華潤微(688396.SH)未來還能維持高增速嗎?

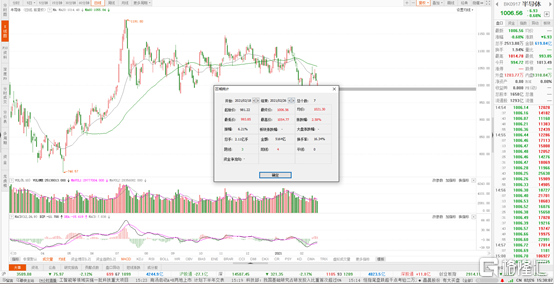

目前已經召開的兩會都提到了培養半導體新產業,而開春以來,隨着國際缺芯潮的愈演愈烈,A股半導體板塊行情走勢也好於整體行情,截止2021年2月26日半導體漲幅2.58%。

(數據來源:東方財富)

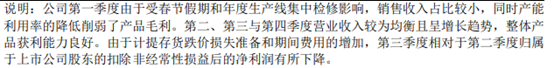

下面要來講的一隻股票剛剛發佈業績快報,下面我來解讀一下這份業績快報,再看看其在2021H1業績會有怎麼樣的表現。截止目前收盤,華潤微跌1.07%。

截止發稿2021年3月1日華潤微漲幅3.21%。

(數據來源:東方財富)

一.公司簡介

公司以IDM模式經營,擁有芯片設計、晶圓製造、封裝測試等全產業鏈一體化經營能力;產品聚焦於功率半導體、智能傳感器與智能控制領域。

二.公司業績

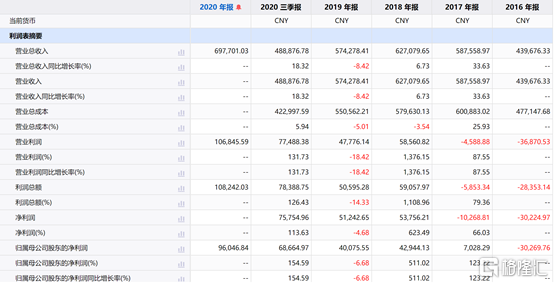

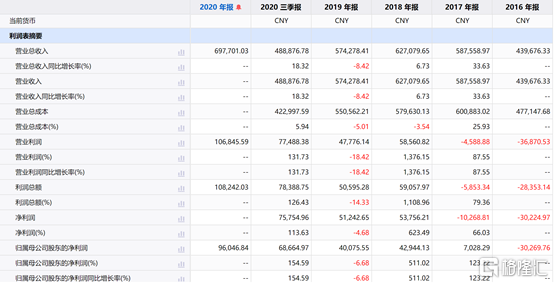

(1)公司2020年業績:公司2021年1月26日公佈業績快報,2020年度,公司實現營業收入697,701.03萬元,較上年同期增長21.49%;歸屬於母公司所有者的淨利潤96,046.84萬元,較上年同期增長139.66%;歸屬於母公司所有者的扣除非經常性損益的淨利潤84,995.45萬元,較上年同期增長311.98%;淨利率為13.77%,較上年同期增長4.83%。

(數據來源:iFind)

(2)公司業績達預增公吿上限:早前公司發佈業績預增公吿,預計2020年實現歸母淨利潤92,173.77萬元到96,193.87萬元,同比增長130%到140.03%;扣非淨利潤82,524.60萬元到85,327.94萬元,同比增長300.00%到313.59%;歸母淨利潤和扣非淨利潤基本達到業績預增公吿的上限。

(3)公司營收、淨利潤、淨利率、扣非同比增長説明:

①公司營收較去年有所增長主要因為今年景氣度較高,公司基本滿產能生產;淨利潤和淨利率較去年大幅增長,主要由於公司訂單充足,基本在挑訂單做的狀態,同時疊加公司產品漲價影響,因此淨利潤漲幅也高於營收增速;

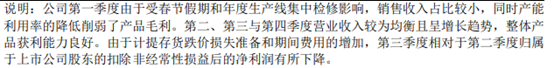

②扣非同比大幅增加,主要由於去年一季度受春節假期和年度生產線集中檢修影響,產能利用率較低,導致去年一季度扣非為負;而在去年第三、四季度由於需要計提存貨跌價準備和期間費用的增長,也影響公司第三、四季度扣非;從而去年扣非基數較低,而今年由於景氣度上升,產能利用率充足,存貨跌價準備較去年有所下滑,所以今年扣非較去年大幅增加。

(數據來源:公司公吿)

(4)以目前公司業績報吿對華潤微進行估值:公司2020年EPS為0.8334,以股價61.08,對應PE 為73.23,對應PB為 7.02,對應PS為 10.65;在整個半導體行業屬於一個較為合理的估值。

三.未來業績展望

(1)預計2021H1公司原業務維持滿產能+訂單漲價的狀態:那麼可以估算公司2021H1營收為2020Q4的兩倍至417,648.5萬元,預計同比增長36.35%;按2020Q4淨利率13.11%計算2021H1淨利潤,預計2021H1淨利潤可達54,753.72萬元,預計同比增長35.83%。

(2)擴產計劃下半年才能貢獻營收:目前公司無錫8英寸已經開始建設,預計下半年釋放一部分產能;同時重慶8英寸產線升級也不會在今年上半年釋放產能;而另一條建設的12英寸產線,2021年為建設期,預計2022年才能釋放產能。

(3)收購子公司剩餘股權貢獻利潤:公司早前收購重慶華微剩餘47.3%的資產,預計對公司2021H1貢獻淨利潤6,361.85萬元。總體來看公司2021H1預計淨利潤為61,115.57萬元,同比增長51.61%。

四.小結

在下游景氣度維持較高水平,公司持續滿產能+漲價預期,2020年已經實現了較好了業績增長;預計公司2021H1淨利潤可實現61,115.57萬元,同比增長51.61%,同時隨着下半年產能的釋放,可以為公司貢獻更多的營收,預計公司2021年依然維持高增速!

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.