二季度漲超100%!百億級私募大佬緊盯這隻票,原來是看好這個賽道

本文來自:上海證券報,作者:馬嘉悦

近日,天賜材料的一次調研吸引了眾多知名百億級私募的目光。

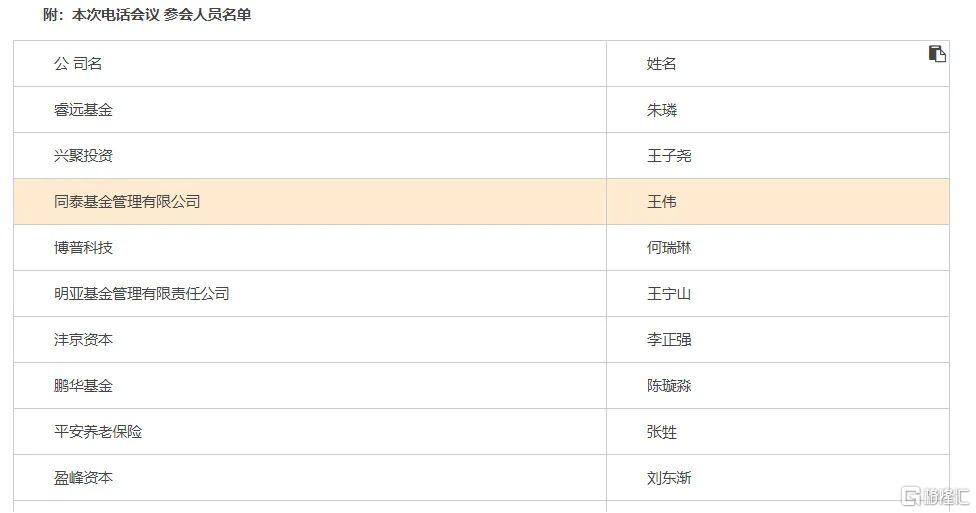

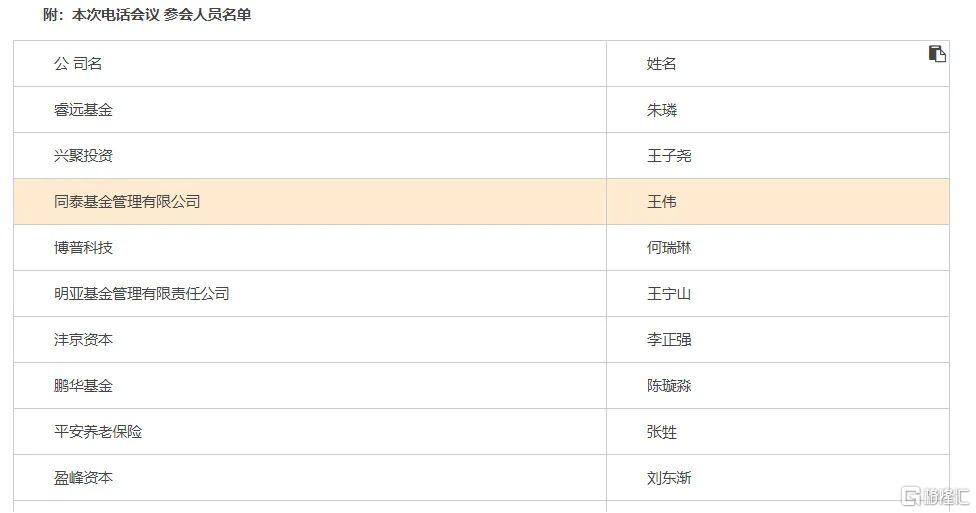

Choice數據顯示,本週天賜材料接待了兩百餘家機構的調研,其中出現了凱豐投資、源樂晟、淡水泉、和諧匯一等多家知名百億級私募的身影。

記者採訪獲悉,天賜材料近期備受關注與其佈局電解液儲能市場有直接關係。業內人士直言,拋開個股來説,儲能產業作為風電和光伏的配套設施,有望進入高速發展期,產業鏈上的龍頭股潛力巨大。

天賜材料備受關注

知名公私募機構的扎堆調研讓天賜材料備受市場關注。

Choice數據顯示,本週多家知名機構調研天賜材料。比如睿遠基金、博時基金、易方達基金等公募機構,以及凱豐投資、源樂晟、淡水泉、和諧匯一等多家知名百億級私募。其中,源樂晟基金經理楊建海還親自參與調研。

從調研記錄來看,天賜材料佈局電解液儲能市場的相關動作成為機構關心的重點。

資料顯示,6月11號天賜材料就公吿稱公司定增募集資金總額預計不超過16.65億元,其中3.19億元擬投入年產18.5萬噸日用化工新材料項目;2.68億元擬投入年產2萬噸電解質基礎材料及5800噸新型鋰電解質項目,1.93億元擬投入年產40萬噸硫磺制酸項目;1.55億元擬投入年產10萬噸鋰電池電解液項目。

因此,在近期的調研中,機構對於15萬噸六氟磷酸鋰項目的擴產、公司在生產磷酸鐵的優勢等細節進行了提問。

儲能產業方興未艾

記者採訪獲悉,公私募機構對天賜材料的跟蹤更多源於其對儲能產業鏈的關注。

“需求端的牽引是企業最核心的原動力,碳達峯和碳中和的全球共識長期將助推儲能系統需求增長,需求上升則將助力相關公司擴大潛在市場空間。”滬上一家百億級私募人士直言。

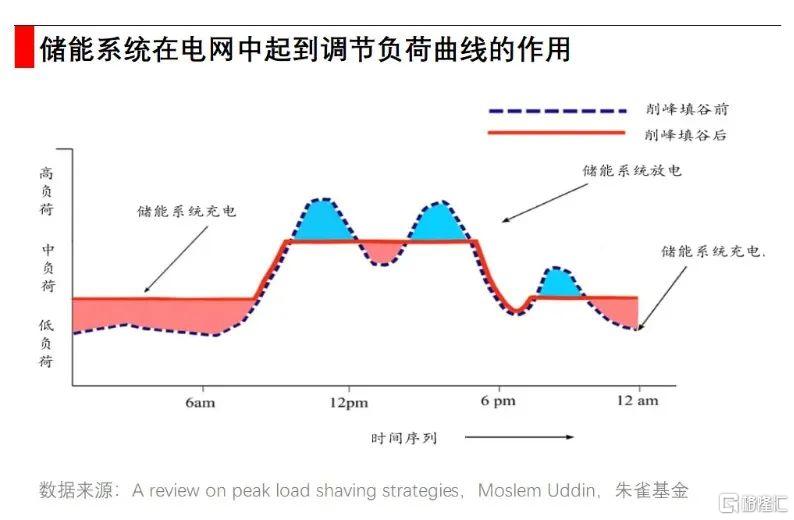

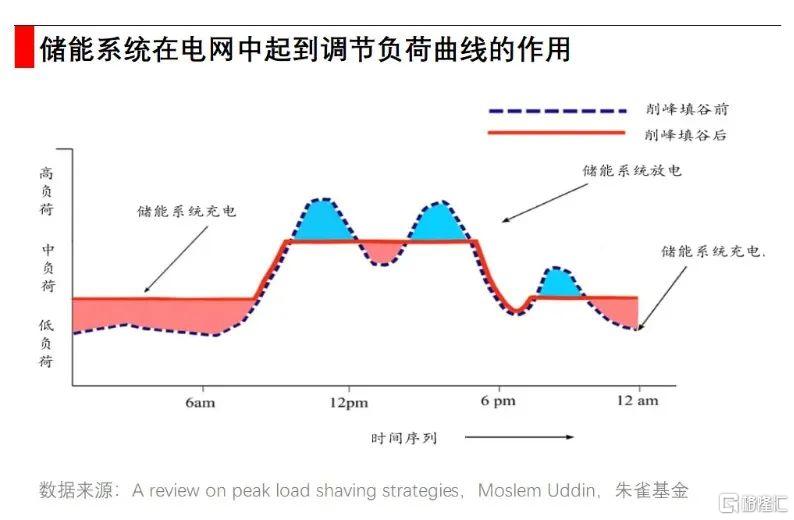

朱雀基金分析稱,2020年,中國發電總量7.4萬億kWh,其中煤電發電量佔比高達65%,佔全球煤電總量的50.2%。降低煤電發電量,提高風電和光伏等清潔能源的比例,是實現碳中和的關鍵。但風電和光伏有明顯的季節性和波動性,風光發電佔比提升將影響電力系統的穩定。儲能可以解決電力的供需時差(調峯),平滑風光的輸出頻率(調頻),減少電網側的輸送壓力,進而降低棄風棄光率,儲能這一賽道沒人願意錯過。

緊密跟蹤 尋找好股票

不過朱雀基金也指出,儲能實現商業化有三大要素,需求、安全和成本,最核心的是成本。需求是否真實有效,要看成本是否下降到足夠低,產生了盈利空間。公私募機構在調研天賜材料時也反覆提及成本問題。

一位私募研究員也直言:“儲能產業鏈空間巨大,但目前仍需緊密跟蹤,一些公司開始量產的話,價格大概率會隨之下降,成本優勢如果不明顯,短期盈利表現也可能不太樂觀。”

另外,還有私募機構提示,二季度以來多隻儲能概念股漲幅明顯,估值壓力逐步顯現,個人投資者需根據資金性質做出判斷,“短期入場大概率安全性較低,中長期持有或將表現不錯。”

Choice數據顯示,多隻儲能領域標的近期股價表現亮眼。比如,截至本週五,天賜材料二季度以來漲幅高達108%,億緯鋰能同期漲幅則超過40%,陽光電源漲幅也接近40%。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.