MLCC龍頭三環集團(300408)再迎漲價預期,能否點燃市場熱情?

2021年2月1日,三環集團漲幅5.37%。

一.公司財務

(1)2020Q4歸母淨利潤預計同比增長100%

2021年1月29日,公司發佈年度業績預吿,2020年歸屬淨利潤13.1億元-15.2億元,同比增長50%-75%。對應Q4單季度歸母淨利潤3.1-5.2億元。按照中值4.1億元計算同比增長100%。業績增長主要受益於5G技術加速普及與國產替代進程不斷深化。

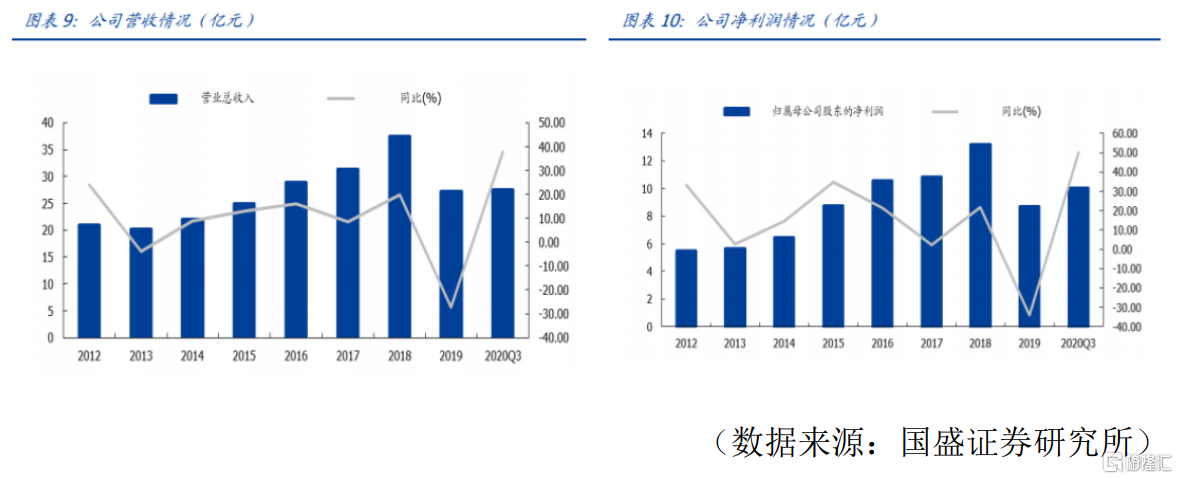

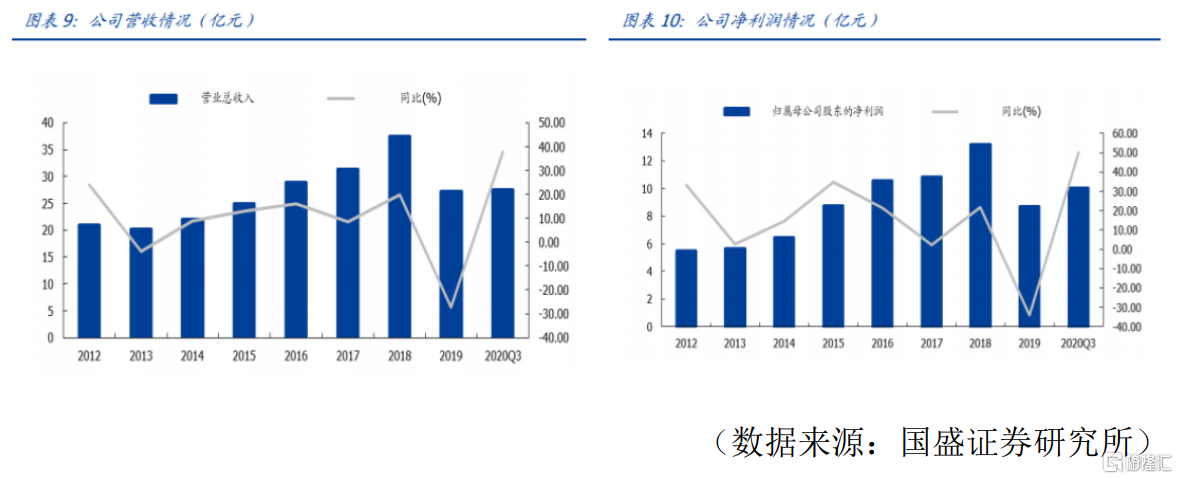

(2)2019年受MLCC影響,公司營收與淨利增長首次出現負增長

要知道三環集團上市以來,只有2019年出現過營收與淨利增速出現負的情況。從2012到2018年營收從21.03億元增長到37.50億元,歸母淨利潤從5.52億元增長到13.19億元。

2018年下半年受中美貿易摩擦,以及消費帶腦子需求疲軟影響,疊加全球各個MLCC大廠擴大產能影響,導致MLCC價格大幅下跌,公司營收和淨利也受此影響。

二.MLCC價格波動大

MLCC保質期只有1-2年,這就使得需求端不能囤貨,在需求保持不變的情況下,MLCC大廠擴大產能或者縮小產能都容易導致MLCC價格的劇烈波動。

歷史上有三次MLCC價格的暴漲暴跌情況出現:

①2000年,全球互聯網迎來泡沫,由於寬帶網絡基礎設施大規模擴建,MLCC下游瘋狂下單,反饋至上游過度擴產,MLCC庫存積壓嚴重,導致MLCC價格暴跌。

②2013年,以蘋果和三星為首的智能手機廠商,為應對4G手機的普及,大量拉動MLCC需求的增長,導致MLCC價格上升。

③以村田為首的日系廠商紛紛降低中低端MLCC的供給,從而推動中低端MLCC產品價格上漲。

三.MLCC漲價預期

①以日本村田為首的MLCC大廠發佈消息稱,目前公司訂單已經排到2月份,且需要取消休假,加班加點滿足眾多訂單需求。近期不幸的是,日本村田本土爆發新冠疫情,目前已經有13名員工感染。從而導致供給更加吃緊。

②1月13日華新科東莞廠房發生大火,而東莞廠房佔公司MLCC總產能50-60%,這把大火更讓市場擔心MLCC供給緊缺。

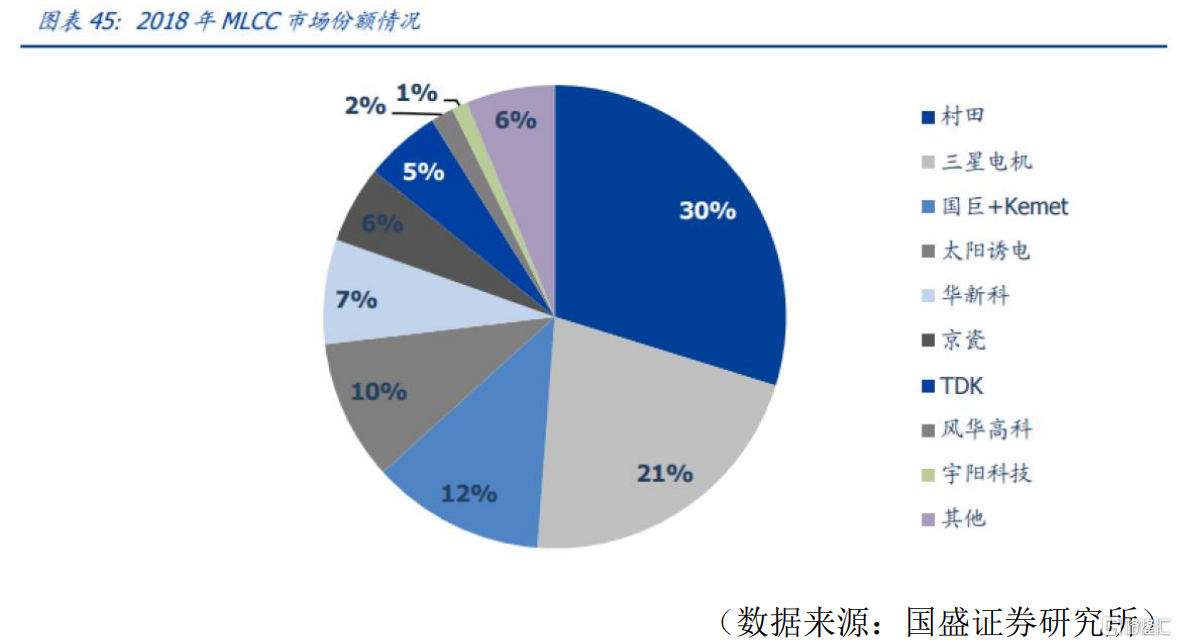

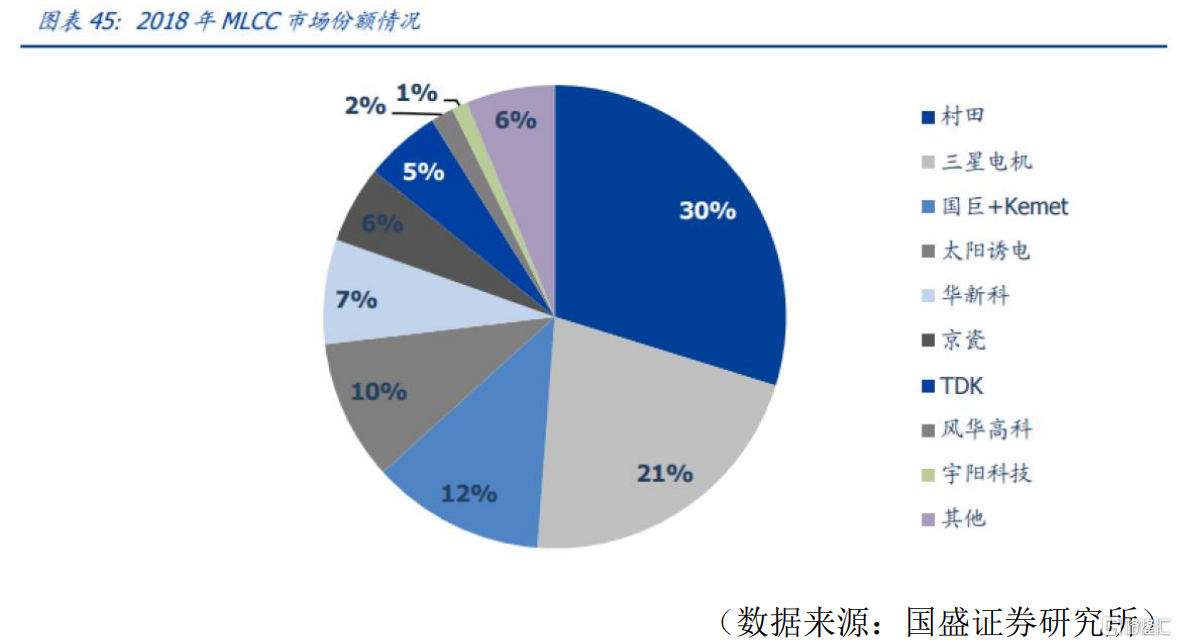

③要知道我國目前MLCC主要依賴進口,國產化率尚不足7%;這就更加加劇市場對MLCC漲價的預期。

四.三環集團作為MLCC供應商享受材料漲價以及國產替代帶來的業績增長

①日本村田早期宣佈,將減少中低端MLCC產能,而需求端受5G基站建設和數據中心建設增長影響,需求旺盛。這部分缺口主要靠國內廠商供給,如三環集團、國瓷材料等。

目前公司MLCC產能正在爬坡,預計2021年底擴產140億隻。公司在MLCC業務上正享受量價齊升的紅利。

②公司定位於緊緊圍繞“先進陶瓷”,打造“材料”+生態平台的發展戰略,目前已經掌握了MLCC上游的技術,而之前MLCC上游技術也被國外企業壟斷,掌握技術後,有望加速MLCC國產替代;國產率的提升同樣帶來公司業績的增長。

在MLCC量價齊升以及國產替代率提升的情況下,公司有望受益於MLCC產業的發展,而實現業績增長。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.