全球最大主權基金“日賺”6億美元!看看都買了啥?

全球最大主權基金挪威政府全球養老基金(Government Pension Fund Global)表示,在2021年上半年基金回報率爲9.4%,回報約爲9900億挪威克朗(合約1110億美元),日賺約6億美元。

截至2021年6月30日,該基金的資管規模爲1.356萬億美元。其中72.4%投資於股票,25.1%投資於固定收益,2.4%投資於未上市房地產,0.1%投資於未上市的可再生能源基礎設施。

其中股票投資的收益率爲13.7%,固定收益投資的收益率爲負2.0%,未上市房地產投資的收益率爲4.6%。未上市的可再生能源基礎設施的回報率爲負1.9%。該基金的回報率比基準指數高出28個基點。

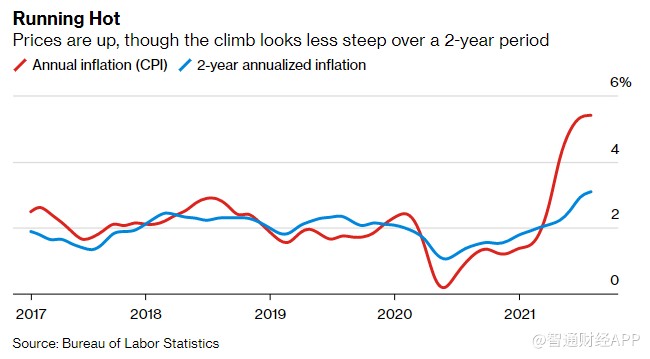

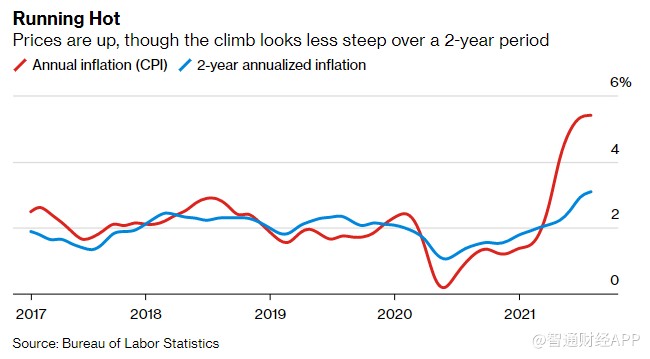

挪威政府全球養老基金首席執行官Nicolai Tangen本週早些時候表示,通脹現在正成爲最大的威脅,股市和債市都可能受到影響。在此期間,關於價格上漲是“暫時的”還是會變得更加持久的爭論仍在繼續。過去兩個月,美國的通脹率一直在5%以上,是10多年來的最高水平。

該基金錶示:“在此期間表現最強勁的是受通脹影響較大的行業,如能源、金融、材料、房地產和工業類股。”“回報率最高的股票從成長型股票轉向了價值型股票。”

自從Tangen擔任首席執行官以來,挪威政府全球養老基金更加公開地表示將致力於可持續發展。該基金計劃加快步伐,剝離從環境、社會和公司治理(ESG)角度來看存在風險的公司。作爲同一戰略的一部分,它還將限制其在新興市場的敞口。

與此同時,該基金一直在推動更廣泛的權重調整,將投資重心從歐洲轉移到北美,以追求更高的回報。週三,該公司公佈其投資的科技股價值增加了16.8%,其增長動力主要來自蘋果(AAPL.US.)、微軟(MSFT.US)、谷歌母公司Alphabet Inc.(GOOGL.US)和亞馬遜(AMZN.US)等大型科技公司數字廣告的持續增長。

在整個疫情流行期間,衛生和科技板塊都獲得了可觀的回報,並且在今年上半年繼續保持增長。今年上半年,該基金在北美股市的回報率爲17%,佔股票投資組合的45.2%。

截至6月底,該基金的股票投資組合佔總資產的72.4%,略低於第一季度,這表明投該基金已經不得不減少其股市敞口,以免偏離70%的目標太遠。大約5年前,該基金被要求持有的股票只能佔其投資組合的60%。

政府全球養老基金今年早些時候該基金首次涉足可再生基礎設施。此舉標誌着該基金的資產類別再次擴大,此前該基金的資產類別僅限於股票、債券和房地產。

根據2020年年報,該基金的中國持倉前三大重倉股分別爲阿裏巴巴(09988)、騰訊控股(00700)和美團(03690),持倉市值分別爲64.9億美元、58億美元和19.4億美元。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.