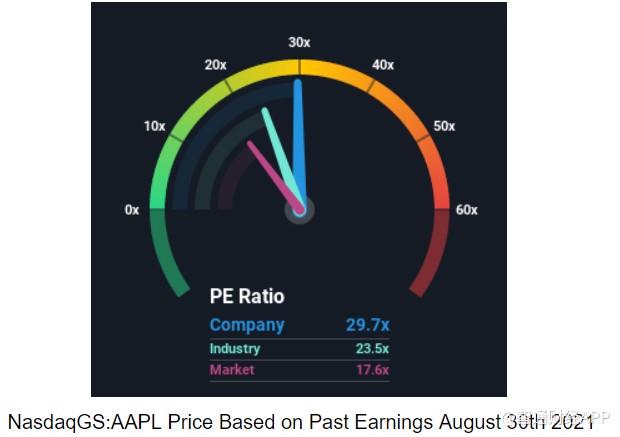

蘋果(AAPL.US)的市盈率達29.7倍,遠高於市場和行業平均估值水平。儘管估值很高,蘋果仍然是備受投資者青睞的投資標的。

顯然,蘋果在現金流、營運資金管理、盈利能力,尤其是回報率等多方面表現出色。蘋果最近公佈的收益增長超過了大多數公司,表現相對不錯。 投資者認爲這種強勁的盈利表現將持續下去。

蘋果是否有足夠的增長空間?

蘋果的高市盈率在強勁增長的公司中並不罕見,重要的是,該公司的表現要比市場好得多。

蘋果去年收益增長率高達55%,最近三年的每股收益增長了85%。

展望未來,分析師估計,未來三年蘋果每年將實現6.0%的增長。 與此同時,市場其他公司預計將以每年12%的速度增長,明顯更具吸引力。

從這個角度來看,相對於市場平均估值,蘋果的市盈率太高了。

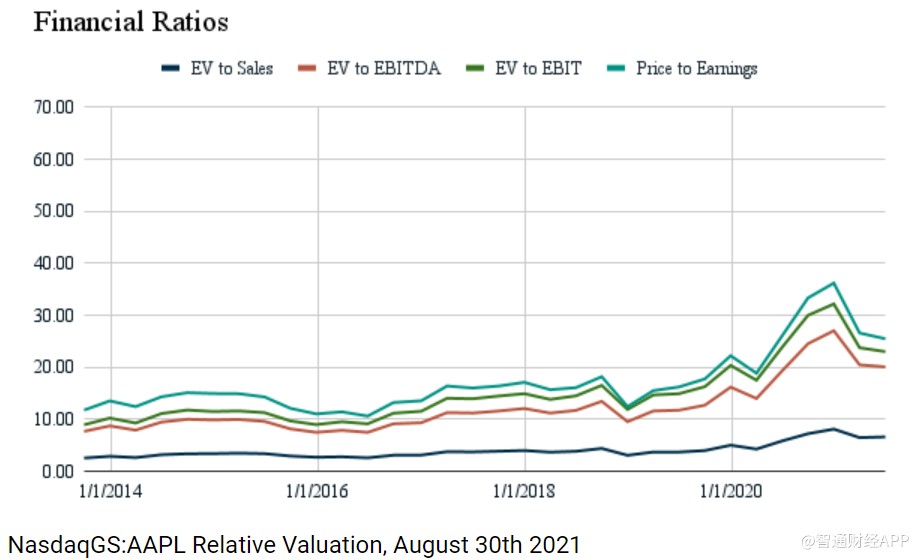

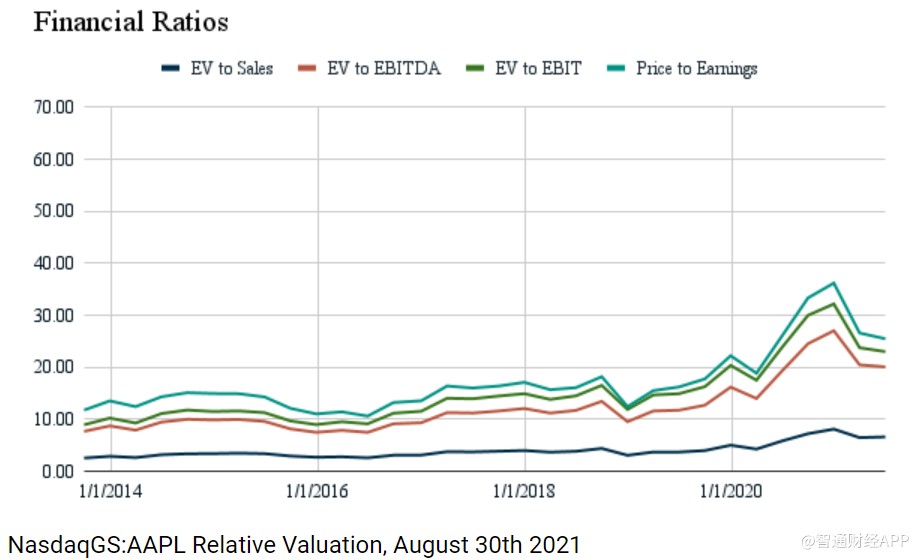

Simply Wall St 分析師Goran Damchevski 將銷售額和三種利潤指標與市場估值進行了比較。在一個健康的市場環境中,投資者可以預期市場會適當調整增長,這樣的圖表會產生相對一致的水平線。

可以看到,2018年之後,市場對蘋果的利潤不再那麼嚴格。 與其他指標相比,市場估值與銷售額的比率出現了偏差。對此,有人認爲,銷售增長更多地與股價保持同步,其次是收益增長。

我們還可以注意到,市場會定期進行修正。 預測未來的時間跨度越長,修正就變得越不穩定。

因此,Damchevski提醒投資者,如果有興趣購買蘋果股票,長期持有可能是避免一些波動的更好策略。

結論

蘋果股票目前比市場和行業平均估值水平更貴。

營收增長似乎跟上了股價的上漲步伐,然而,公司的利潤增長率落後於股價。

需要明確的是,蘋果的增長速度仍然很快,但市場對現金流的要求似乎降低了。

蘋果仍然是一家表現無可挑剔的穩健公司,但其股票開始顯示出未來短期波動的跡象,投資者可能需要考慮採用長期持有的策略來抵消這一影響。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.