新天绿色能源(00956.HK):A股增发支持LNG业务发展,把握行业长期机遇,给予“增持”评级,目标价2.30港元

机构:中泰证券

评级:增持

目标价:2.30港元

A股增发支持唐山 LNG 项目发展,把握国家 2060 年碳中和目标所带来的长期机遇公司近日公布,有意增发不超过 11.5 亿 A 股(600956 SH)股份,集资总额最多 51.1 亿人民币。资金主要用于开发唐山液化天然气(“LNG”)项目(第一及第二阶段)及唐山 LNG 接收站外输管线项目(曹宝段及宝清段)。唐山 LNG 项目(第一及第二阶段)计划分别于 2022 年及2025 年建成投产。前者包括四座 20 万方的 LNG 储罐及一座 8-26.6 万方 LNG 船舶接卸泊位;后者则包括八座 20 万方 LNG 储罐及一座 1-26.6 万方 LNG 船舶接卸泊位。LNG 接收站外输管线项目则预计于 2022 年建成投产。由于中央早前宣布在 2060 年实现碳中和目标,中国天然气使用可望加快增长。公司发展上述项目,正好把握行业长期机遇,满足京津冀地区天然气需求。

股份增发提升 A 股占比,可增强市场对公司的关注

此次增发计划将增加公司总股本30.0%,盈利摊薄效应看起来较大。但公司大股东河北建投(河北省国资委旗下全资企业)将最少认购实际增发股数的 48.73%(即约 5.6 亿股份,不 高于 6.6 亿股份),持股比率将介乎 48.73%至 50.70%,主要股东身份不变动。另外,可流通 A 股股份(不含河北建投)占公司总股本的比例将由目前 3.5%上升最多至增发后的14.5%。这有助公司吸纳更多较熟悉中国天然气行业的境内投资者,可增强市场对公司的关注,从而技术上有利公司股价。

重申“增持”评级

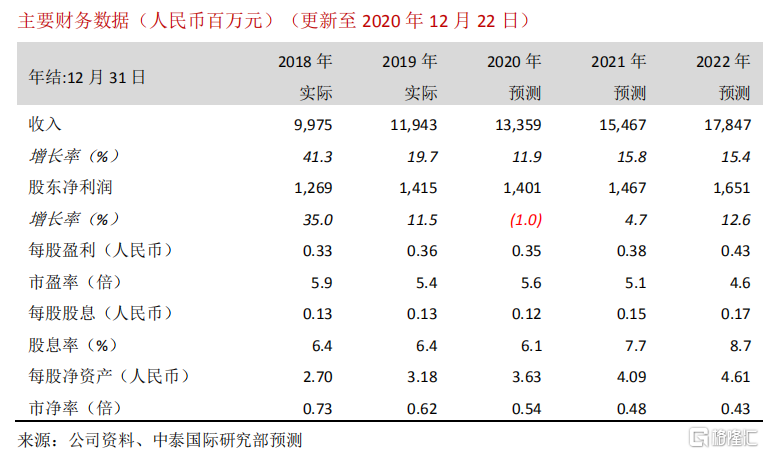

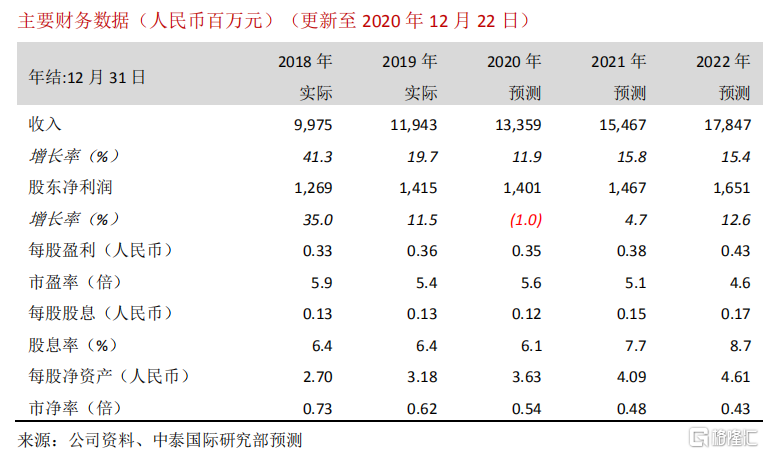

股份增发目前有待股东大会及中证监批准,我们预计可以在 2021 年下半年完成。待计划详情进一步落实后,我们将更新财务模型。我们目前不调整 2020 年-2022 年盈利预测,并维持贴现现金流分析(DCF)推算的 2.30 港元目标价,这对应 5.6 倍 2021 年市盈率和 8.0%上升空间,重申“增持”评级。

风险提示:(一)项目开发延误、(二)应收账款风险、(三)并网电价下跌。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.