有色金屬板塊大漲,銅鋁引領行情,鋰鎳鈷有望隨後

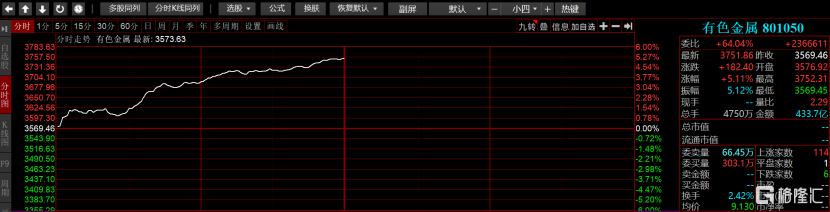

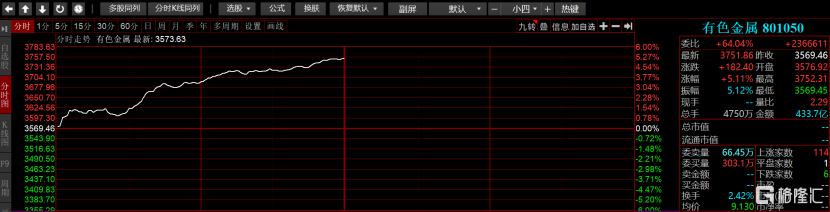

近期多種有色金屬價格漲幅明顯,週一早盤無論是期貨還是股票,均受市場資金追捧。

滬銅主力合約早盤開盤幾分鐘便大幅拉昇3%以上。並且多種金屬期貨飄紅,滬銀3.12%、滬鋅漲幅1.55%、滬鎳1.4%、滬錫1.14%等。

股票方面,上週申萬有色金屬指數上漲2.06%,除黃金外所有子板塊均上漲,漲幅居前板塊為鋁、稀有金屬、稀土等。今日,有色板塊早盤更是大漲5%左右。

截止今日早盤收盤,有色板塊個股,怡球資源、雲鋁股份、西部材料、華峯鋁業等9只股票漲停,明泰鋁業、雲南銅業、和勝股份逼近漲停。申萬有色金屬指數的個股幾乎全線飄紅,該指數包含個股公121只,翻綠僅6只,其他均呈現不同程度的上漲。

價格方面,上週鋁價繼近期強勢突破1.5萬元/噸後大漲至1.564萬元/噸,創三年以來新高。其中,LME價:銅、鋁、鉛、鋅、錫和鎳分別上漲0.8%、1.8%、4.1%、0.1%、0.2%和3.9%。

根據中國有色金屬工業協會最新數據,7月以來,銅、鋁、鉛、鋅基本金屬價格保持高位運行,超過疫情前水平。三季度有色企業信心指數為50.1,較二季度回升1個百分點。且產品售價、企業盈利水平、企業經營環境等分項指數較二季度有較大提升。

有色金屬的價格上漲主要是兩方面:

首先,寬鬆的貨幣政策和財政政策,預計經濟回暖。中國銀河最新研報顯示,為應對疫情對經濟的衝擊,各國可能會祭出新一輪政策刺激措施。其中,市場對歐洲央行在四季度加碼量化寬鬆的預期加強。美國新一輪財政刺激計劃有望推出,美聯儲為配合財政刺激計劃進一步寬鬆貨幣政策的預期也將加強。

其次是國內經濟復甦逐漸常態化,行業復甦帶動需求旺盛。

電子、汽車下游等需求端恢復明顯。數據顯示,10月,汽車產銷分別完成255.2萬輛和257.3萬輛,環比分別增長0.9%和0.1%,同比分別增長11.0%和12.5%。截至本月,汽車產銷已連續7個月呈現增長,其中銷量已連續六個月增速保持在10%以上,並且電纜、交通、電子端需求同樣恢復明顯。強需求疊加當前較低庫存,帶動銅鋁鋅價持續上漲。

中信證券指出,在經濟復甦、温和通脹、庫存週期等因素共振下,有色金屬價格具備向上持續動力。有色金屬板塊公司估值仍處於歷史中樞以下,伴隨盈利逐季抬升,“低估值”“順週期”龍頭具備持續上行動力。

此外,鋰鎳鈷價格也有價格上漲的趨勢。上週鋰價格:鋰精礦報價漲1.3%至393美元/噸;電池級碳酸鋰報價漲3.6%至4.3萬元/噸,其他無變化。鈷價格:粗製氫氧化鈷計價係數漲0.3%、無錫電鈷跌0.8%和現貨電鈷跌0.7%和鈷粉跌0.7%,其他無變化。

日前發佈的《新能源汽車產業發展規劃(2021-2035年)》,鼓勵企業提高鋰、鎳、鈷等關鍵資源的保障能力,並且10月我國新能源汽車生產/銷售16.7/16.0萬輛,環比+19.6%/+13.9%,同比+69.7%/+105%,繼續保持高速增長。2020年1-10月累計生產/銷售91.4/90.1萬輛,同比-9.2%/-7.1%,降幅進一步縮窄。

鋰鈷價格處於歷史底部附近,低價格疊加政策、需求端利好是近期產品價格及板塊上漲的重要原因。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.