太刺激!歐普康視領跌11%,通策醫療、愛爾眼科、泰格醫藥等醫藥龍頭再度暴跌!

今日,A股港股滿屏綠!醫療生物板塊開盤重挫2.6%,而後向上反彈。

板塊內分化明顯,前期暴漲的龍頭個股仍不改下跌趨勢,而中小盤醫藥生物個股表現相對較好。具體來看:角膜塑形鏡龍頭歐普康視跌幅居前,暴跌11%;牙科龍頭通策醫療大跌6%,節後以來短短7個交易日,其股價跌逾30%;愛爾眼科、泰格醫藥、九洲藥業等個股紛紛跟跌。

反之,濟民製藥、達安基因漲超8%。其中濟民製藥自2月18日低點以來,一路高歌,反彈53%左右;達安基因則因業績大增而股價齊飛,旗下核酸檢測試劑盒及核酸檢測儀器、相關耗材等產品銷量受益於疫情而大幅增長,公司昨日發佈業績快報稱,2020年營業收入為53.45億元人民幣,同比增長386.70%;歸母淨利潤24.33億元,同比增長2539.66%。

除此之外,上海醫藥、潤都股份、三鑫醫療漲超7%。

港股方面,截止發稿,醫療及醫學美容服務領跌6%,其中恆大汽車領跌7.46%;香港私營綜合醫療服務提供商盈健醫療跌幅居前,暴跌7.69%;去年年底上市的醫美服務供應商瑞麗醫美亦跌超7%。醫療保健設備板塊整體下跌2.6%。

對於今日醫藥生物表現相對抗跌的原因,主要是近期市場對於流動性收緊的預期,以及估值泡沫破裂的擔憂,疊加債券利率上行,隔夜外圍市場出現大幅下跌的局面。受此影響,A股開盤繼續跟跌,而醫藥生物亦難以避免。

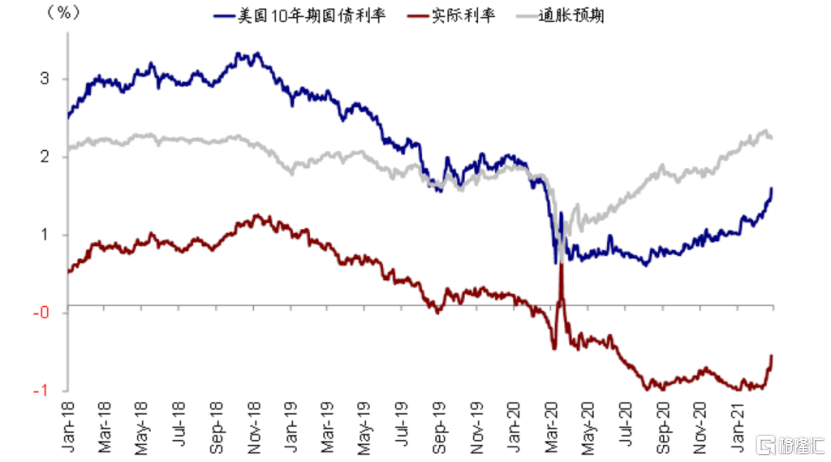

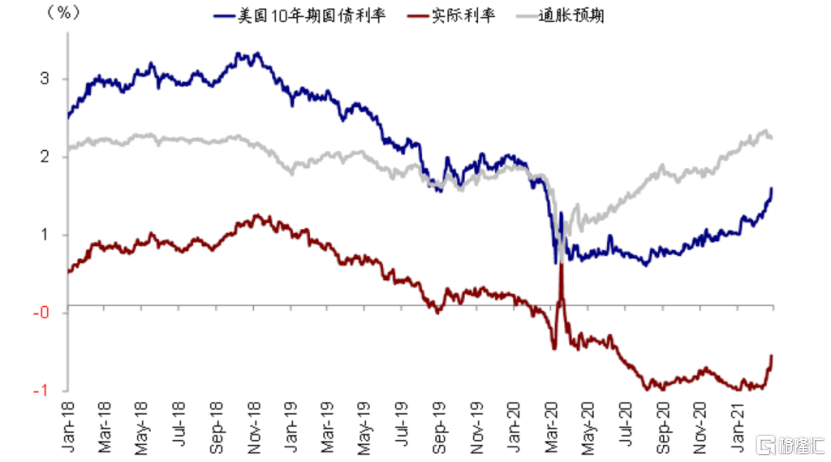

近期,在全球整體疫情改善、疫苗接種加速以及美國新一輪1.9萬億財政刺激漸行漸近的背景下,市場對於經濟復甦增長和通脹預期進一步向好,同時,市場預期流動性收緊問題也提上日程。

儘管此前美聯儲主席鮑威爾重申將保持利率接近零,直到充分就業和通貨膨脹上升到2%,並有望在一段時間內適度超過2%,並表示寬鬆貨幣政策將繼續存在。但從美債收益率來看,10年美債利率昨日不僅突破關鍵關口1.5%,更是在盤中一度創下1.61%的高點,為2020年疫情爆發以來的新高。

(來源:中金公司)

利率飆升對估值的壓制會立竿見影,高估值的科技股成為重災區,可以看到美股市場尤其是以科技成長股為主的納斯達克大跌3.5%,道瓊斯和標普500指數分別下跌1.8%和2.5%。

不過,就A股而言,前期醫藥板塊漲幅明顯,高位醫藥股普遍存在估值過高的情況,尤其是細分領域龍頭股,存在明顯的估值泡沫。而這一波殺估值的環境下,龍頭股成為重點下殺估值的對象,這也是為何本輪下跌板塊內分化的主要原因。譬如,醫美龍頭愛美客連續7日下跌,累計跌幅近30%;醫療器械龍頭邁瑞醫療7日下跌16%;眼科龍頭愛爾眼科則下跌20%。

站在當前時點來看,龍頭股估值仍處於較高水平,殺估值的情況可能還會持續。而中小醫藥股受到業績及低估值的影響,對其股價上漲具有一定支撐。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.